- The previous week was very bearish for the dollar index, while this week we see a bullish consolidation towards a correction.

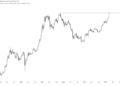

Dollar Index Chart Analysis

The previous week was very bearish for the dollar index, while this week we see a bullish consolidation towards a correction. On Monday, the dollar fell to the 104.84 level, stopping the decline and starting a bullish consolidation. On Wednesday, the index rose to the level of 105.80, where it met the EMA50 moving average, which at that time did not allow a breakout above it and continued on the bullish side.

After the rejection of the EMA50 moving average, the dollar turns defensive and retreats to reach the support at the 105.40 level. Yesterday we formed a new price bottom from which we began the recovery of the dollar index with bullish momentum. That move took us down to the 106.00 level.

The 106.00 level as a springboard for a bullish option

During the Asian session the dollar moved in the range 105.80-106.00. The same movement continued in the EU session. We need a breakout above this zone to get rid of the bearish pressure and move smoothly towards further recovery on the bullish side. The highest potential targets are the 106.20 and 106.40 levels.

We need a negative consolidation and a pullback to the 105.60 level for a bearish option. Therefore, we would move below the EMA50 moving average, which would have a negative effect on the dollar index. There would be increased bearish pressure and a further pullback to lower support levels would be expected. The lowest possible targets are the levels 105.40 and 105.20.

ADDITIONAL VIDEO: Weekly summary of market news

!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod?n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;n.queue=();t=b.createElement(e);t.async=!0;t.src=v;s=b.getElementsByTagName(e)(0);s.parentNode.insertBefore(t,s)}(window,document,’script’,’https://connect.facebook.net/en_US/fbevents.js’);fbq(‘init’,’504526293689977′);fbq(‘track’,’PageView’)

NEWSLETTER

NEWSLETTER