Image Source: Getty Images

Nvidia The actions (Nasdaq: NVDA) took some hematoma in January, falling 13% at one point. However, it has recovered and is now 3.4% higher in 2025. For five years, it is 1,817% just credible!

The ai Chip King will launch its profits from the fourth quarter of 2025 on February 26. Here, I will take a look at the last forecasts that are addressed to the results report.

Incredible growth

Since ChatgPT was launched at the end of 2022, the quarterly NVIDIA results have eliminated Wall Street estimates.

The following table shows the income and earnings figures per action (EPS), along with the surprise of EPS expectations.

| Room* | Revenue | Income surprise | EPS | EPS surprise |

|---|---|---|---|---|

| Q1 24 | $ 7.2bn | 10.1% | $ 0.11 | 18% |

| Q2 24 | $ 13.5bn | 20.7% | $ 0.27 | 29.7% |

| Q3 24 | $ 18.1bn | 11.2% | $ 0.40 | 18.5% |

| Q4 24 | $ 22.1bn | 8.4% | $ 0.52 | 12.3% |

| Q1 25 | $ 26bn | 5.8% | $ 0.61 | 9.2% |

| Q2 25 | $ 30 billion | 4.4% | $ 0.68 | 5.4% |

| Q3 25 | $ 35.1bn | 5.8% | $ 0.81 | 8.3% |

As we can see, Nvidia was crushing estimates in two digits about a year ago. However, as the ai revolution matured and analysts have a better control on demand for chips, these surprises have fallen understandably in individual digits.

Of course, that remains impressive, and means that Nvidia has overcome estimates both in the upper quarter and in the background since the beginning of 2023. And during the period, an amazing $ 2.8TRN in market capitalization has added!

For Q4 25, Wall Street expects income of $ 38 billion and EPS of $ 0.84. That would represent an exceptional growth of 72% and 64%.

These are the main figures that investors must take into account. Although what will probably decide the address of the price of the subsequent action is the term orientation for the first quarter of 26. Investors will want to know that the demand for chips of ai will continue to be strong this year.

At this time, analysts forecast revenues of $ 41.7 billion and EPS of $ 0.91 for the current quarter (Q1). If the company reviews this up, the shares could increase more and vice versa.

Target price

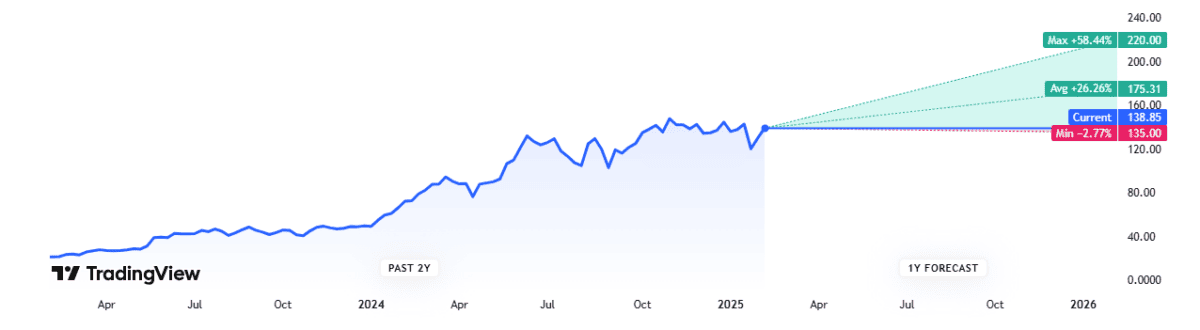

The price objectives of the corridor shares should always be taken with a pinch of salt, especially when it comes to a volatile stock like NVIDIA. That said, they can provide a valuable vision on the potential market disparities.

So what is the latest in this Front for Nvidia? According to 52 analysts that cover the share, the average object of 12 months is $ 175. That is around 26% higher than the current price of $ 138 shares.

Valuation

Finally, we have the assessment. According to current estimates of fiscal year 2016, the action is traded approximately 31 times the term profits. That does not seem too demanding, given the rapid growth of the company.

Combining this with the target price of $ 175, there could be a convincing case that it is a growth action to consider buying.

What could go wrong?

However, as Stanford's computer scientist once said: “We tend to overestimate the effect of a short -term technology and underestimate the long -term effect.. ”

In other words, new transformative technologies have rarely avoided early speculative bubbles throughout history. Internet was the most famous example, although there have been others.

In addition, about 36% of Nvidia sales come from only three customers in the last quarter. If these customers reduce their ai infrastructure expense after the initial construction, the chips manufacturer could experience an immediate deceleration in income growth.

Given this medium term uncertainty, I will not buy the shares at today's price.

(tagstotranslate) category. Investing

NEWSLETTER

NEWSLETTER