Image Source: Getty Images

LloydsThe price of the shares' (LSE: Lloy) has increased by an impressive 47.2% during the past year. And yet, at 63.1p per action, the Ftse 100 The bank still looks very cheap in several value metrics.

With a ratio to profits (p/e) 9.3 times and 5.4% dividend yield by 2025, Lloyds shares seem cheap according to the expected profits and expected cash rewards.

Finally, with a multiple of price to book (p/b) just below one, the bank also quotes with a slight discount to the value of its assets.

Risky business

But are the actions of Lloyds really the bargain that appear for the first time? I am not convinced.

On the positive side, income can improve and bad loans decrease as interest rates fall. But the risks to profits (and, consequently, the returns of the shareholders) remain considerable, including:

- Sinking margins as interest rates fall.

- The bad growth of sales prolonged as the United Kingdom's economy struggles to grow.

- Additional income and margin pressure as competition intensifies in all sectors.

- High claims costs, if the regulator is guilty of loans for incorrect sales cars.

Against this rear train, I believe that Lloyds actions will continue to deliver bad yields (their annual average is an insignificant 1.1% since the beginning of 2015).

So, although they are cheap, I think they could end up costing me as a long -term investor package.

I'm looking for this

I prefer to invest my effective won with so much effort HSBC (LSE: HSBA) instead.

It faces the same industry pressures as Lloyds, such as increasing competition and pressures of interest rates. His great operations in China also leave him vulnerable to the country's crunch of the country.

However, its important exposure to emerging markets also provides long -term opportunities. I hope that profits take off as the growing wealth and population growth on the demand for financial services.

The bank said that “In the medium and long term, we are still waiting for a single -digit year -on -year growth in customer loans“

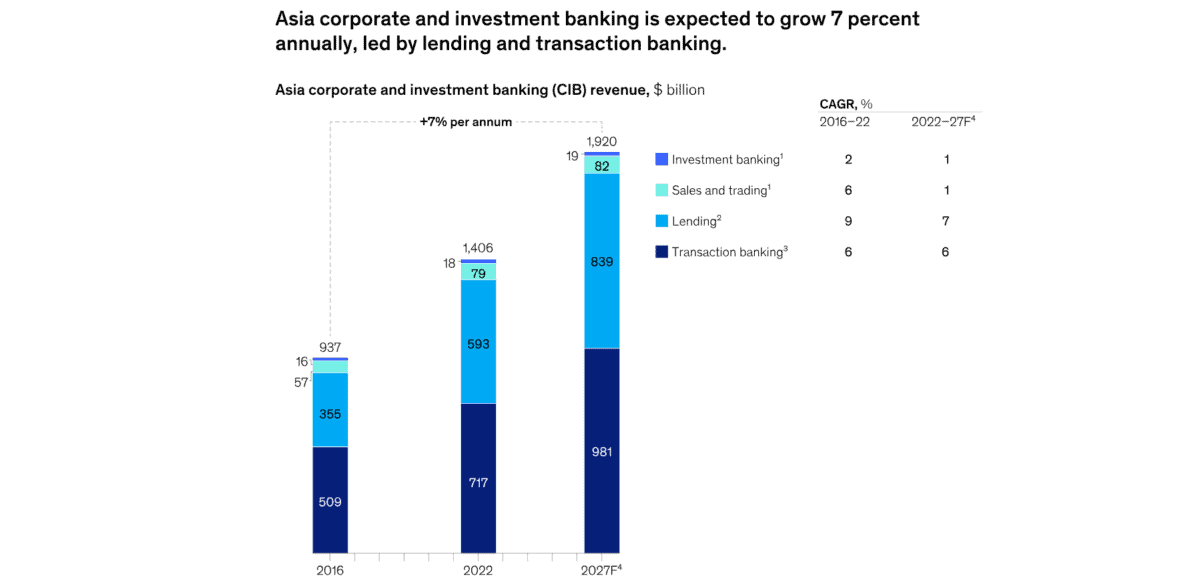

McKinsey & Company analysts hope that the corporate and investment sector of Asia will grow an annual 7% between 2022 and 2027 alone, continuing the rapid expansion of recent years.

HSBC is cutting its non -Asian operations to better focus attention and resources on these hot growth markets as well. Last month, he announced plans to lose his investment banking operations in the US, United Kingdom and Europe, since they readjize their global footprint.

An annual yield of 8%

I am sure that this will lead to exceptional returns from shareholders in the coming years.

The past performance is not a guarantee of future profits. But the average annual performance of 8% of HSBC shares in the last decade illustrates the possible profits that investors could obtain.

That is better than the performance of 1.1% of Lloyds' shares during the same period. It is also better than the yield of 6.5% delivered by the broader FTSE 100.

I do not believe that HSBC's abrasing potential is reflected in its low price of shares. It is quoted in a direct P/E ratio of 8.6 times, which is even lower than that of Lloyds.

The dividends yield of 5.8% of the bank also gives value investors something to scream.

Although it is not exempt from risks, I believe that HSBC shares are worth seeing the current price of 897.2p.

(Tagstotranslate) category. Investing

NEWSLETTER

NEWSLETTER