Maria Vonotna

November was a memorable month for biotech stocks, as gene therapy developers outperformed and pharmaceutical giants looked for M&A opportunities in the industry amid an improving macro setup.

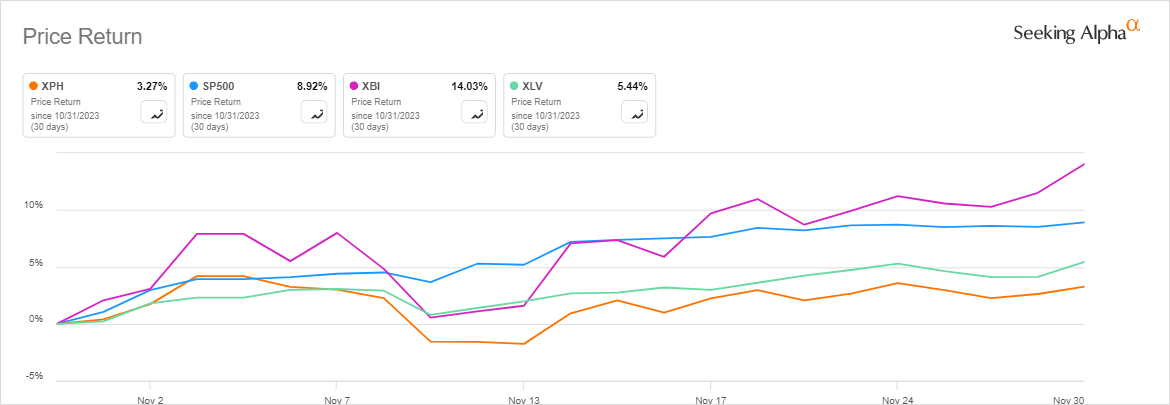

SPDR S&P Biotech ETF (NYSERCA:XBI), which represents more than 130 biotech stocks, rose ~14% while the S&P 500 added only ~9%. Elsewhere in the healthcare sector, the SPDR S&P Pharmaceuticals ETF, which measures pharmaceutical stocks, gained just ~3%, and the broader healthcare sector rose ~5%, as indicated by the Health Care Select Sector SPDR ETF Fund (XLV).

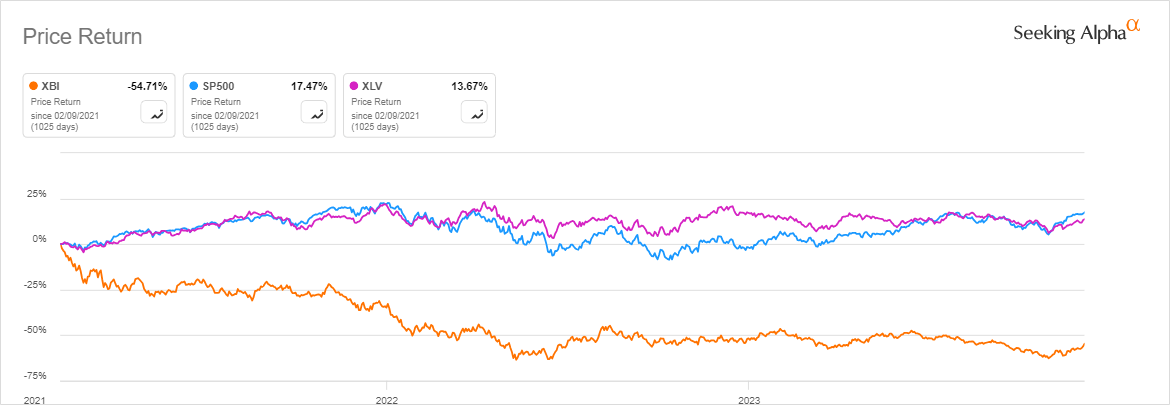

While healthcare posted its best monthly performance since October 2022 in November, it was the best month since November 2020 for biotechs. However, the industry remains stagnant, with a ~55% clearance from its February 2021 peak compared to the ~14% increase in the healthcare sector.

Jared Holz, healthcare equity strategist at Mizuho, attributed the recent gains to a broader rally among small-cap stocks and a growing consensus among market participants that interest rates will not rise further.

In addition to higher financing costs, an adverse interest rate environment impacts biotechs as rising Treasury yields hurt the present value of their future cash flows, reducing valuations derived from Feds. . In a note to investors, Goldman Sachs analyst Asad Haider said in early October that the XBI “has largely become an indicator of inverse rates.”

Still, there were pockets of optimism in the biotech space in November. Gene therapy developers, including CRISPR Therapeutics (NASDAQ:CRSP) and Beam Therapeutics (NASDAQ: HAZ), were among the notable winners for the month.

In mid-November, Switzerland-based CRISPR (CRSP) and its US partner Vertex Pharmaceuticals (VRTX) got the UK go-ahead for their CRISPR-based drug exa-cel for sickle cell disease and beta-cell disease. thalassemia, marking the world's first regulatory approval of a gene editing therapy.

Goldman Sachs' Haider signaled a challenging outlook for biotechs, citing “a uneven road for interest rates in the next month” and arguing that “the long-term direction of travel could remain uneven and challenging.”

However, citing an improving macro setup and renewed interest among investors, BTIG became more bullish towards biotech as 2023 draws to a close.

“We view 2024 as a potentially better year for the sector, with an improving macroeconomic backdrop and a return of interest in high-growth sectors such as biotech,” analyst Justin Zelin wrote in a note on Friday.

“We see investors currently overlooking the fact that the industry's fundamentals remain intact, with the engine of innovation running strongly in the pharmaceutical and biotech industry,” Zelin added.

More catalysts await room for gene editing this year, as possible US approval of exa-cel is expected on December 8 after a group of independent FDA advisors issued positive opinions on a marketing application for the treatment in October.

Big pharma is also taking note. M&A interest in the sector spiked this month when AbbVie (ABBV) offered $10.1 billion to acquire cancer drug maker ImmunoGen (NASDAQ:IMGN). The developer of antibody-drug conjugates ended up being the best-performing biotech stock in November.

AbbVie's (ABBV) all-cash deal comes on top of Eli Lilly's (LLY) $1.4 billion bid to add radiotherapy developer Point Biopharma (PNT) and Bristol Myers Squib's $4.8 billion bid ( BMY) to buy cancer drug maker Mirati Therapeutics (MRTX) in October.

NEWSLETTER

NEWSLETTER