JulPo/E+ via Getty Images

The Industrial Select Sector SPDR Fund ETF (XLI) rose +1.82% for the week ending August 23, while the SPDR S&P 500 Trust ETF (SPY) rose +1.41%.

Powell Industries (NASDAQ:POWL) was the biggest industrial gainer (in the segment) of the week, which saw construction stocks and infrastructure companies soared after Federal Reserve Chairman Jerome Powell's speech on Friday significantly increased the odds of a September rate cut. Meanwhile, Dycom Industries (New York Stock Exchange:DY) was the stock that lost the most this week, including aerospace defense companies and airport operators.

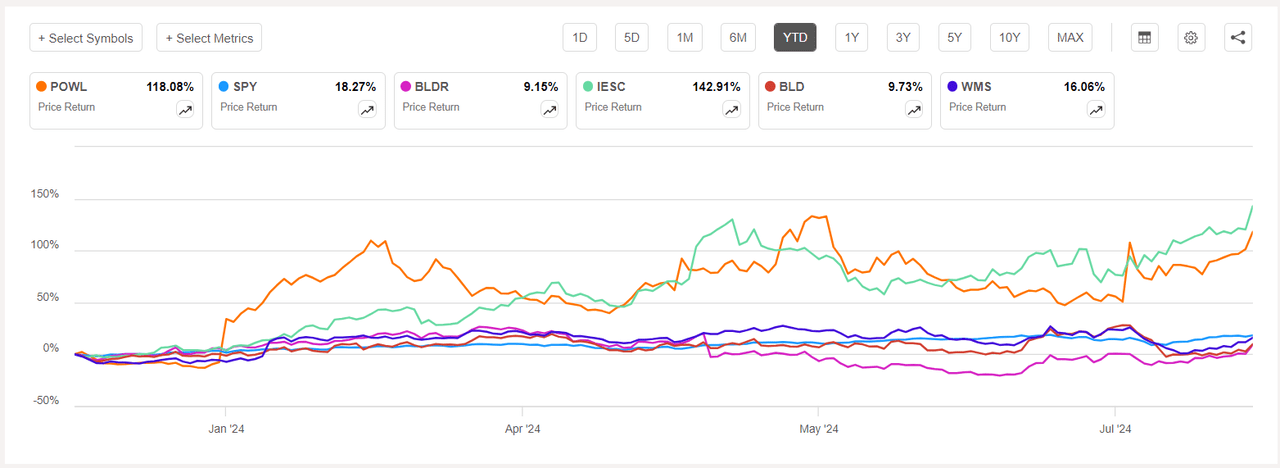

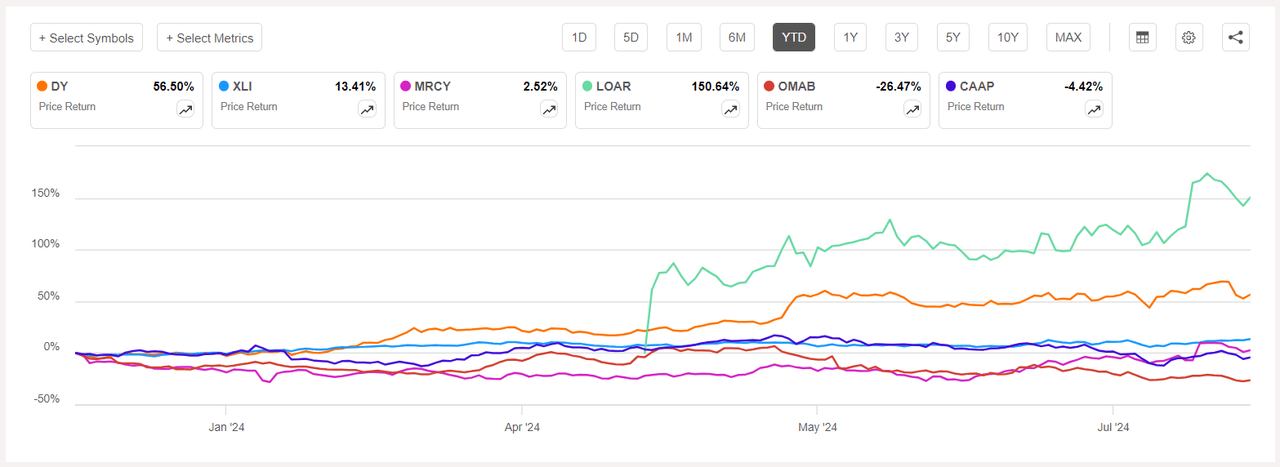

Industrial sectors were among 10 of the 11 in the S&P 500 that ended the week in the green. Year to date, or YTD, the XLI is up +13.41%while SPY has skyrocketed +18.27%.

