Image Source: Getty Images

On the back of a disappointing set of full-year results, barclays (LSE:BARC) shares are down nearly 10%. Nonetheless, the recent dip could present a buying opportunity for those looking for some passive income.

have their wings clipped

Like other major banks, Barclays was expected to perform well in 2022 as a result of higher interest rates. This was the case for its top line, as overall revenue improved by 14%. However, a number of factors offset these gains, leading to declining net earnings, which is why Barclays shares plummeted.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Total revenue | £24.96 billion | £21.94 billion | 14% |

| net interest margin | 2.86% | 2.52% | 0.34% |

| spoilage charges | £1.22 billion | -650 million British pounds | 288% |

| Net profit | £5.02 billion | £6.21 billion | -19% |

| Return on Tangible Equity (ROTE) | 10.4% | 13.1% | -2.7% |

First, its investment banking division came to a halt in 2022, when financial markets crashed. This was the main culprit for the fall of ROTE. Second, higher impairment charges forced Blue Eagle Bank to set aside more of its earnings to cover bad debts. And to make matters worse, Barclays shared that it had to set aside an additional £1.59bn for litigation charges, further hurting its results.

Moderate prospects?

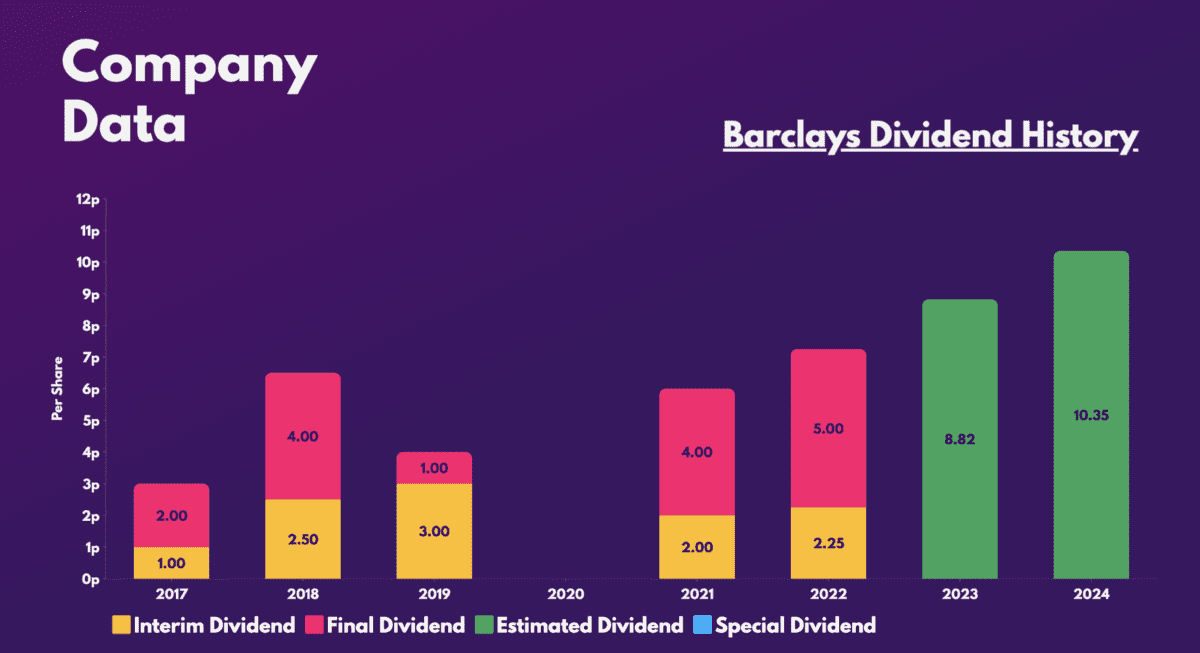

Despite the negatives, however, the lender is still offering a 21% increase in its dividend, much to the delight of passive income investors. And to sweeten things, he also announced plans for another £500m worth of share buyback programme, enriching shareholder value. This makes a strong case for investing in Barclays stock both for its passive income and growth potential.

After all, the company is poised for a better 2023. The conglomerate anticipates its net interest margins to be above 3.2%, while aiming for ROTE of at least 10%. As such, analysts are forecasting forward dividend yields of 5.1% and 5.9% over the next two years.

Finding your balance

However, it is worth noting that such strong forecasts will be strongly determined by the health of the economy, as well as the outlook for future interest rates.

On the one hand, a rate easing could spark a rebound in the firm’s investment banking activity. This would provide a huge boost to your overall income. However, Barclays will also see net interest margins fall, which could affect lucrative payouts. On the other hand, higher rates will allow the group to continue accumulating interest margin without cost. But this will come at the expense of potentially higher spoilage charges.

Be that as it may, investing in Barclays shares is not a bad idea to generate a second source of income. Its payments are well covered at 4.2 times, and its CET1 ratio (which compares a bank’s capital to its assets) remains strong. So it’s no surprise to see JP Morgan, citiand Goldman Sachs all have bullish ratings on the stock, with an average price target of £2.46. This presents a 42% advantage over current levels.

Its valuation multiples are cheap and it certainly has passive income potential. That said, its consistent issues with the law are unsightly and add a tinge of unreliability to its bottom line and future shareholder returns. Still, I think the stock looks too cheap to ignore at current levels, which is why I am planning to open a position.

| Metrics | barclays | industrial average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.4 | 0.7 |

| Price-Earnings Ratio (P/E) | 5.5 | 9.8 |

| Forward price-earnings (FP/E) ratio | 5.5 | 6.8 |

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);