Image source: Getty Images

He FTSE 100 it is still home to many of the UK’s largest dividend payers. That said, its mid-cap cousin, the FTSE 250, still has a number of decent names. One action in particular that stands out to me is dunelm (LSE:DNLM), which has a forward dividend yield of 6.8%.

Providing good results

Having reached multiple all-time highs during the pandemic, Dunelm’s shares fell as much as 50% last year. That’s because as the cost-of-living crisis loomed, investors worried that demand would fall catastrophically. Fortunately, such fears were exaggerated, and shares of the FTSE 250 have now recouped almost all of their losses and are up 80% from their trough.

In fact, Dunelm shares have continued their bullish momentum this year with an additional 25% gain. This is due to a better-than-expected set of half-year results, as the company practiced “strict business discipline and operational control”.

| Metrics | 1S 2023 | 1S 2022 | Growth |

|---|---|---|---|

| Revenue | £835 million | £796 million | 5% |

| Gross margin | 51% | 53% | -2% |

| Profit Before Taxes (PBT) | £117 million | £141 million | -17% |

| Free Cash Flow (FCF) | £102 million | £106 million | -4% |

| Diluted earnings per share (EPS) | 45.8p | 55.4p | -17% |

dividend payment

Despite not currently being a shareholder, it is always a pleasure to see the FTSE 250 firm doing well. This is especially the case after I made numerous bullish calls last year, citing the retailer’s strong proposition to deliver value during a cost-of-living crisis, all while increasing market share.

Unfortunately, however, I sold my stake at that time because the shares had reached my target price. If I had held out, I would have made a handsome 60% profit. That being said, I do plan to reinvest in Dunelm as it continues to impress on all fronts and most profitably for its special dividends.

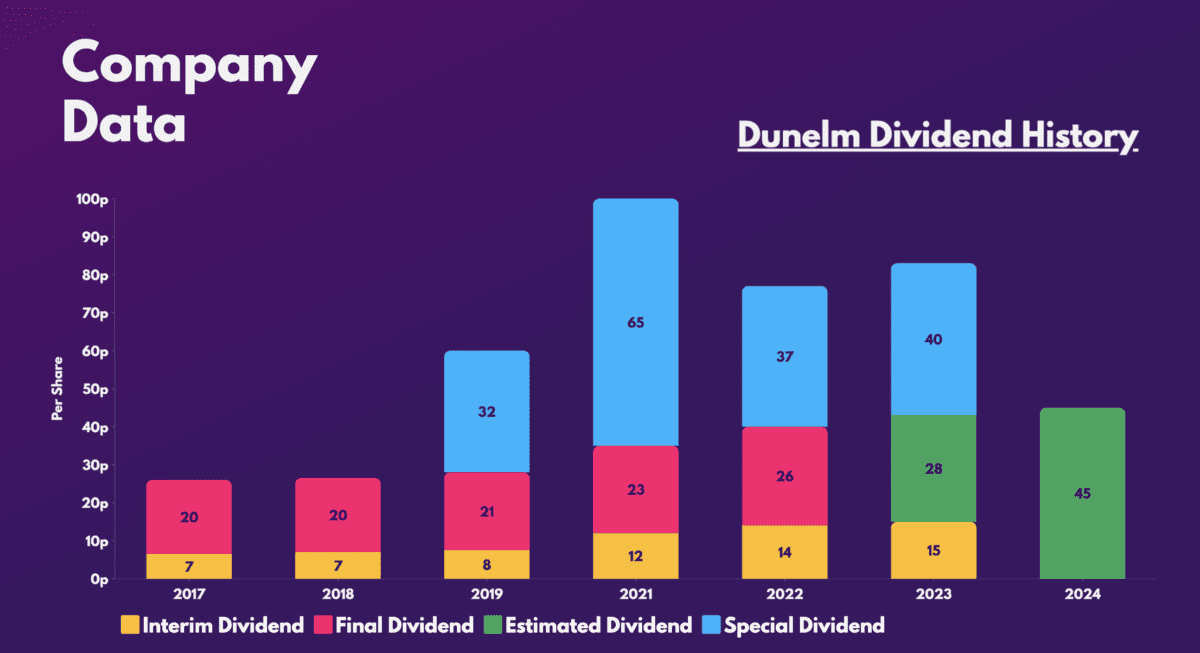

In its semi-annual report, the group announced a special dividend of 40 pence per share. Given a forecast of 28p for its final dividend later this year, and 16p for next year’s interim dividend, this presents a solid 6.8% yield if you were to buy Dunelm shares today.

