Have you ever wondered what the diamond continuation pattern is and why you need to know how to identify it? Compared to many other patterns, how will it greatly help you in trading?

First of all, the more you know about trading patterns, such as the continuation diamond pattern, the better chance you have of outperforming the competition and, with their help, achieving your desired profits in the most effective and quick way.

But what does the continuation diamond chart pattern actually mean? What is the best way to detect it, interpret it and use it to trade? Let’s get to the heart of the matter, shall we?

The Diamond Continuation Definition and Explanation

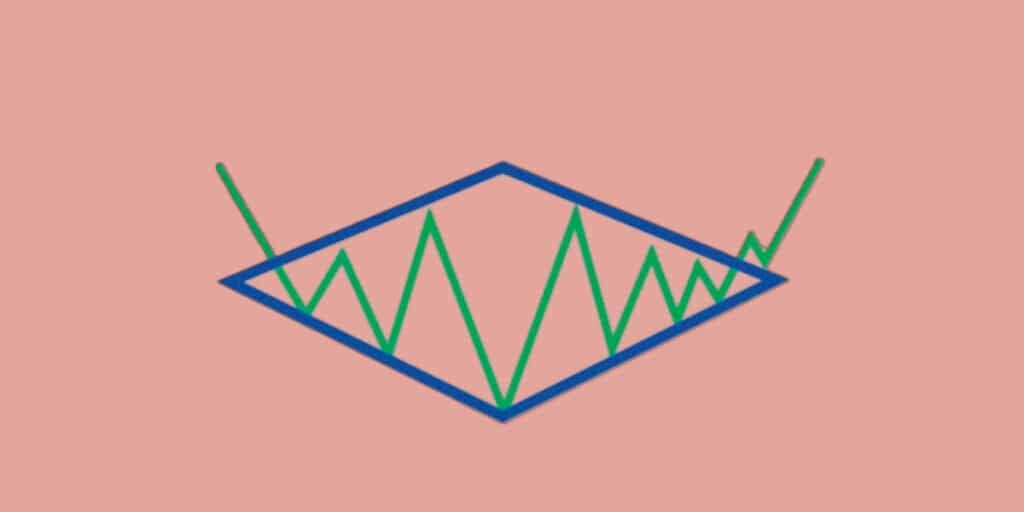

The diamond continuation pattern represents a distinctive pattern or formation on charts once price breaks out of a consolidation phase and continues an uptrend. This pattern begins with a downtrend, during which prices from lower lows and higher highs are in an expanded pattern.

As the trading range contracts, the highs and lows of the high level begin to trend up. The key indication of the diamond continuation pattern is once the price breaks out of the diamond boundary lines. It does so by signaling the renewal of the previous uptrend.

Diamond Formation: A Relatively Rare Occurrence

It is crucial that traders use other technical analysis tools in conjunction with the Diamond formation to confirm the continuation of the uptrend. Also, it is essential to note that diamond formation is a relatively rare occurrence in financial markets and should be used in combination with other signals to make a trading decision.

Traders can use the diamond continuation pattern as a confirmation signal of a trend reversal or as a reversal pattern that confirms the continuation of the past trend.

The pattern will not always indicate a trend reversal or continuation.

It is crucial to remember that the Diamond formation is not a foolproof pattern and may not always indicate a trend reversal or continuation. To ensure a sound trading decision, it is essential to use a variety of technical analysis tools in conjunction with the Diamond formation to confirm the trend.

Furthermore, it is also crucial to pay attention to the trading volume during the formation of the Diamond. The reason for this is that significantly high volume during the breakout of the Diamond pattern can provide additional confirmation of the continuation of the uptrend.

In addition, the size of the diamond formation should also be considered, as larger diamond patterns generally indicate a stronger trend than smaller ones.

How to identify the Diamond Continuation Pattern?

Once you are about to identify the famous diamond continuation chart pattern, remember that the symmetry of the pattern is a crucial aspect to consider. When the lows and highs are somewhat symmetrical, and the pattern lines are parallel, this diamond continuation pattern is considered more reliable.

