Image source: Getty Images

The UK’s main index is now just 50 points away from its all-time high of 7,903. Although the general consensus is to buy low and sell high, I still plan to buy FTSE 100 shares as the index heads towards the 8,000 mark.

setting new records

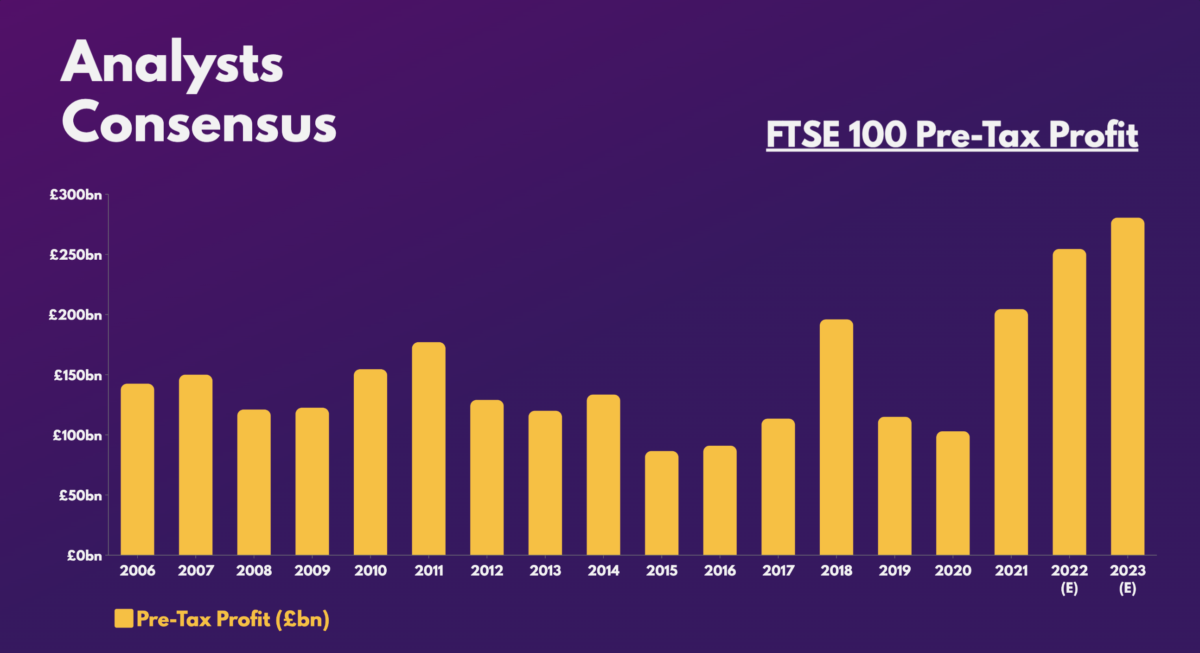

UK stocks aren’t renowned for their strong growth, but 2023 will be a record year for overall earnings. Despite a looming recession, Britain’s top voters make most of their profits outside the UK. Therefore, analysts forecast average pre-tax earnings to be around £280bn. As such, it is no surprise that the FTSE 100 has been in the green since the New Year and is approaching its all-time high. This is why.

The first would be the banks. With inflation still stubbornly high, the Bank of England is expected to continue raising interest rates. Consequently, banks like lloyds you will benefit as earnings grow due to increased rates. The second would be the reopening of China, since it is the largest consumer of basic products in the world. With a sizeable portion of FTSE 100 companies producing energy and metals, such as antofagasta Y PA they are on the watch list of many investors as oil and metal prices are expected to continue to rally.

higher dividends

These main catalysts would serve to benefit shareholder returns in the form of dividend payments. The FTSE 100 is known to be one of the largest dividend generators in the world. And since most of its biggest dividend payers are in the financials and commodities sectors, it’s very likely that the biggest gains will also translate into dividends. Therefore, analysts anticipate that ordinary dividends will also reach an all-time high.

