Image source: Getty Images

When it comes to revenue shares, a high yield may seem attractive. But dividends are never guaranteed, so it's also important to consider the likelihood that the dividend per share will go up, down, or stay the same.

Last year, a UK stock increased its dividend per share by 25%. This followed growth of 23% the year before and 20% the year before that.

As I consider whether to buy it for my portfolio, I wonder if those double-digit increases can continue to happen.

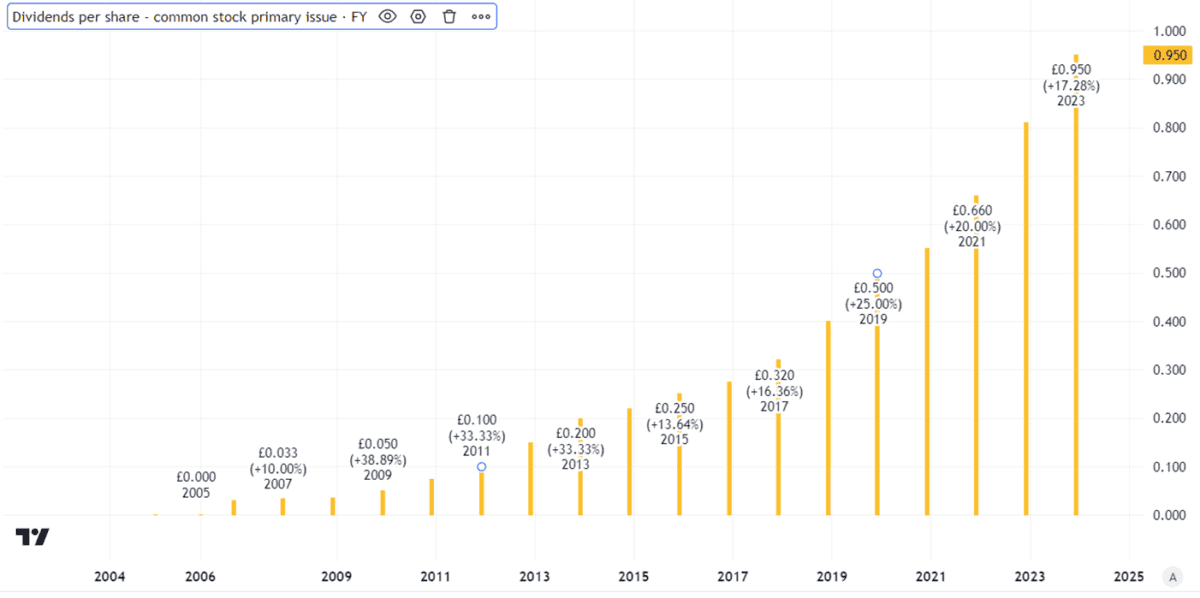

Impressive record of shareholder payments

The company in question is a specialist in laboratory measurement tools. Scientific Judges (LSE: JDG). Its track record of dividend increases speaks for itself.

Created using TradingView

The business model behind that impressive streak of dividend growth is simple but attractive.

By purchasing small and medium-sized specialist instrument manufacturers and then improving their profitability (for example, by offering some centrally shared services), Judges can make a decent profit.