The top five gainers in the industrial sector (stocks with a market capitalization of more than $2 billion) gained more than +10% Each one this week. So far, all 5 stocks are in the green.

Powell Industries (POWL) +14.39%Shares of the Houston-based company, which makes substations for power control rooms, were among many that rose on Friday (+8.29%), after Federal Reserve Chairman Jerome Powell signaled the central bank is ready to begin cutting interest rates from a two-decade high. +118.08%.

POWL has a SA Quant rating (which takes into account factors such as momentum, profitability, and valuation, among others) of Strong Buy. The stock has a factor rating of A- for profitability and A+ for growth. The average rating from Wall Street analysts (1 analyst in total in this case) differs and has a rating of Hold.

FirstSource Builders (BLDR) +13.08%Shares of the building materials manufacturer rose +8.75% on Friday. So far, +9.15%BLDR's SA Quant rating is Hold, with a B- score for both valuation and momentum. The average Wall Street analyst rating is more positive, with a Buy rating, with 8 out of 15 analysts considering the stock a Strong Buy.

The chart below shows the year-to-date price-to-yield performance of the top five gainers and SPY:

IES Holdings (IESC) +12.60%Shares of IES, which offers network infrastructure installation services, also rose on Friday (+10.23%). So far, +142.91%.

Top Construction (BLD) +10.36%The stock rose further on Friday (+6.79%). LAST YEAR, +9.73%BLD's SA Quant rating is Hold, while the average rating from Wall Street analysts is Buy.

Advanced Drainage Systems (WMS) +10.17%The Hilliard, Ohio-based company, which makes pipes and water management products, saw its shares rise further on Wednesday (+4.32%), in addition to seeing a peak on Friday (-3.98%). LAST YEAR, +16.06%SA Quant's rating on WMS is Hold, which contrasts with the average Wall Street analyst rating of Strong Buy.

The five industrial stocks that fell the most this week (market caps over $2 billion) lost more than -4% each. So far, 2 of these 5 stocks are in the red.

Dycom Industries (DY) -6.76%Shares of the company, which provides contracting services to the telecommunications and utilities industries, fell -7.55% On Wednesday, after it provided guidance for the current quarter along with its quarterly results, shares are up year-to-date. +56.50%.

DY's SA Quant rating is a Buy, with a B+ rating for growth and a C for profitability. The average Wall Street analyst rating is in agreement and has a Strong Buy rating, with 8 out of 8 analysts believing the stock to be such.

Mercury Systems (MRCY) -6.51%Shares of the aerospace and defense products maker were among the top five gainers last week. This week, the stock fell further on Thursday (-3.76%). LAST YEAR, +2.52%SA's quantitative rating for MRCY is Hold, with a B+ score for momentum and C+ for valuation. The average rating from Wall Street analysts is in agreement and also has a Buy rating, with 4 out of 9 analysts rating the stock as such.

The chart below shows the YTD price-yield performance of the five worst losers of the week and XLI:

Praise (LOAR) -6.36%The company, which makes components for aircraft and aerospace and defense systems, saw its shares fall more sharply on Wednesday (-3.40%). Loar was also among the top five gainers last week. YTD, +43.81%The average rating on LOAR from Wall Street analysts is Buy.

North Central Airport Group (OMAB) -5.98%Shares of the Mexican airport operator fell -3.29% on Wednesday. So far, -26.47%OMAB's SA Quant rating is Sell, which contrasts with the average Hold rating from Wall Street analysts.

America Corporation Airports (CAAP) -4.60%The Luxembourg-based airport operator saw its shares fall -4.25% on Thursday after releasing its second quarter results (after-market on Wednesday). YTD, -4.42%Both the SA Quant rating and the average Wall Street analyst rating for CAAP are Buy.

NEWSLETTER

NEWSLETTER