Image source: Getty Images

Airline stocks have rallied exceptionally since they crashed during the pandemic. Some airlines have even seen their share price double. Nevertheless, easyJet (LSE:EZJ) shares have been an exception as they are still below their 2020 low. So here’s why I’ll buy the stock.

ascending numbers

While easyJet continues to lag behind its peers, it’s worth noting that the airline’s passenger numbers continue to recover apace. This has seen his revenue rise, though his bottom line still lags by quite a large margin.

| Metrics | fiscal year 22 | fiscal year 21 | fiscal year 2019 | Change vs. FY19 |

|---|---|---|---|---|

| passengers | 69.7m | 20.4m | 96.1 meters | -27% |

| Charge factor | 85.5% | 72.5% | 91.5% | -6% |

| Ability | 81.5 meters | 28.2m | 105.0m | -22% |

| Income | £5.77 billion | £1.46 billion | £6.39 billion | -10% |

| Diluted earnings per share (EPS) | -22.4p | -159.0p | 87.8p | -126% |

However, CEO Johan Lundgren is optimistic about the FTSE 250 company prospects. It expects revenue per seat (RPS) to increase 20% and load factor to reach 87% this year. This should bring the company ever closer to its pre-pandemic levels and profitability.

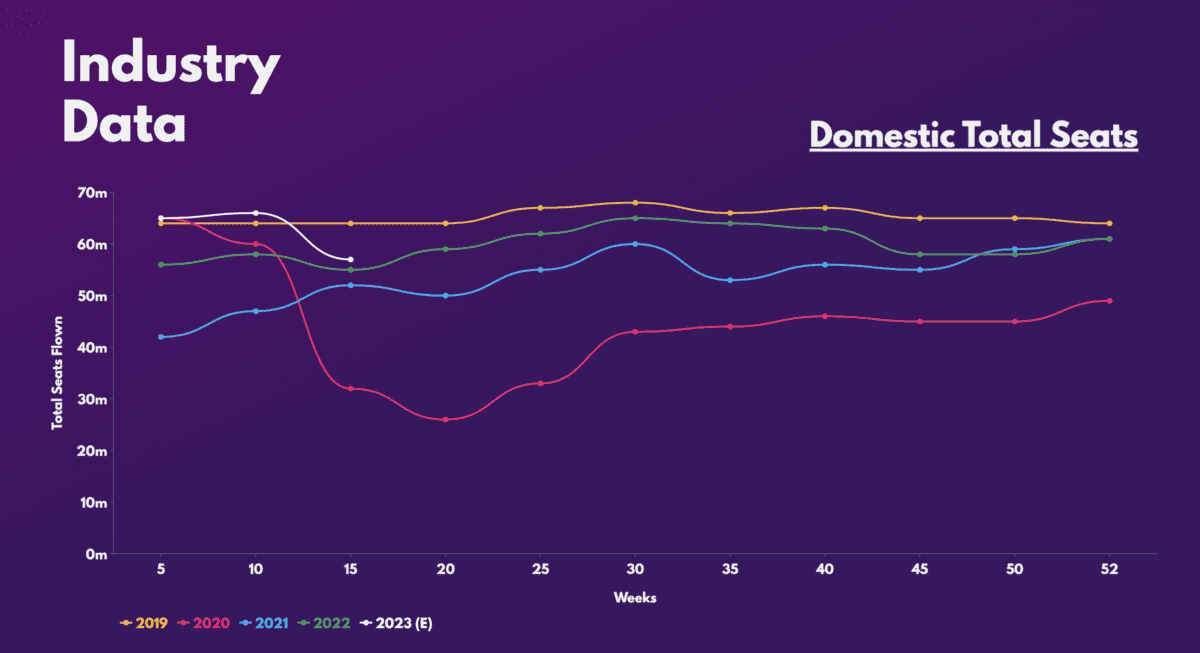

Concerns about an impending recession have investors fearing that demand for air travel will wane. This has led to fewer domestic flights being booked so far this year.

