Andrii Yalanskyi

Following a mixed fourth-quarter earnings report, Jon Gray, Blackstone (New York Stock Exchange:BX), president and chief operating officer, said on Thursday that headwinds from higher interest rates led to a “challenging” quarter for segments of the real estate sector.

However, Gray said CNBC that in the longer term, the higher cost of capital would limit the amount of new offering that can come to market. “That’s a tailwind for real estate,” he said.

“We’ve been adjusting for that (higher interest rates) in our portfolio with higher cap rates. But then when you look within asset classes, it’s really dramatic. The differences if you look at the US office market. now above 20% and rents are coming down, and that’s a very challenged sector,” Gray added.

Given difficult market conditions in 2022, the company deployed most of its capital into travel and travel-related businesses, logistics, its hedge fund operations, quant and macro investing, energy and energy transition, Gray reported.

In its results, the company’s earnings grew 8% in the fourth quarter, with an 11% increase in assets under management. Segment performance: Real Estate – Opportunistic -2.0%; Core -1.5%; Private Equity – Corporate Private Equity +3.8%; Tactical Opportunities +0.6%; Secondary -1.8%; Hedge Fund Solutions – +2.1%; Credit and Insurance – Private Credit +2.4%; Liquid Credit +3.0%.

However, the alternative asset manager missed its expectation to achieve AUM of $1 trillion by the end of 2022. It reported AUM of $975 billion, up from $951 billion in the prior quarter.

As for stock movement, BX was trading at $92.49 in intraday action on Thursday, rising more than 4% on its earnings report.

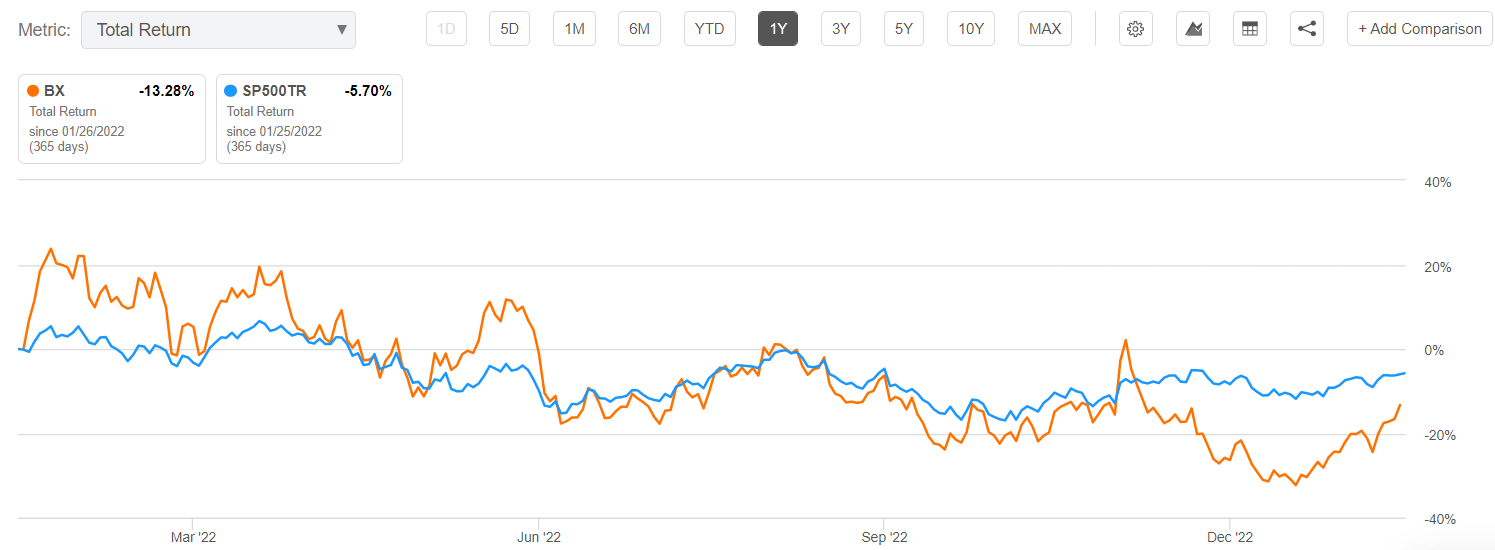

Looking longer term, stocks have lost about 17.3% during the last 12 months, although they have recovered with twenty-one% earnings so far in 2023.

In the meantime, see why Seeking Alpha contributor Samuel Smith says: “Investors will generally move away (and valuations will decline) from BX’s private equity and real estate products as interest rates rise.”

A quick comparison of BX with a broader market index: