Carl Lokko/iStock via Getty Images

Biosimilar drugs, generic versions of typically expensive biologic drugs, will save patients and the healthcare system $180 billion over the next five years as more come to market.

new releases and An expected increase in the adoption of biosimilars will likely push overall spending on them to $20 billion to $49 billion by 2027, IQVIA estimates in a new report.

Between 2023 and 2027, at least 10 biologics are scheduled to face competition from biosimilars.

By the end of 2022, the US FDA has approved 45 biosimilars for 14 reference products since 2006. However, only 31 biosimilars since 2006 have actually reached the market.

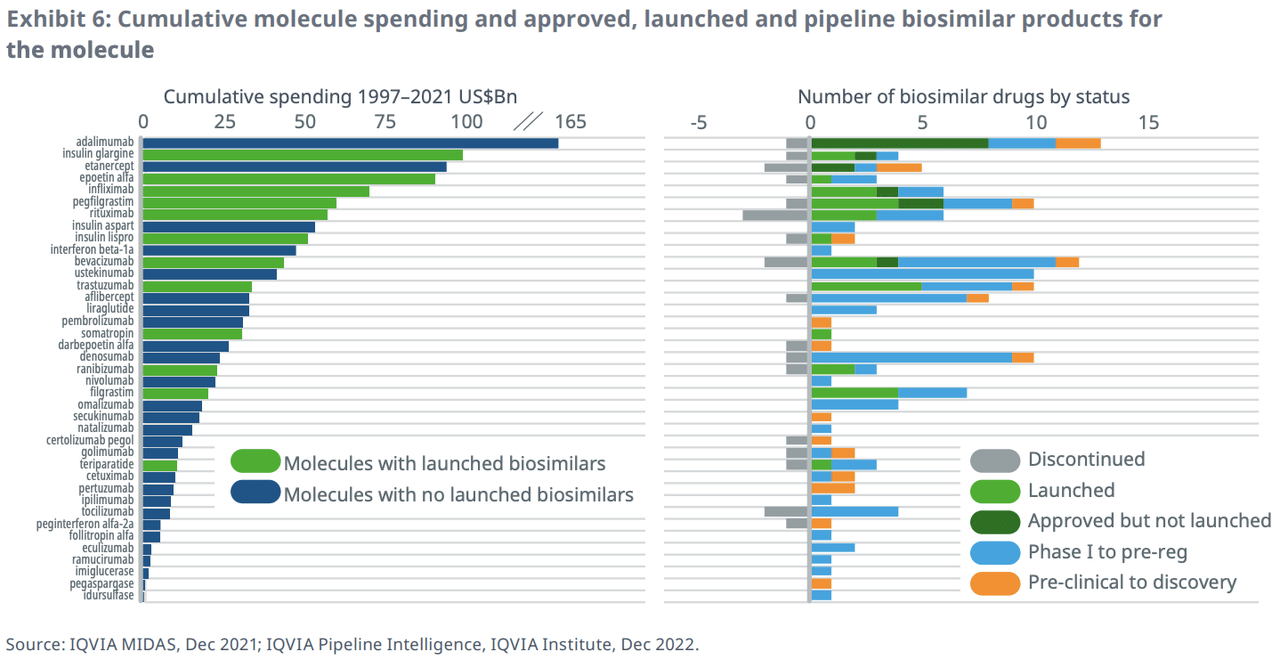

This year has already seen the introduction of one of the most anticipated biosimilars, one from AbbVie (New York Stock Exchange: ABBV) the blockbuster Humira (adalimumab), which brought in $21.2 billion in revenue in 2022.

Amgen (NASDAQ:AMGN) launched Amjevita (adalimumab-atto) at the end of January. Samsung Bioepis and its partner Organon (OGN) are scheduled for a July launch. Of the 10 biosimilars expected to launch in 2023, eight are adalimumab biosimilars.

