Image source: Getty Images

I think investors who want to earn a second income should pay attention Unilever (LSE: ULVR) shares. A portfolio of strong brands in a defensive sector has a good chance of generating lasting dividends.

The problem is that the rise in the share price this year has caused the dividend yield to fall. But there is a chance that things will be different in 2025 and I think investors should try to be prepared.

Dividends

In 2023, the dividend yield on Unilever shares approached 4%. Before that, it had been more than 10 years since investors had last had the opportunity to lock in that kind of passive income return.

Unilever dividend yield 2015-24

<img decoding="async" src="https://s3.tradingview.com/snapshots/x/XTR2poEl.png” style=”width: 2000px”/>

Created in TradingView

They can't do it now. The stock is up about 20% since the beginning of the year and the dividend now only represents about 3.2% of the current share price.

Unilever has a good track record of increasing its dividend. But it's fair to say that growth in recent years has been more steady than spectacular.

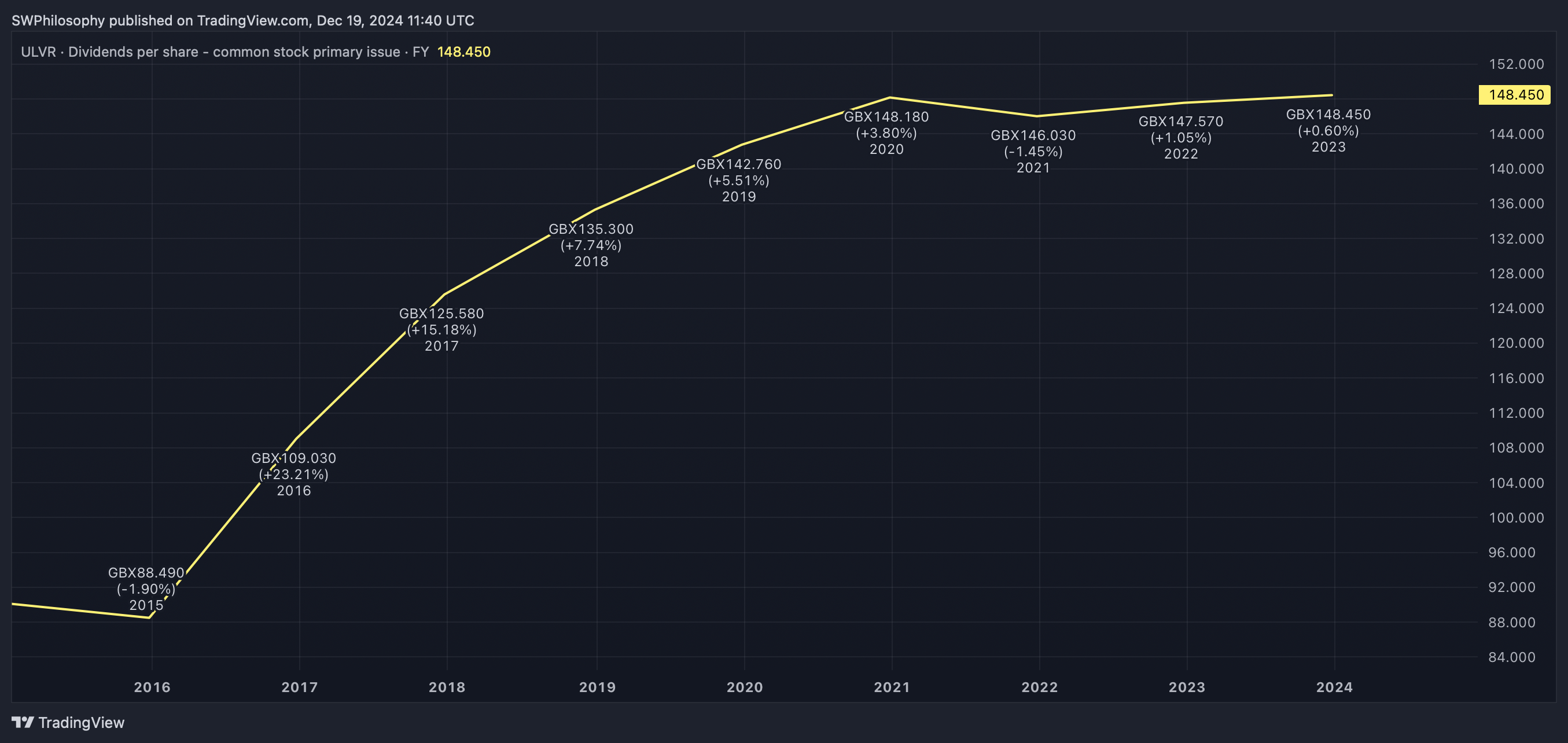

Unilever dividends per share 2015-24

Created in TradingView

That means it's more important for investors looking to buy stocks to pay attention to initial performance. And this decline over the past year as stocks rise makes the opportunity less attractive.

Inflation

The possibility of buying Unilever shares with a dividend yield close to 4% has only arisen once in the last decade. But I wonder if it could return in 2025.

Rising inflation in the UK has caused the Bank of England to be cautious about lowering interest rates. And this is something that could continue next year.

Inflation is about the balance between supply (goods and services) and demand (money). And while there's still a lot to develop, I can see factors that could drive up prices on both sides of the equation.

Companies could well try to increase prices to offset budget costs. At the same time, a higher national minimum wage could lead to greater consumer purchasing power.

Second chances

Investors should note that lower interest rates are not the only reason Unilever shares have been rising. The company has done an impressive job of growing its core brands and shedding weaker ones.

But there's no guarantee that higher-than-expected interest rates will cause the stock to fall to a level where the dividend reaches 4%. But I think investors should be alert to this possibility.

At the current level, I am not convinced that the supply yield is high enough to offset the risk of consumers lowering their prices. This is a constant challenge with products that have no switching costs, such as those from Unilever.

High inflation could exaggerate this risk. But if interest rates remain higher than expected in 2025, then stocks could fall to a level where the investment equation becomes much more attractive.

be ready

Investing well means being able to take advantage of opportunities when they present themselves. And dividend investors who missed out on Unilever shares in 2023 but have been considering them should make sure they're ready in 2025.

A big drop from current levels could be needed for Unilever shares to trade at a 4% dividend yield. But given that the dividend will increase next year, it might be more realistic than it seems.