Kwarkot

With NAREIT's REITweek conference coming up next week, now is a good time to see which REIT stocks the SA Quant system picks best. Of the 114 stocks that appear when you list each REIT category in the SA Stock Screener, two of the SA Quant's top three ratings are cannabis-focused REITs.

Cannabis REIT NewLake Capital Partners (OTCQX:NLCP) ranks first among SA Quant's Strong Buys, followed by retail REIT CTO Realty Growth (New York Stock Exchange: CTO) and Innovative Industrial Properties (New York Stock Exchange:IIPR), another cannabis REIT.

NLCP scores top marks for profitability, momentum, and EPS revisions under the SA Quant system, while IIPR scores A+ for growth and momentum.

CTO, which also owns a stake in net lease REIT Alpine Income Property Trust (New York Stock Exchange: PINE), earns top marks for growth and EPS reviews.

InvenTrust Properties (New York Stock Exchange: IVT), owner of multi-tenant commercial properties in the Sunbelt, often anchored by a grocery store, ranked fourth in the evaluation, with A+ grades in EPS reviews.

Rounding out the top five, Essential Properties Realty Trust (New York Stock Exchange:EPRT), which owns and rents single-tenant properties to mid-market businesses such as restaurants, car washes, equipment companies, and medical and dental services, shines the brightest in terms of growth and profitability.

Looking at the average Wall Street ratings of those five companies, NewLake Capital (OTCQX:NLCP), CTO Realty (CTO), and Essential Properties (EPRT) rate as Strong Buys.

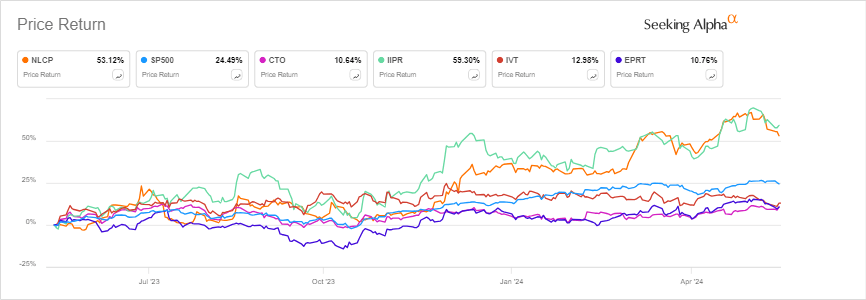

Of the five stocks, cannabis REITs performed the best last year, with IIPR up 59% and NCLP up 53%, easily outpacing the S&P 500's 24% gain.

Of the five companies, two will be featured at REITweek: InvenTrust (IVT) on June 4 at 9:30 a.m. (CET) and CTO Realty (CTO) on June 5 at 3:30 p.m.

In total, 14 REITs were rated Strong Buys by the SA Quant system. The others are: Host Hotels & Resorts (HST), National Health Investors (NHI), Kite Realty Group (KRG), Cousins Properties (CUZ), Vici Properties (VICI), Alpine Income Property Trust (PINE), NetstREIT ( NTST). and EPR Properties (EPR).

NEWSLETTER

NEWSLETTER