If you are a beginner in trading, you have probably heard of many technical terms, such as “bullish flag chart pattern vs. bearish flag chart pattern.” It may seem confusing at first. Don't worry, in this article we will demystify these concepts and show you how they can be used to identify lucrative trading opportunities.

What is the pattern of the flag?

The flag is a technical analysis pattern often used by price action traders. There are bullish and bearish flags. A flag consists of a small channel formed with a swing between resistance and supports.

This channel is the opposite of the trend, meaning that for a bullish flag, the channel will be slightly bearish. When support or resistance is broken, the price breaks out of the channel and usually sees a strong market move in the direction of the trend.

Bullish Flag Pattern Versus Bearish Flag Pattern Explained

Flags are a trading pattern that appears briefly after a marked market movement. They are characterized by a small parallel channel that goes against the dominant trend. After this period of consolidation, a breakout occurs and the price vigorously returns to the initial trend. There are two types of flags: bullish and bearish.

In the case of a bull flag, the consolidation is to the downside within an overall rising market. The breakout of this upward channel heralds the resumption of the upward trend.

On the other hand, a candle with a bearish flag represents, before the breakout indicates the continuation of the fall, a downward trend but with upward consolidation.

You can avoid receiving false signals by adding additional confluence factors.

In order to trade bullish flags effectively, it is important to predict the continuation of the trend after a period of consolidation. Strategically position yourself near the bottom end of a channel (for a bullish flag) to prepare for the next breakout and capitalize on the strong trend reversal.

What is a bull flag?

The bull flag helps traders find an entry point for a generally long trading position. This flag is also known as a bullish pennant. You can see it on the chart, indicating the continuation of the uptrend. It has two main components: the flagpole and the flag.

The flagpole represents the initial stage of the bullish flag. You can see it as a sharp and sudden increase in the price of assets. It is usually driven by strong buying pressure. Traders are paying close attention to this rapid rise as it could suggest a notable shift in market sentiment in favor of buyers.

After the flagpole stage, the market enters a period of price consolidation, creating a pennant formation. The pennant is characterized by a tighter, more horizontal price pattern, with the highs and lows of the candlesticks converging. This consolidation serves as a temporary pause for traders after a rapid rise in prices during the peak phase.

Identify a bullish flag

There are several ways to identify a bullish flag. Let's see the most convenient ones. First it is necessary to detect a clear upward trend with increasingly higher highs and lows. Then it is necessary to identify the flagpole by looking for a sharp increase in price with a significant increase in trading volume. Additionally, traders should look for the pennant by watching for price consolidation with tighter price movements and decreasing trading volume.

How to trade Bull Flag?

Once you have identified a bullish flag, you may be wondering how to proceed as a beginner trader. Here are some practical tips:

- Wait for confirmation: Before acting, wait for the price to break the bullish pennant resistance line. This confirms the bullish flag and indicates a possible continuation of the uptrend.

- Choose a good entry point: place a buy order slightly above the pennant resistance line to take advantage of a possible price increase.

- Set Profit Targets and Stop Losses – Determine desired profit levels based on past price movements. Similarly, use stop-loss to limit your losses if the trade goes against your predictions.

- In terms of risk management, a price movement below the support of the flag formation can be used as a stop-loss or bust level.

The bull flag is an essential pattern that trading beginners must understand. If you recognize this correctly, you will be able to take advantage of potentially lucrative trading opportunities during uptrends.

Remember to always implement proper risk management when trading. With practice and experience, you will be able to take full advantage of the potential of Bull Flag to improve your performance as a trader.

What is bear flag pattern?

The bearish flag should not be confused with the bearish pennant. The bearish flag can be classified in the same family as “ranges”, but it does not lead to the same conclusions regarding price forecasts. Learning to detect such a pattern is not very complicated, especially since many stock market software offers automatic pattern recognition. The hardest part is marketing it and profiting from it.