Market dynamics

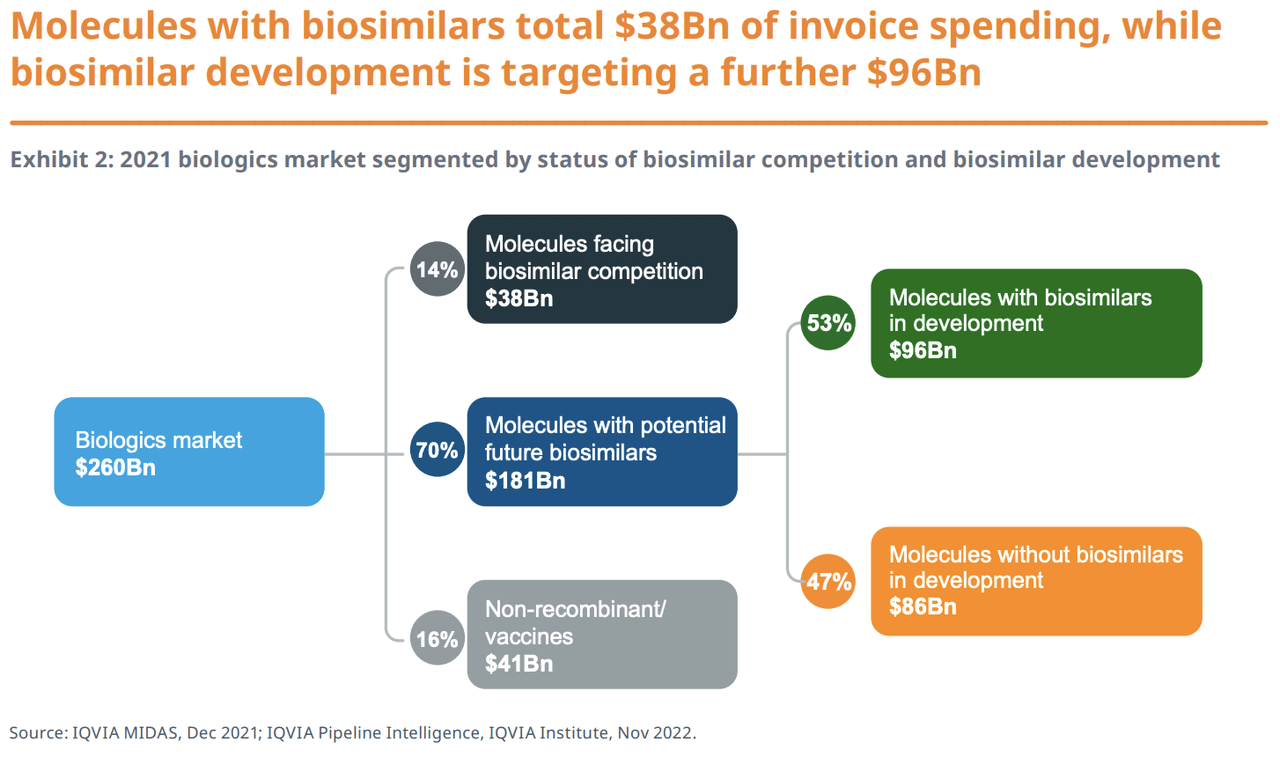

IQVIA projects that by 2023, 15% of biologics will face competition from biosimilars. That number is poised to rise in the coming years, as the US biologics market has grown 12.5% per year, on average, for the past five years on an invoice price basis.

IQVIA noted that there are 178 biologics without biosimilar development, representing $86 billion in sales in 2021. Of this number, 145 have exclusivity protection and generated $77 billion in spend. A large number of these biologics are relatively new, and biosimilar development has not yet started on many of them, although this could change in the future.

While the other 33 are off-patent, they generated $9 billion in sales. IQVIA said that biosimilar development for these is unlikely due to lower potential sales.

Although insulins provide healthy revenue for companies, biosimilar launches and development are relatively small as they are difficult to manufacture and market discounts would limit financial returns.

IQVIA noted that smaller companies are taking an increasing part in biosimilar development. In 2020, these pharmaceutical and biotech companies sold 9% of biosimilars. This figure increased to 23% in 2022 and is estimated to reach 30% in 2023.