After all, £55.2bn worth of share buybacks were made in 2022 alone. In addition, an additional £2.8 billion was paid in special dividends. As a result, analysts are now pricing in dividends worth £79.1bn to be paid this year.

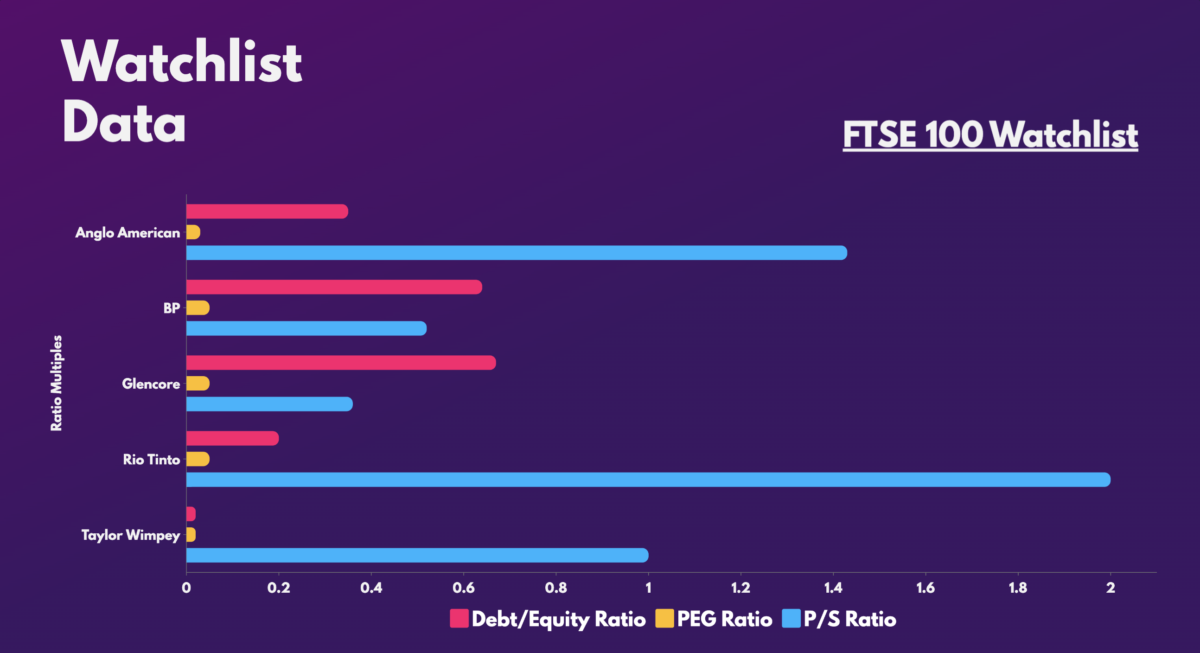

This is not surprising, since the average company’s balance sheet hasn’t been in a better position in nearly a decade. big names like Anglo-American Y glencore they have strong free cash flow and more than double dividend coverage. This allows them to hedge their lucrative dividend yields quite comfortably which is why investing in FTSE shares appeals to me as it is an opportunity for me to generate some passive income.

| Sector | Pre-tax profit growth | dividend growth |

|---|---|---|

| oil gas | 24% | 23% |

| Finance | 23% | 18% |

| Mining | sixteen% | sixteen% |

cheap blue chips

However, the main reason I buy FTSE 100 shares is because of their relatively cheap valuations. While the index tops out, there are still a couple of big names trading at a bargain. Developer taylor wimpey and the iron ore giant red river suffered last year as construction and industrial activity slowed locally and internationally.

As a result, these stocks are now trading at a relatively cheap price-earnings (P/E) ratio with high dividend yields. Furthermore, they even have good dividend hedges and a strong dividend policy.

So, with house prices remaining strong and iron ore prices recovering at a brisk pace, here are several FTSE 100 stocks I’m looking to buy once my preferred broker launches UK stocks on their platform.

NEWSLETTER

NEWSLETTER