Identify the bearish flag

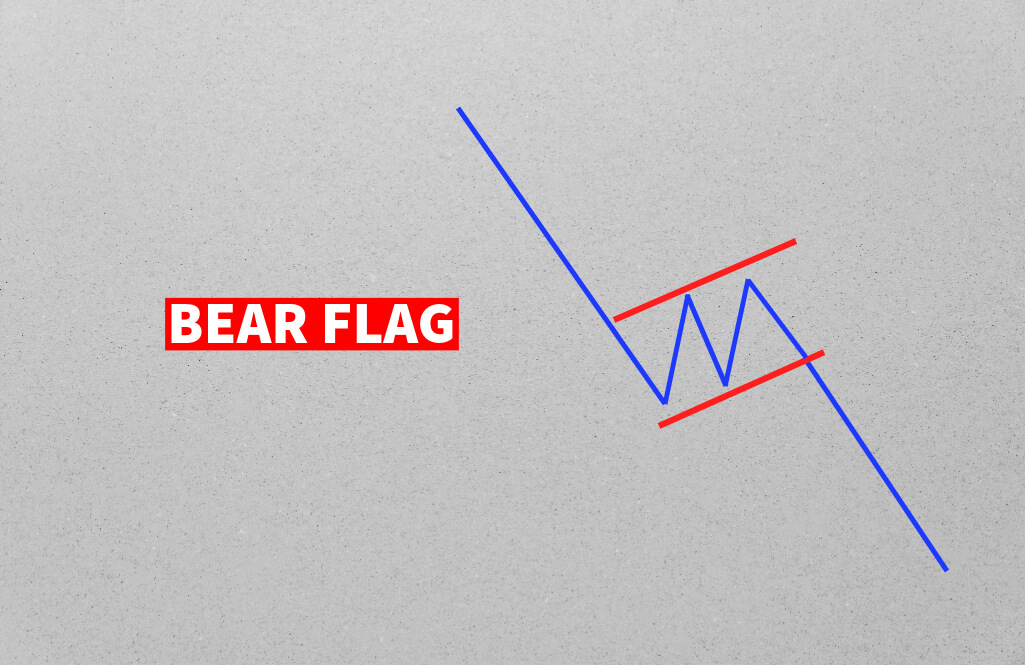

The term “bearish” refers to two elements: the past trend and the future prediction. A bear flag is then formed in a downtrend. The price seems to want to start rising again and begins to evolve in the form of a flag, oscillating between two parallel lines of positive slope, which act as support and resistance.

When trading with bearish flags, the time frame is not important: a bearish flag can be detected at any time, like all chart figures because they are fractals.

What does the bearish flag predict?

The bearish flag is a continuation pattern and not a reversal. Therefore, the formation of this pattern will not cause a trend change. The formation of a bearish flag corresponds to a market consolidation phase after a bearish acceleration. Once this consolidation has occurred, the market will begin to fall again.

The only unknown in the interpretation of this figure is the duration of the consolidation phase: this can be more or less long and it is very difficult to predict the exit moment.

The greater the slope of the flag, the faster the output, relative to the UT at which the figure is analyzed.

When the price abandons its flag and the exit is validated, the bearish potential is easy to evaluate: according to the great principle of symmetry that we often find in chart analysis, the bearish movement that will follow will be of an amplitude equal to the one that preceded it. the formation of the flag.

Therefore, the objective, the goal, can be deduced very simply.

How to trade bearish flags?

There are several ways to position yourself in the market when a bearish flag is forming.

One trading strategy is to take a short selling position as soon as the price crosses the support line to benefit from the bearish acceleration. But the best thing is to wait for confirmation of the decline and position yourself for the decline that occurs nine times out of ten

Another riskier technique is to treat the flag as a range. In the case of a bearish flag, the underlying trend is bearish, we will be able to sell the asset whenever the price reaches the support resistance and we will buy again when the price reaches the support.

Proceeding in this way we reduce the risk incurred because the output of the flag will normally be in trend, that is, in the direction of the VAD. In both cases, the trend is your friend: in other words, we play the fall with a bearish flag.

The Importance of a High Volume Breakout

High volume helps avoid false breakouts. Those who trade bullish and bearish flag patterns can anticipate a breakout with a significant increase in trading volume.

An increase in volume during a breakout indicates a powerful force driving price out of a period of consolidation and into a new trend. A high volume breakout suggests that the direction of the breakout is more likely to continue in the same direction.

!function (f, b, e, v, n, t, s) {

if (f.fbq) return;

n = f.fbq = function () {

n.callMethod ?

n.callMethod.apply(n, arguments) : n.queue.push(arguments)

};

if (!f._fbq) f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = ();

t = b.createElement(e);

t.async = !0;

t.src = v;

s = b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t, s)

}(window, document, ‘script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘504526293689977’);

fbq(‘track’, ‘PageView’);

NEWSLETTER

NEWSLETTER