Alvarez/E+ via Getty Images

The Select Industrial Sector (XLI) was in the red for the second week (-2.35%) in a row, for the week ending March 17. This week’s industry gainers (in our segment) include some logistics service providers, while those down I saw some airline names.

The SPDR S&P 500 Trust ETF (SPY) +1.06% won, fueled by technology and communication, in the midst of the worst financial crisis since 2008. In the US, Signature Bank and Silicon Valley Bank were taken over by American regulators due to liquidity problems, while Credit Suisse of Switzerland received a lifeline of $54 billion from its Swiss National Bank. Meanwhile, markets expect a 25 basis point rate hike from the Federal Reserve at its next policy meeting.

The top five gainers in the industrial sector (stocks with a market capitalization of more than $2 billion) earned more than +5% each this week. YTD, all these five are in green.

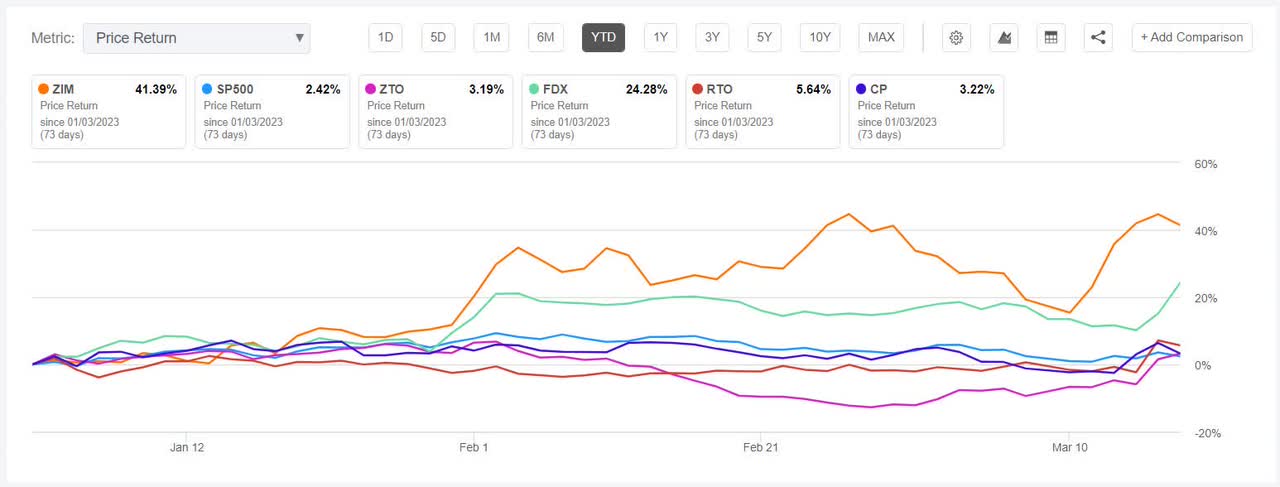

ZIM Integrated Shipping Services (NYSE:ZIM) +22.53%. The Israeli shipping company, which was among those who declined two weeks ago, jumped to take the top spot this week on the back of its fourth-quarter earnings report. On Monday, the company’s shares rose (+6.59%) on Q4 earnings pace and a positive outlook while declaring a quarterly dividend of $6.40/share. The next day, the stock rose even higher (March 14 +10.35%).

ZIM has an SA Quant rating, which takes into account factors such as momentum, profitability and valuation, among others, retention. The stock has a factor rating of A+ for Profitability but F for Growth. Wall Street’s average analyst rating is in line with a self-hold rating, in which 3 out of 7 analysts view the stock as such. THE LAST YEAR, +39.50%.

ZTO Express (Cayman) (ZTO) +10.53%. The Chinese logistics service provider landed among the winners for the second week in a row. the stock went up +7.94% on Thursday even though fourth-quarter results have no estimates.

The SA Quant rating on ZTO is Buy, with a score of A for Profitability B- for Momentum. Wall Street analysts’ average rating is a Strong Buy, with 16 of 22 analysts labeling the stock as such. THE LAST YEAR, +5.88%.

The chart below shows the YTD price-performance ratio of the top five gainers and SP500:

FedEx (FDX) +9.50%. Shares of FedEx, its logistics peer, rose +7.97% on March 17 after its third-quarter earnings showed cost-saving efforts boosted performance. The Memphis, Tennessee-based company also raised its forecasts for fiscal 2023, prompting several analysts to upgrade the stock.

The SA Quant Rating on FDX is Hold, with a C rating for both Momentum and Valuation. Wall Street analysts’ average rating differs from the Buy rating, in which 12 of 29 analysts view the stock as a Strong Buy. THE LAST YEAR, +27.20%.

Rentokil Initial (RTO) +7.39%. UK-based pest control service provider Rentokil saw its shares soar further this week on Thursday (+9.71%) after fiscal year 22 revenue grew around 25% Y/Y. The SA Quant rating on RTO is Hold, which initially contrasts with Wall Street analysts’ average Buy rating. THE LAST YEAR, +7.01%.