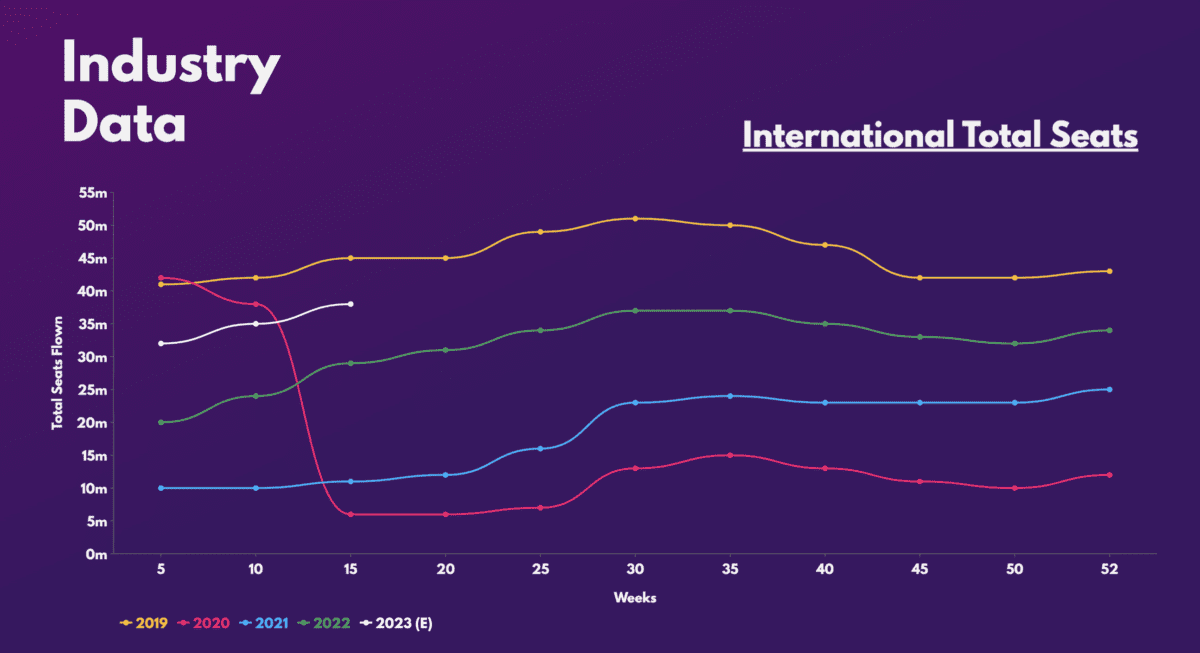

That said, it’s important to note that most of the company’s revenue comes from international flights, even if they are short-haul. Unlike domestic travel, international travel is forecast to continue to recover in 2023, which stocks are expected to benefit from. In fact, easyJet’s share price is already up 20% this year.

as the likes of fresh air Y ryanair Not reporting signs of slowing demand for short-haul international air travel, I’m anticipating the orange carrier will report a set of upbeat numbers in its first quarter update later this month.

Make easy money?

