Lara Belova

The shape of the casino and gambling sector in 2023 is complicated, as global macroeconomic pressures face the return of business travel, international travel and the expansion of legalization of sports betting after the pandemic . Investors will also face the challenge of threading the needle between high-growth plays and value picks.

US Region Games: Boyd Gaming (BYD) and Penn Entertainment (PENN) earnings reports were strong enough to overcome some concerns about consumers cutting casino spending, though there is still a cautious outlook for 2023. The reading was important because regional casinos have seen the first signs of distress historically, even with revenue trends that tend to be more resilient in periods of recession and consumer pullbacks. Morgan Stanley analyst Stephen Grambling noted that regional brick-and-mortar store GGR levels slowed from 10% to 15% in the fourth quarter, above 2019 levels, toward high single digits. Macquarie analyst Chad Benyon forecasts a -2% decline in revenue for regional carriers, with the first quarter seen as the strongest quarter due to easier comparison to a year ago. The firm sees MGM Resorts (MGM), Bally’s Interactive (BALY) and Monarch Casino & Resort (MCRI) as the operators most likely to beat estimates.

Las Vegas Strip: Casinos in Nevada saw a 14% increase in gaming revenue in December to more than $1.31 billion, according to an update from the Nevada Gaming Control Board. Las Vegas Strip casinos accounted for $814 million of the monthly tally, which was 25% higher than the level of a year ago. An increase in group and convention business during the month and events like Raiders home football games, a college bowl game, the Pac 12 football championship and a national rodeo event helped bring more traffic to Las Vegas in December. The Strip’s big month helped offset some weakness with downtown Las Vegas casinos (-6.9% Y/Y) and the Boulder Strip region (-8.0%). CBRE Equity Research analyst John DeCree said the Strip is now in full swing, with continued growth in gaming volumes, including signs of an early recovery in international gaming like baccarat. Higher room prices due to a rebound in the group and convention business are expected to accelerate further. Accelerates The company is bullish on the Strip’s FY23 outlook, particularly for the first quarter due to weak comparables.

Macau: Gross gaming revenue in Macau soared 82.5% year-over-year in January to 11.6 billion patacas ($1.4 billion) to beat the consensus estimate of a 37% increase. The GGR count was the highest since January 2020, according to data from the Gaming Inspection and Coordination Office. The strong month was a result of the government ending most of the COVID-19 border restrictions on January 8, just before the Chinese New Year holiday. A general opinion is that casino operators with greater exposure to the mass market will see stronger growth rates in 2023 than VIP operators. “We believe there is more room for recovery, particularly within Mass GGR in 2023 (when we believe GGR may approach 60% of 2019 levels) and improve further in 2024 (to 90% of 2019 levels)” said Joseph Greff, an analyst at JP Morgan. . Overall, the firm views Macau stocks as excellent for China’s reopening, and singled out Las Vegas Sands (LVS), Wynn Resorts (WYNN) and Melco Resorts (MLCO) as top picks.

Online gaming/sports betting: Analysts have raised their estimates for the 2023 total addressable market for online sports betting and they see iGaming and expect strong revenue and an improved win rate in existing states. Two of the most important developments to watch are DraftKings (DKNG)’s pursuit of profitability by the end of 2023 and the growth of BetMGM (MGM) (OTCPK:GMVHF). Deutsche Bank noted that a significant increase in the recreational player base and reduced bonus levels are likely to drive a slowdown in gaming gross revenue growth, but increase growth in EBITDA margins and perhaps attract more investment. investor attention. Meanwhile, Roth Capital recalled that Penn Entertainment (PENN) is just one of three iGaming operators, along with FanDuel (DUEL) and Caesars Entertainment (CZR), that expect positive EBITDA in the US/Canada in 2023.

What to see: Next weekend’s Super Bowl will shed another bright light on the sports betting industry with record numbers expected to not only win in games but also keep rates down, and prop bets and parlays expected to be profitable. are in a high combination of total bets.

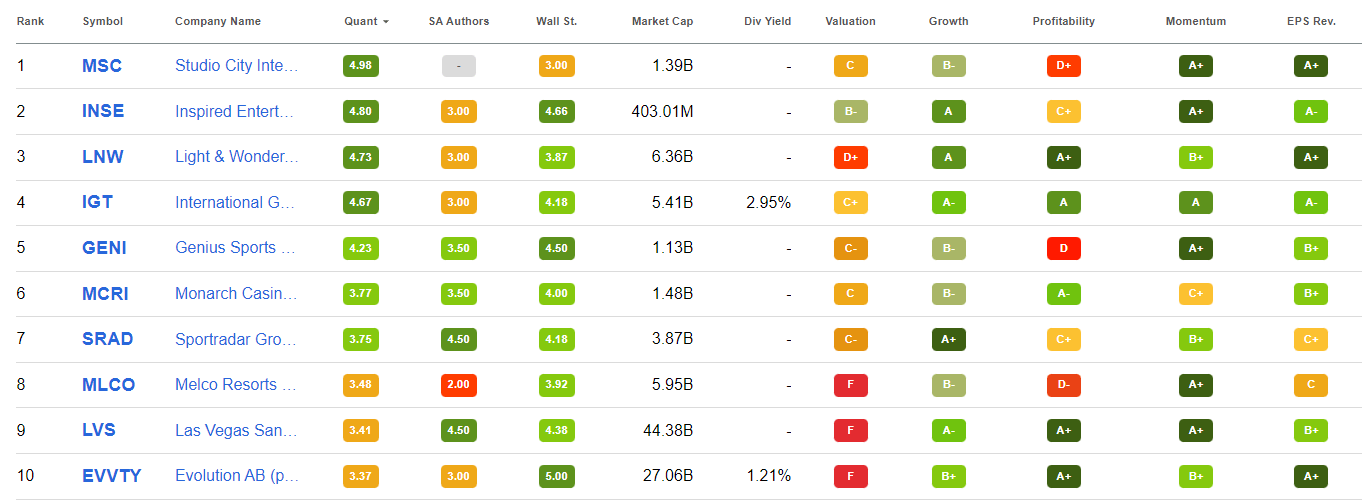

Seeking Alpha Quant Rating’s list of top stocks includes some under-the-radar picks like Sportradar (SRAD), Light & Wonder (LNW) and Evolution AB (OTCPK:EVVTY).

Create your own list of top stocks with Seeking Alpha’s advanced selection tool.