Canadian Pacific Railway (CP) +5.69%. The Surface Transportation Board on Wednesday approved CP’s acquisition of Kansas City Southern, prompting an increase in inventories. Wall Street analysts’ average rating on CP is a buy, while the SA Quant rating is a hold. THE LAST YEAR, +3.62%.

This week’s top five decliners among industrial stocks (market capitalization over $2 billion) lost more than -14% each. YTD, 3 of these 5 stocks are in the red.

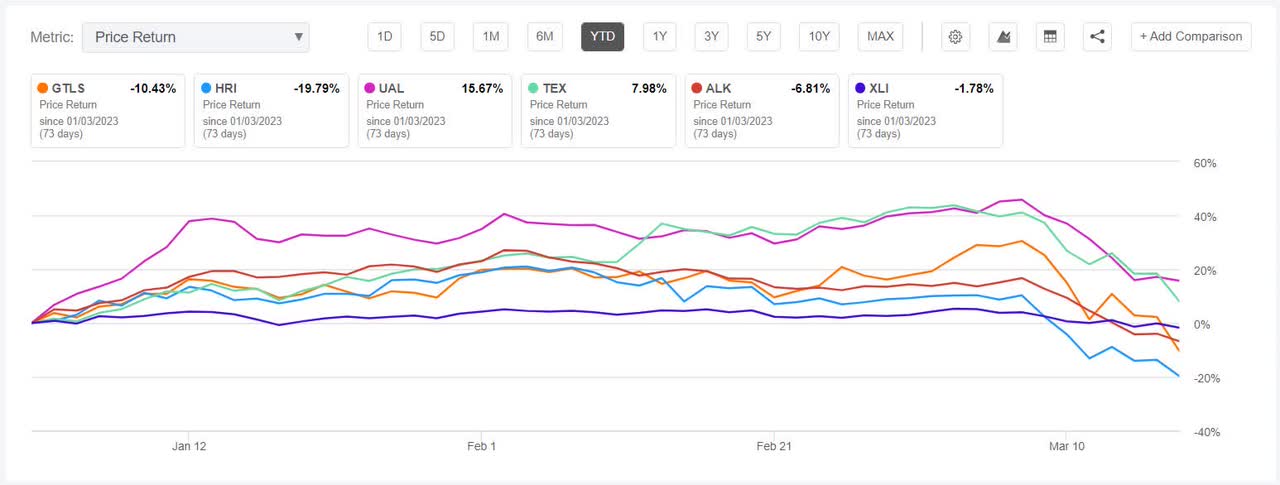

Graph Industries (New York Stock Exchange: GTLS) -22.09%. The Ball Ground, Georgia-based provider of cryogenic solutions fell to its lowest level this week on Friday (-12.38%) after providing an updated outlook for fiscal 2023, including the recently completed Howden acquisition, which apparently disappointed investors.

The SA Quant rating on GTLS is Sell with a score of F for Profitability and D for Momentum. The rating stands in stark contrast to Wall Street analysts’ average Strong Buy rating, in which 12 of 15 analysts view the stock as a Strong Buy. THE LAST YEAR, -10.67%.

Herc Holdings (HRI) -16.27%. The Florida-based company, which rents earthmoving equipment, trucks and other equipment, witnessed the biggest drop in its shares this week on Monday (-9.35%). The SA Quant Rating on HRI is Hold, with a score of B- for Valuation and C for Momentum. The average Wall Street analyst rating is a Buy, with 6 out of 10 analysts viewing the stock as a Strong Buy. THE LAST YEAR, -19.59%.

The chart below shows the YTD price-earnings performance of the five worst decliners and XLI:

United Airlines (UAL) -15.56%. Market turmoil seemed to weigh on the airline industry as the (JETS) sector fell sharply on Monday. Shares of UAL, which also saw a drop the week before, fell for three straight days this week, starting Monday, after offering a bearish outlook for the first quarter of 2023.

The SA Quant rating on UAL is a Strong Buy, scoring A+ for profitability and A for growth. The average Wall Street analyst rating is a Buy, with 7 of 21 analysts labeling the stock a Strong Buy. THE LAST YEAR, +14.16%.

Terex (TEX) -14.88%. shares fell -8.80% on Friday after Bank of America downgraded the heavy machinery maker’s shares to Neutral from Buy. The SA Quant rating on TEX is a Strong Buy, while Wall Street analysts’ average rating is a Buy. THE LAST YEAR, +6.06%the only stock other than UAL that is in the green among the five worst performers this week.

Alaska Air Group (ALK) -14.77%. Shares of another airline, which met a similar fate to UAL, declined the week before and fell three days in a row beginning Monday. The Seattle-based company lowered its first-quarter margin forecast amid higher fuel costs. The SA Quant rating on ALK is a Buy, while the average Wall Street Analysts rating is a Strong Buy. THE LAST YEAR, -8.50%.

NEWSLETTER

NEWSLETTER