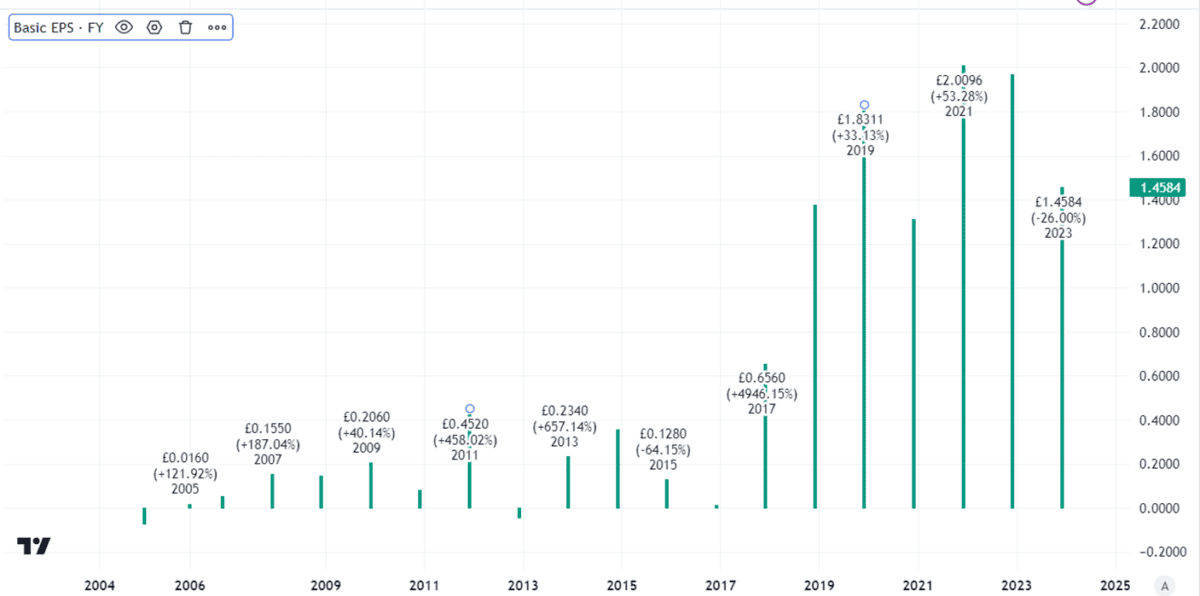

Not only have total earnings grown markedly over the past decade, so have core earnings per share.

Created using TradingView

That shows that the company has been increasing the amount it earns per share, giving it room to increase the dividend. As shares are often priced based on their earnings, among other things, it has also been good for Judges Scientific's share price. That figure has increased 165% in the last five years.

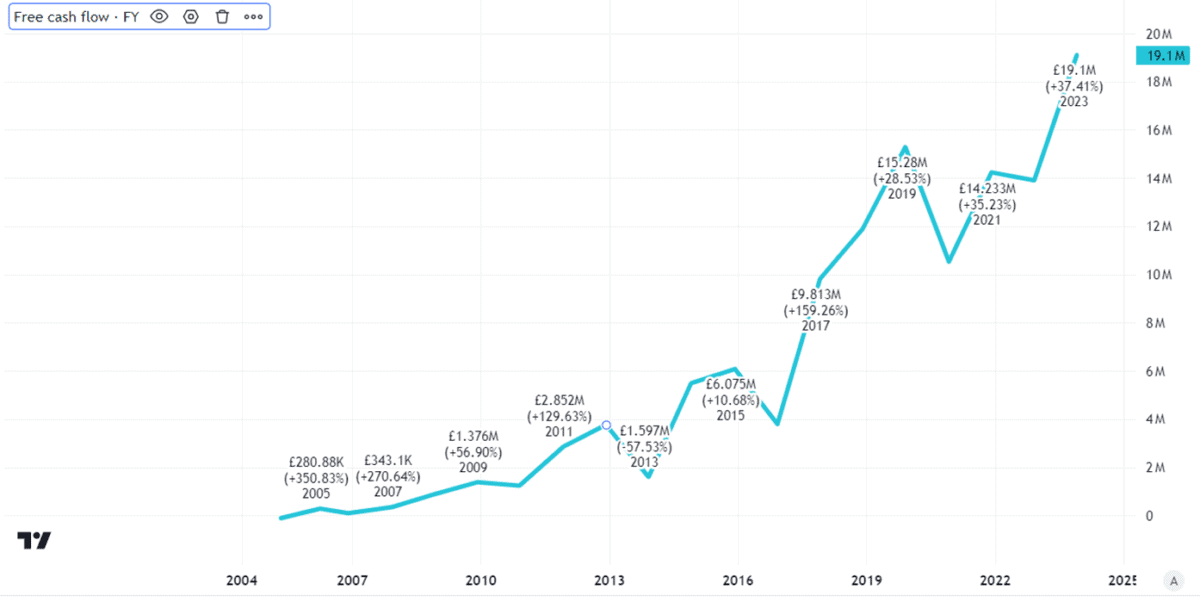

Strong cash flows could support continued dividend growth

But past performance is not necessarily a guide to what may happen in the future. On top of that, while profits are important, in the long term what a company needs to pay dividends is cash. So when I look at revenue share, I always look at their free cash flows and their earnings.

Judges has been growing organically but also through acquisitions. One risk is overpaying for an acquisition, which puts a strain on your balance sheet if you borrow to buy a company and then realize the deal didn't generate the kind of return you anticipated. Statutory net debt at the end of last year was £52m. It may not seem like much, but five years ago the business was completely debt-free.

However, if we look at free cash flows, I think the company's growth strategy has paid off well.

Created using TradingView

If it can continue to extract efficiencies from its existing businesses and grow through intelligently selected and attractively priced acquisitions, I think the company could continue to grow its dividend for years to come.

Since its first dividend in 2006, pay per share has grown at a rate 23% compounded annual rate. I think the dividends could continue to increase from now on.

Why am I not buying?

The very success of the business model poses a risk. Others might try to copy it. Even if they are unsuccessful, having a larger pool of bidders could drive up the price of Judges' acquisitions.

But that's not why I'm not going to buy. I am optimistic about the judges; I just don't like the price of this revenue share.

It currently trades at 64 times earnings. I'm waiting for a significant price drop before buying.

NEWSLETTER

NEWSLETTER