Pfizer (New York Stock Exchange: PFE), Amgen (AMGN), Viatris (NASDAQ:VTRS), the Sandoz unit of Novartis (NVS) and Teva Pharmaceutical Industries (TEVA) are among the largest companies to have launched biosimilars.

What is affecting the adoption of biosimilars?

Recently launched biosimilars have been very well received. These have taken a 60% share of the brand’s bio-share volume in the first three years of launch.

Three oncology biosimilars launched in 2019: Roche’s (OTCQX:RHHBY) generics Avastin (bevacizumab) and Herceptin (trastuzumab) from the Genentech unit, and Rituxan (rituximab) from Genetech/Biogen (BIIB) achieved 82% uptake , 80% and 67%, respectively, during its first three years on the market.

In contrast, Johnson’s & Johnson’s Remicade (infliximab) biosimilars, approved for a variety of autoimmune conditions, achieved only 13% acceptance after three years. However, after six years, it jumped to 44%.

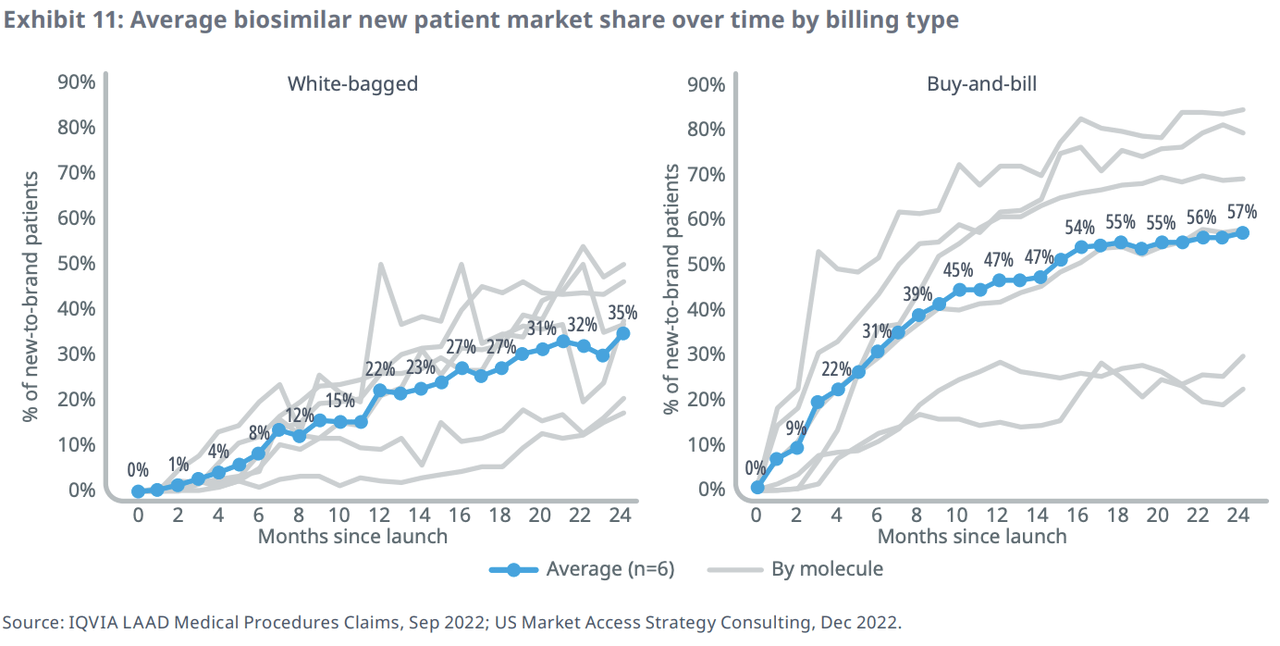

IQVIA found that the way a drug is marketed can also greatly influence acceptance. “Buy and bill” scenarios, where suppliers handle procurement and distribution, have led to greater acceptance of biosimilars compared to “white bagging,” where pharmacies handle distribution. This is because providers often see higher reimbursement rates for prescribing the biosimilar rather than the brand name product.