Cheap stocks?

However, in addition to its dividend, there are also many other reasons why I am interested in investing in the retailer. On the one hand, Dunelm’s growing market share in housewares and furniture shows conviction, as it shows the conglomerate’s drive to grow its business efficiently. This is supported by a growing number of active customers (+5.7%) and higher purchase frequencies (+4.8%).

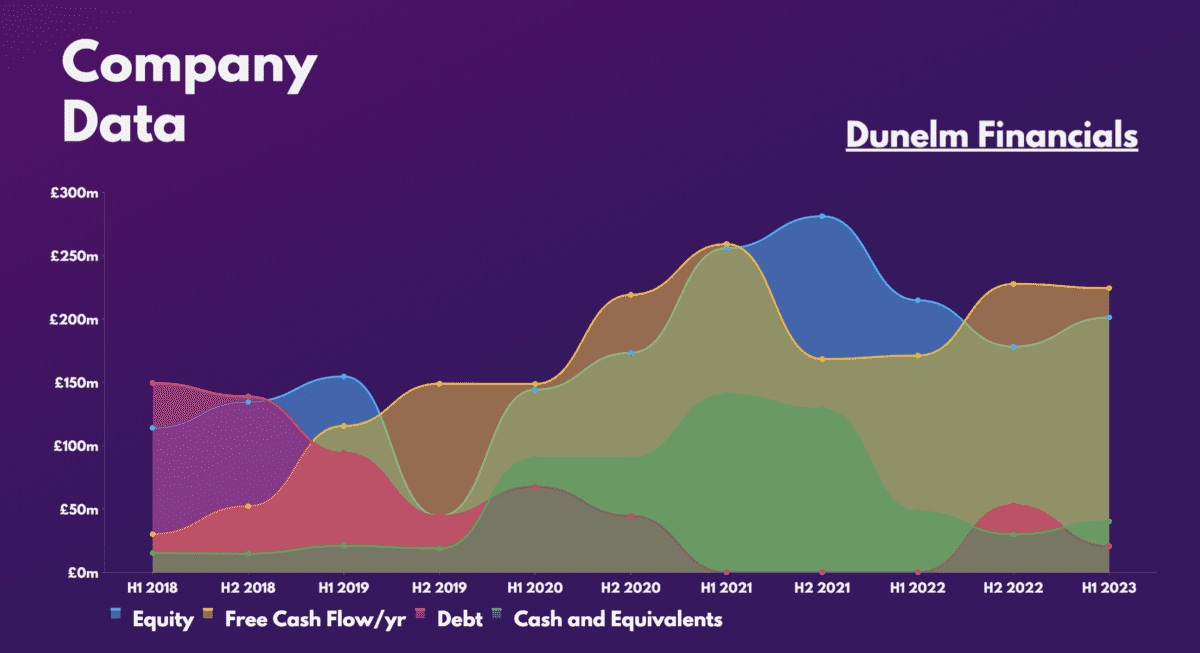

I’m also a big fan of its strong balance sheet, which boasts a healthy debt-to-equity ratio of 10%. Combine that with rapidly growing free cash flow and it’s no wonder the vendor is paying special dividends. Furthermore, the initial headwinds that plagued the FTSE 250 component are now starting to fade. Inflation is starting to ease and the Bank of England expects a milder recession.

However, I also have my reservations. The main one is that both its current and future valuation multiples are not exactly the cheapest. As such, it’s not surprising to see the stock with an average price target of £12.90, showing a minimum 5% upside from the current price.

| Metrics | dunelm | industrial average |

|---|---|---|

| Price-Sales Ratio (P/S) | 1.5 | 0.7 |

| Price-Earnings Ratio (P/E) | 16.4 | 11.4 |

| Forward price-to-sales ratio (FP/S) | 1.5 | 0.7 |

| Forward price-earnings (FP/E) ratio | 17.2 | 13.9 |

Even so, I believe that these estimates have not considered a possible rebound in the housing market, which could generate higher sales in the medium and long term. The stock is certainly on the more expensive end, but I think it’s still quite valued given its upside potential, free cash flow generation, and strong shareholder returns, so I’ll be investing. After all, Warren Buffett once said: “Price is what you pay, value is what you get.”

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);

NEWSLETTER

NEWSLETTER