What is also essential to note is that this particular pattern usually forms over an interval of several months. Therefore, it is not suitable for short-term trading. In addition to this aspect, it is crucial for traders to keep in mind that the Diamond formation is either bearish or bullish. It depends solely on the conditions in the market, along with other indicators.

attention to volume

It is also essential that traders pay attention to the different levels of volume. A decrease in volume throughout the formation of the pattern and an increase in volume during the famous breakout means that the diamond continuation pattern is probably more accurate.

The use of multiple technical analysis tools and indicators in conjunction with the Diamond formation is crucial to confirm the trend and make a trading decision. When interpreting the Diamond pattern, it is also essential to consider the broader context of the market.

Where can this diamond chart pattern be used?

It is important to understand where the Diamond chart pattern is best used. There are several ways in trading that this pattern could be used. Here’s what it all includes:

Make a proper identification of the continuation of an existing trend.

The Continuation Diamond chart pattern refers to a continuation signal. Indicates that the current trend is expected to continue. This particular pattern is used by traders who want to confirm the uptrend and look for potential buying opportunities in the market.

Definition of entry and exit points

The breakout of the diamond pattern could allow an excellent entry point for a single trade. The resistance level of this pattern can also serve as a target for profit. The support level of the diamond continuation pattern can also be used as a stop-loss level to restrict potential losses.

Risk management

Remember that the diamond continuation chart pattern can also help manage risk. You can do this by allowing traders to set thigh stop-loss levels that are based solely on the support levels of the pattern.

Portfolio diversification

This pattern can help traders identify valuable opportunities in various markets and asset classes. It is all crucial to help traders diversify their portfolios and manage their risks in the market for the long term.

Market Timing

The diamond continuation pattern can also be used to perform proper market timing. It is able to do this by recognizing potential selling or buying opportunities based on the pattern breakout.

The thing to remember is that this pattern should be used in conjunction with other technical analysis tools to confirm a certain trend. That will help in making a trading decision, as the pattern itself is not a sufficient indicator.

Bullish Diamond Continuation Pattern – Get the basics.

The bullish continuation diamond pattern represents a bullish signal that the current trend is likely to continue. Diamond patterns typically settle for a couple of months in extremely active markets. Throughout the formation of the bullish continuation diamond pattern, volume will remain high.

As noted above, diamond patterns are characterized by the formation of increasingly higher peaks and lower valleys in a pattern that widens over time. As the trading range narrows, the peaks and troughs begin to trend up.

When prices break out of the Diamond formation and move higher, it can signal a continuation of the previous uptrend, signaling a potential trading opportunity for traders.

Also, it is vital to note that diamond patterns are not always reliable, and traders must use other technical analysis tools in conjunction with the diamond pattern to confirm the trend and make a trading decision.

