in focus

Heading into the biopharmaceutical sector’s third-quarter earnings season, Bank of America has taken a bullish stance on Eli Lilly (New York Stock Exchange:LLY) and Gilead (NASDAQ: GOLDEN) while raising concerns about COVID-era favorites like Pfizer (New York Stock Exchange:PFE) and Regenerón (NASDAQ:REGNAR).

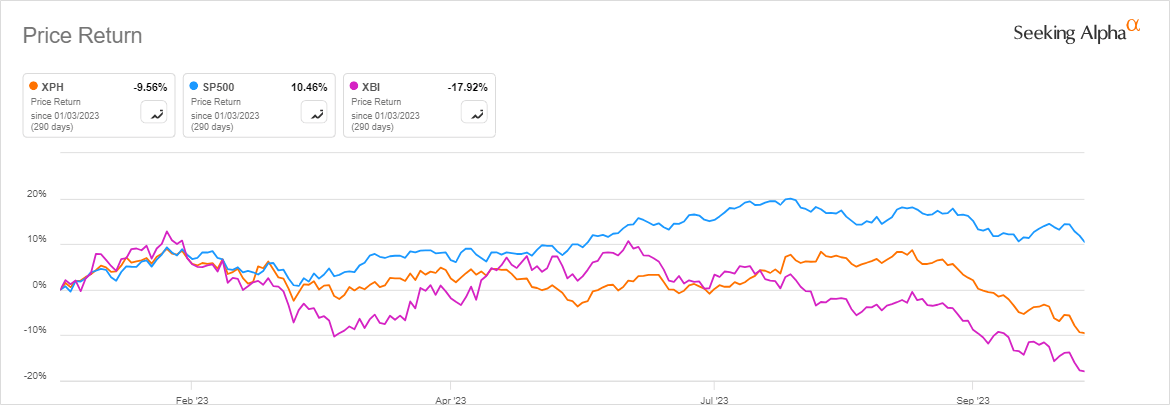

The end of the pandemic The emergency has disrupted the healthcare sector, and biotech and pharmaceutical stocks have underperformed the broader market this year, as indicated in this graph.

Investors have supported obesity drug developers Novo Nordisk (NVO) and Eli Lilly (LLY) as COVID-19 product makers like Pfizer (PFE) and Regeneron (REGN) grapple with a slowdown in revenue boom of the pandemic era.

However, as earnings season progresses, Bank of America attributes biopharma’s year-to-date underperformance to sector rotation, noting that markets expect a “soft landing” amid improving earnings. macroeconomic conditions.

“That said, the focus is likely to remain on trade execution, in the face of macroeconomic risks and the IRA,” wrote BofA analyst Geoff Meacham, indicating the importance of the changes introduced by the Inflation Reduction Act ( IRA) of the Biden Administration.

Ahead of third-quarter results, Meacham sees Eli Lilly (LLY) and Gilead Sciences (GILD) benefiting from strong demand for their products, targeting diabetes/weight loss and HIV, respectively.

With third-quarter sales estimates above consensus for both companies, Bank of America reaffirmed Buy ratings on LLY and GILD in a recent research note, keeping their price targets at $700 and $95, respectively.

However, BofA is not convinced about the prospects of Pfizer (PFE) and Regeneron (REGN). Citing uncertainty in demand for the company’s COVID products, the company forecasts third-quarter PFE sales below consensus and issues a Neutral rating and $45 per share target on the stock.

A few days ago, Pfizer (PFE) lowered its 2023 revenue outlook by up to $9 billion due to lower-than-anticipated sales of its pandemic-era products, particularly its COVID pill, Paxlovid.

However, BofA maintains an Underperform rating and $680 per share target on REGN. With REGN’s third-quarter sales below consensus, Meacham cites pressure on the company’s Eylea franchise in the U.S. despite recent FDA approval of a high-dose version of the blockbuster eye therapy.