Updated at 8:53 AM EDT

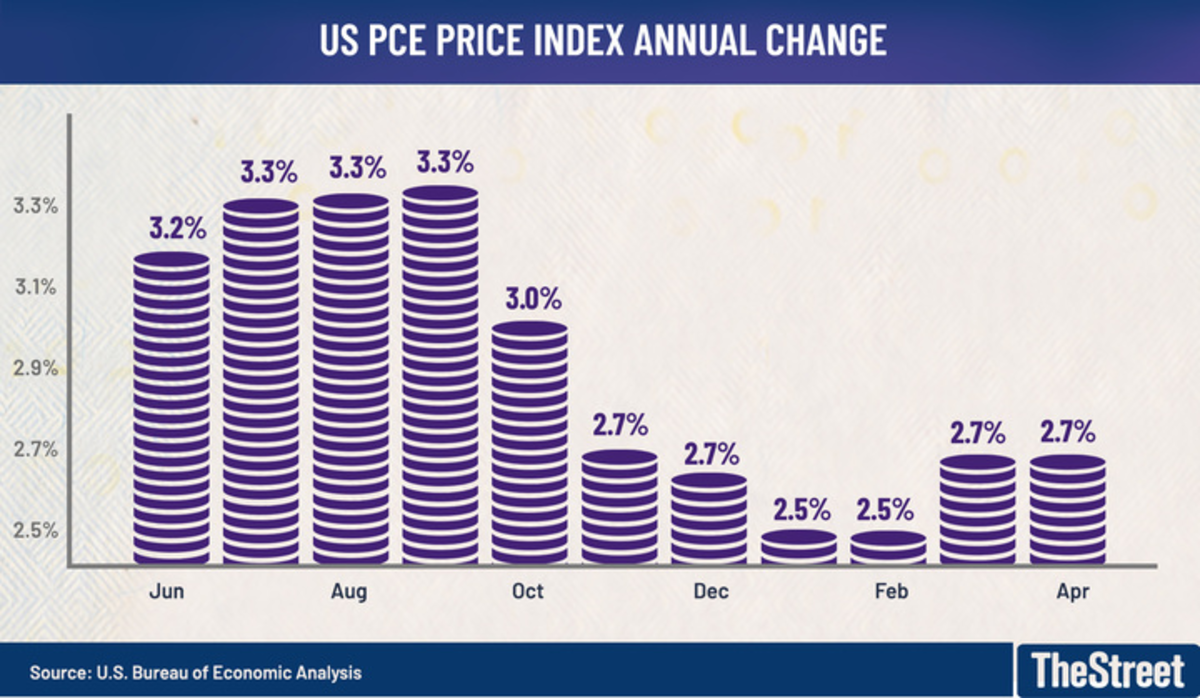

The Federal Reserve's preferred measure of inflation eased modestly in May, falling to the lowest levels in more than three years and possibly strengthening the case for a rate cut in the fall.

The Bureau of Economic Analysis' PCE price index showed core prices rose at a 2.6% annual rate last month, matching Wall Street's forecast and modestly lower than readings in the past two months and the slowest since March 2021.

On a monthly basis, underlying pressures rose 0.1%, a slower pace compared to April's revised 0.3% increase that was also in line with Wall Street's consensus estimate.

Markets typically focus on the bureau's core PCE price index, which the Fed considers a more accurate representation of consumer price pressures because it combines changes in spending patterns.

Meanwhile, the headline index held at an annual rate of 2.6%, in line with Wall Street's forecast. Prices were unchanged in the month, the BEA said, after a 0.3% increase in March.

The BEA also noted that personal income in May rose 0.5%, up from a 0.3% pace in April, reflecting some firmness in the labor market. Spending slowed to a 0.2% increase compared to a 0.1% increase in April.

“The lack of surprises in today's PCE figure is a relief and will be welcomed by the Fed. The annual core PCE has now fallen to the lowest level in three years and should provide some comfort that inflation is slowing somewhat. again,” said Seema Shah, chief global strategist at Principal Asset Management.

“However, the policy path is still not certain,” he added. “A further slowdown in inflation, ideally accompanied by additional evidence of labour market weakness, will be needed to pave the way for a first rate cut in September.”

stocks were broadly unchanged following the release of the data, with the S&P 500 up 20 points and the Dow Jones Industrial Average looking for an initial point advance.

Benchmark 10-year bond yields fell 4 basis points to 4.275% following the release, while 2-year bonds fell 3 basis points to 4.6871%.

The US dollar index, which tracks the greenback's performance against a basket of six global currencies, rose 0.01% to 105.920.

Office of Economic Analysis

Earlier this month, the Commerce Department's headline consumer price index for May was set at 3.3%, down from 3.4% the previous month.

So-called core inflation, which excludes volatile components such as food and energy, slowed to an annual rate of 3.4%, the lowest in more than two years.

More economic analysis:

- Bonds Are Inflation-Crazy

- A key bond market signal sounds the inflation alarm

- Fed rate cuts face a big reset amid renewed inflation risks

He CME Group FedWatch The tool suggests the market expects no rate change from the Federal Reserve when it concludes its two-day May policy meeting on July 31, after holding rates steady at a two-decade high of 5.25% to 5.5% earlier this month.

However, bets on the Federal Reserve starting to cut rates in September are rising to around 66%, and markets are still debating the odds of a second rate cut before the end of the year.

Related: Veteran fund manager picks his favorite stocks for 2024