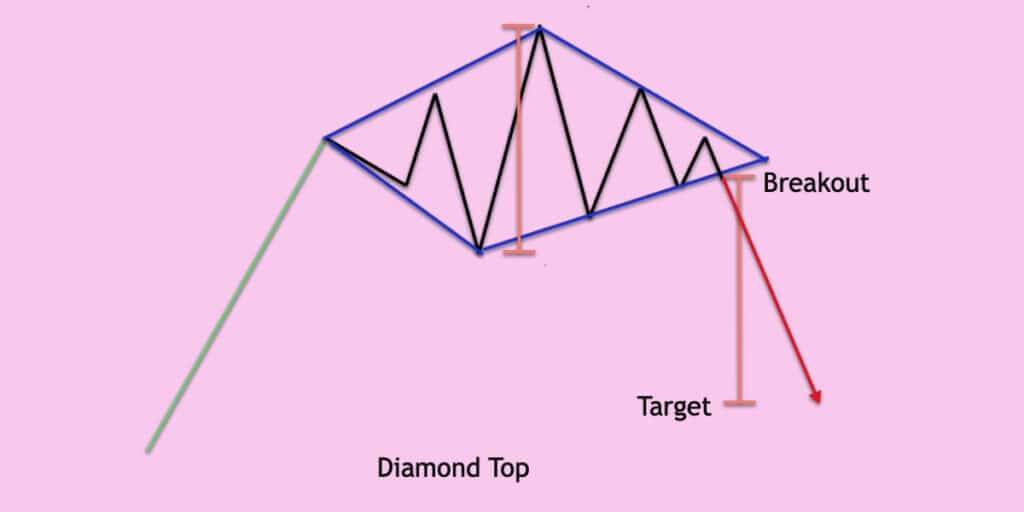

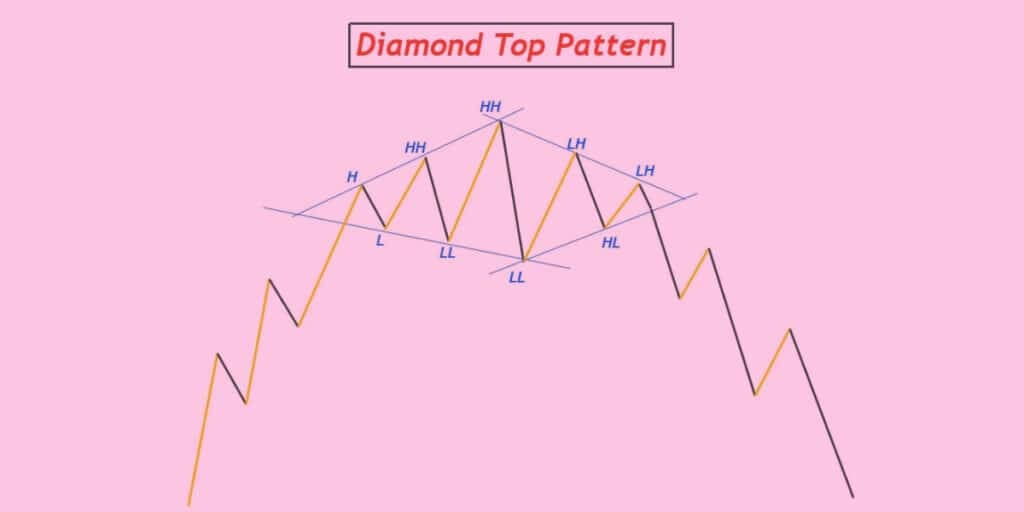

What exactly is a diamond top pattern?

Now that you have all the essential information about the diamond continuation pattern, it’s time to learn what the top diamond pattern represents. This particular pattern is referred to as a technical analysis pattern. A solid uptrend usually takes you higher.

The Diamond Top pattern forms a series of lower lows and higher highs, and then the higher and lower highs on the particular price chart. Traders can spot a diamond shape on the chart by connecting these minor lows and highs and drawing trend lines. For that particular reason, it is called the “Diamond Top Chart Pattern”.

When is the formation of this pattern complete?

This particular chart pattern is formed once the price action is below the lower trend line. It can also be completed once the stock price closes out of it. Please pay attention to the volume which is vital in your creation.

Volume should pick up solidly during the move higher that sets the stage for the formation. After that, it will drop sharply until the expected collapse occurs. As a result of the depletion of the buying force and the influx of sellers taking control of the market momentum, prices drop significantly once the selling pressure is triggered.

This further confirms the strength of the move and makes it more likely that the fall will continue. The volume then increases and remains elevated during the breakout for several days.

How to trade the Diamond Top pattern?

The Diamond Top pattern is best traded once you are confident and follow its breakout direction. In other words, traders can sell once the price is below the lower trend line. Furthermore, they can buy once it breaks above the upper trend line.

Resume

The diamond continuation chart is a unique formation that appears on the charts when the price breaks out of a consolidation phase and continues an uptrend. This pattern begins with a downtrend, during which prices create lower lows and higher highs in an expanded pattern. As the trading range narrows, the highs and lows begin to trend up.

The key indication of this pattern is when the price breaks out of the Diamond limits, indicating the continuation of the previous uptrend. It is important to note that the continuation diamond chart is only sometimes a reliable pattern, and traders must use other technical analysis tools in conjunction with it to confirm the trend and make a trading decision.

Also, traders should pay attention to trading volume during the diamond continuation chart formation, as high volume during the pattern breakout can provide additional confirmation of the continuation of the uptrend.