Biosimilar adoption has also been faster in professional settings, such as doctors’ offices, compared to institutional settings, such as hospitals or skilled nursing facilities. In the former, uptake reached 36% of the new patient market share after six months and 50% after 12 months, compared to 23% and 43%, respectively, for the latter.

Volume and price impacts

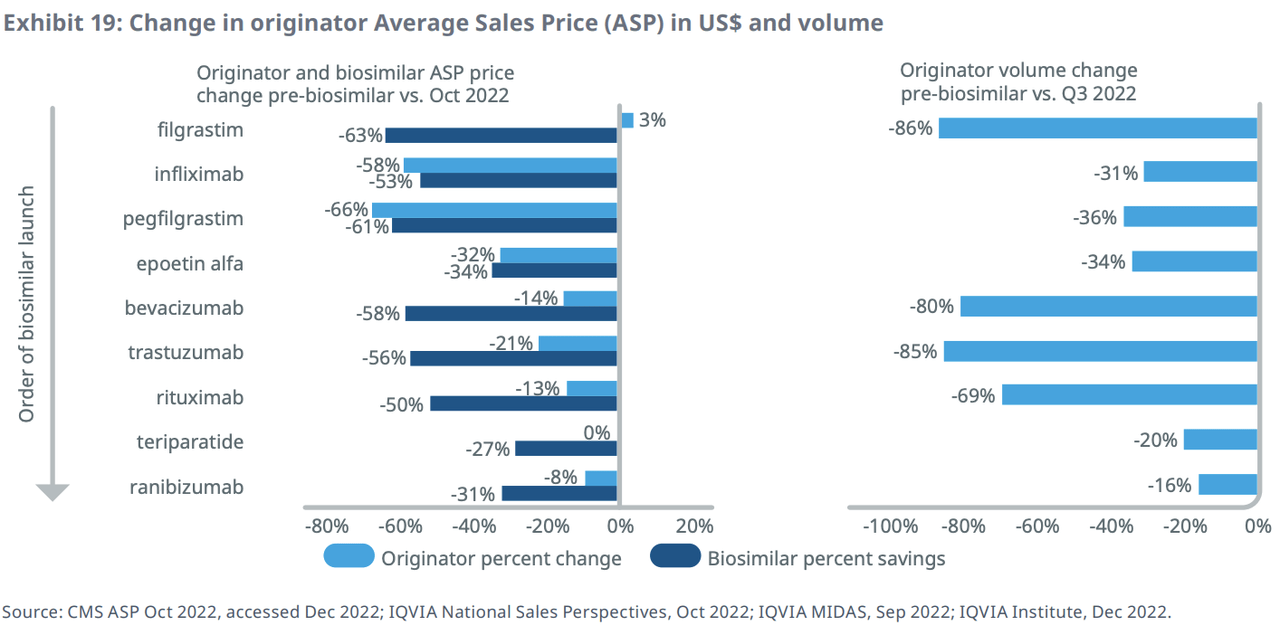

While the introduction of a biosimilar is cheaper than the bio-brand counterpart, it also leads to a reduction in the price of the brand. But price reductions for biosimilars and originals can vary significantly.

For example, Avastin and Herceptin have had the fastest decrease in per-unit cost of molecules (includes both originator and biosimilar) due to significant biosimilar adoption. Meanwhile, Remicade’s biosimilars experienced slow adoption initially. However, the adoption of biosimilars and increased use of a less expensive licensed generic resulted in a 50% decrease in overall infliximab costs approximately six years after biosimilars became available.

IQVIA found that there is a correlation between the price reduction of the original product compared to the cost of a biosimilar. A smaller drop in originator prices has resulted in larger volume losses for them.

Looking ahead, IQVIA’s base case scenario projects a 34% biosimilar share of molecule volume achieved after 24 months, along with a 30% price reduction compared to the original.