Markets have been in an “increasingly positive mood” since the Federal Reserve's April meeting and while there are still hurdles to overcome, there are factors in the market's favor after last month's slowdown, Deutsche Bank said. this week.

The SP 500 (SP500)(FLIGHT)(IVV) in early May posted its best four-day performance so far this year, helped by the 10-year performance (US10Y) fell for five consecutive sessions for the first time since August, Deutsche Bank (DB) macro strategist Henry Allen said in a research note.

“It's a decent turnaround from mid-April, when the S&P 500 posted a streak of six consecutive declines and there were strong fears about persistent inflation and geopolitical risks,” he said. The benchmark index fell 4.2% in April.

“Of course, there is still a long way to go for the rest of the year, but there are several reasons to believe that a more positive market narrative is now emerging.”

DB listed “five reasons to be positive” on the stock:

Globally, data releases look increasingly positive across the board.

Allen said the U.S. economy remains in “good shape,” and unemployment remains below 4%. Eurozone growth is improving after several quarters of largely stagnant conditions and China's first-quarter GDP growth of 5.3% was stronger than expected.

For now, Fed Chair Powell's comments and data remove tail risk from near-term rate hikes.

After the April meeting, Powell said the next policy rate move was “unlikely to be an increase,” calming market fears following heated inflation data. Allen said slightly weaker-than-expected data, including the weak April jobs report, prompted investors to price in +40 basis points of rate cuts for the Federal Reserve's December meeting, against a low of 28 basis points before the April meeting.

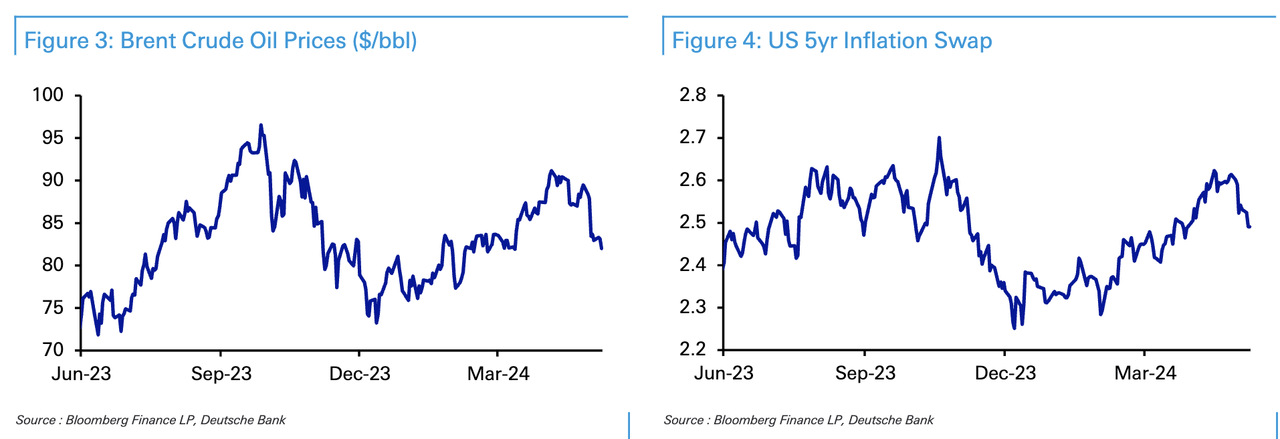

Oil prices are falling again, helping to ease inflationary pressures.

Brent crude (CO1:COM) at around $83 a barrel was at its lowest price in almost two months, largely because fears of a broader geopolitical escalation have not materialized, which in turn reduced expectations. inflation expectations, Allen said. The US 5-year inflation swap closed below 2.5% this week for the first time since late March.

So far, the global economy has continued to demonstrate impressive resilience to higher rates.

There has been no major slowdown given the rapid speed of rate increases, and periods of turbulence such as the collapse of the Bank of Silicon Valley have been contained, Allen said. “Given that monetary policy operates on a lag, this pass-through still occurs, particularly for fixed-rate borrowers. But with each passing month, the economy is increasingly adjusting to the higher level of rates now prevailing.”

Recession has not materialized after periodic deterioration in data

Some indicators point in a more negative direction, such as the 10-year yield falling below the 2-year yield (US2Y), a move that has signaled the last 10 US recessions. “But it has been reversing continuously since July 2022, the longest 2s10s reversal on record, and there are still no signs of a recession,” Allen said.

NEWSLETTER

NEWSLETTER