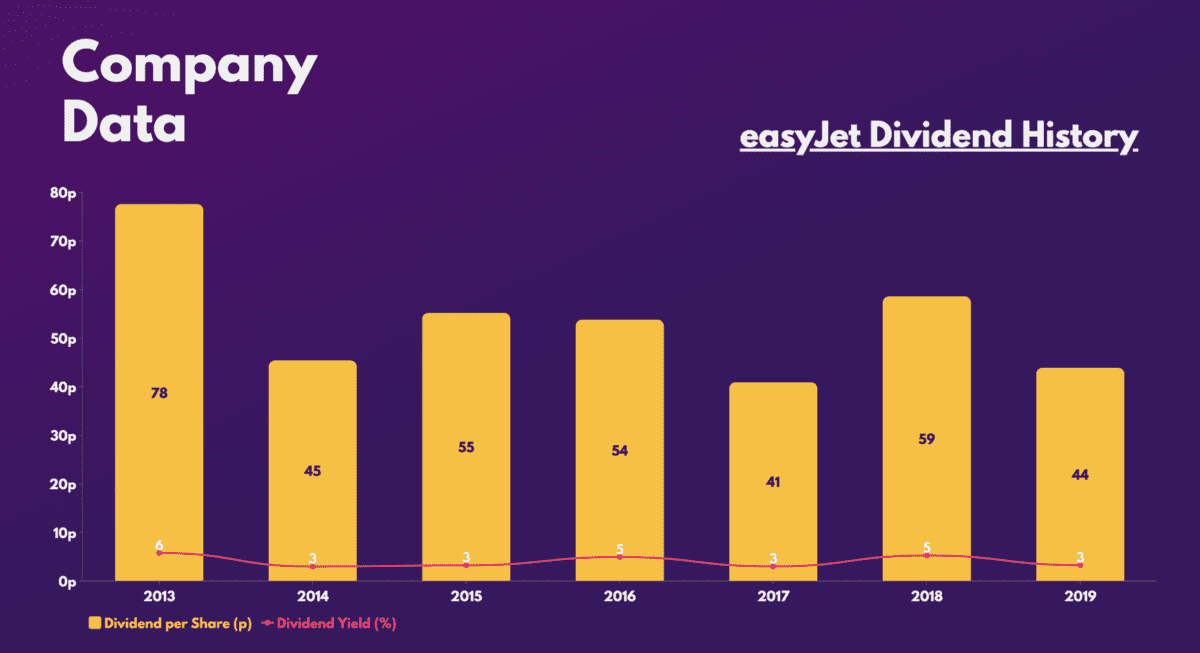

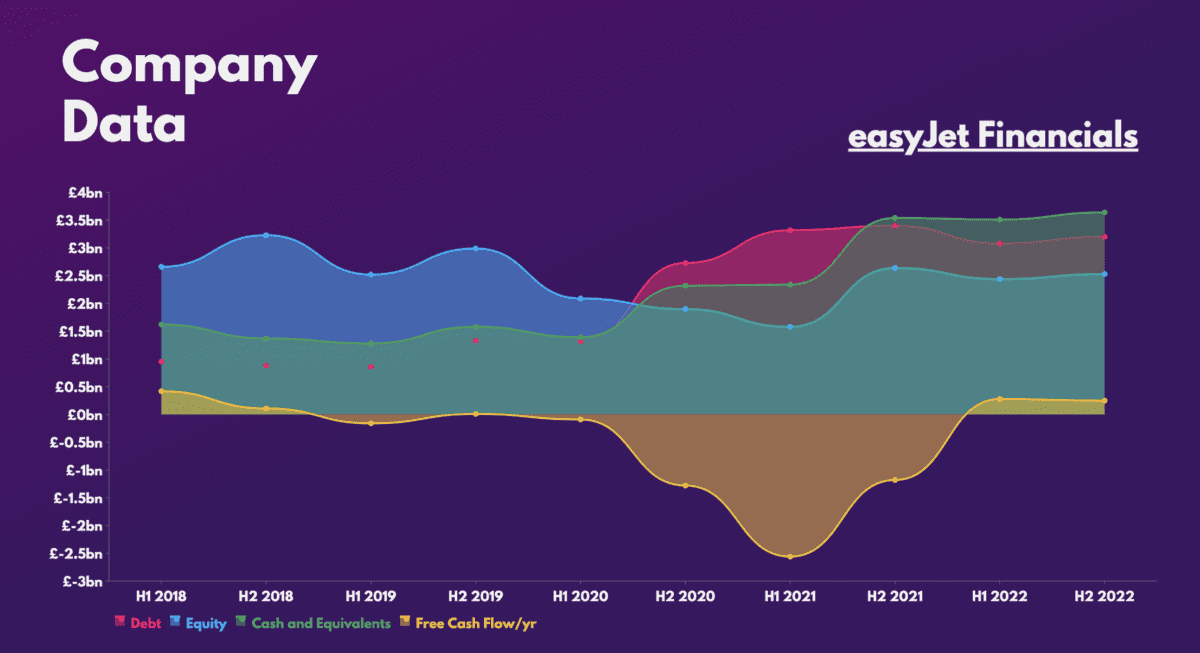

Before the pandemic, the group paid a robust set of dividends annually. Unfortunately, shareholder returns have since ground to a halt, as profits plummeted and debt levels rose.

However, it’s worth noting that easyJet has one of the best balance sheets in the industry. As long as the conglomerate’s top and bottom lines continue to rise, analysts forecast a dividend reset as soon as the end of this year. This would especially be the case if the budget airline reaches profitability by then. As such, I can envision investors looking for passive income to start buying stocks and driving their share price up.

Potential to fly higher

However, aside from dividends, the Luton-based airline also has a number of excellent long-term growth prospects. From trying to develop a hydrogen-powered engine with rolls royceto industry tailwinds in which IATA forecasts passenger numbers for air travel to grow to 8 billion passengers by 2040.

Furthermore, people like Bernstein and UBS rate the stock a ‘buy’, with an average price target of £6. This would present easyJet shares with an advantage of 50% of current levels. Additionally, a price-to-sales (P/S) ratio of 0.5 and a price-to-book (P/B) ratio of 1.3 indicate that the stock is trading at a reasonable valuation at these levels.

easyJet is not known for quality earnings, averaging a profit margin of less than 5%. However, the strong bullish momentum of its rally leads me to believe that the growth stock can achieve significant margin expansion once it reaches profitability. After all, with falling fuel prices, this might be possible. So I will be looking to buy easyJet shares once my preferred broker launches UK shares on their platform.

NEWSLETTER

NEWSLETTER