Image source: Getty Images

It has been a difficult year for the blood pressure (LSE:BP), which has fallen 7.31% over the past 12 months. Much of the damage was done in the past month, when it fell 8.23%. At the current price of 445p, the stock is FTSE 100 Index The oil and gas giant is trading at a 52-week low.

Inevitably, the price of oil is at the centre of everything. Although BP is much more than an oil exploration company, its fortunes are still tied to energy prices. A barrel of Brent crude oil is now worth $76.81, or 9.52% less than a month ago.

FTSE 100 Index star falls

Brent is down 10.56% in a year despite tensions in the Middle East, which have so far had little impact on supply.

The decline is largely due to the slowdown in the global economy, with demand falling in the United States, Europe and China. Even falling inventories in the United States have failed to boost prices.

BP's second-quarter results, released on July 30, were mixed. The group reported a quarterly loss of $100 million, compared with a $2.3 billion profit in the first quarter. That included $2.8 billion of adjustment items, including $1.5 billion of impairments. The board also warned that production could fall in the third quarter.

Fortunately, there was also plenty of good news for shareholders, with free cash flow more than doubling to $4.4 billion. The board is keen for shareholders to reap the rewards, so it has increased the dividend by 10% and announced another share buyback worth $1.75 billion. BP also wrote off $1.42 billion of its debt pile in the quarter, reducing it to $22.6 billion.

Today, BP shares look incredibly cheap, trading at just 6.61 times earnings. Better still, the yield is back above 5%.

Dividend growth potential

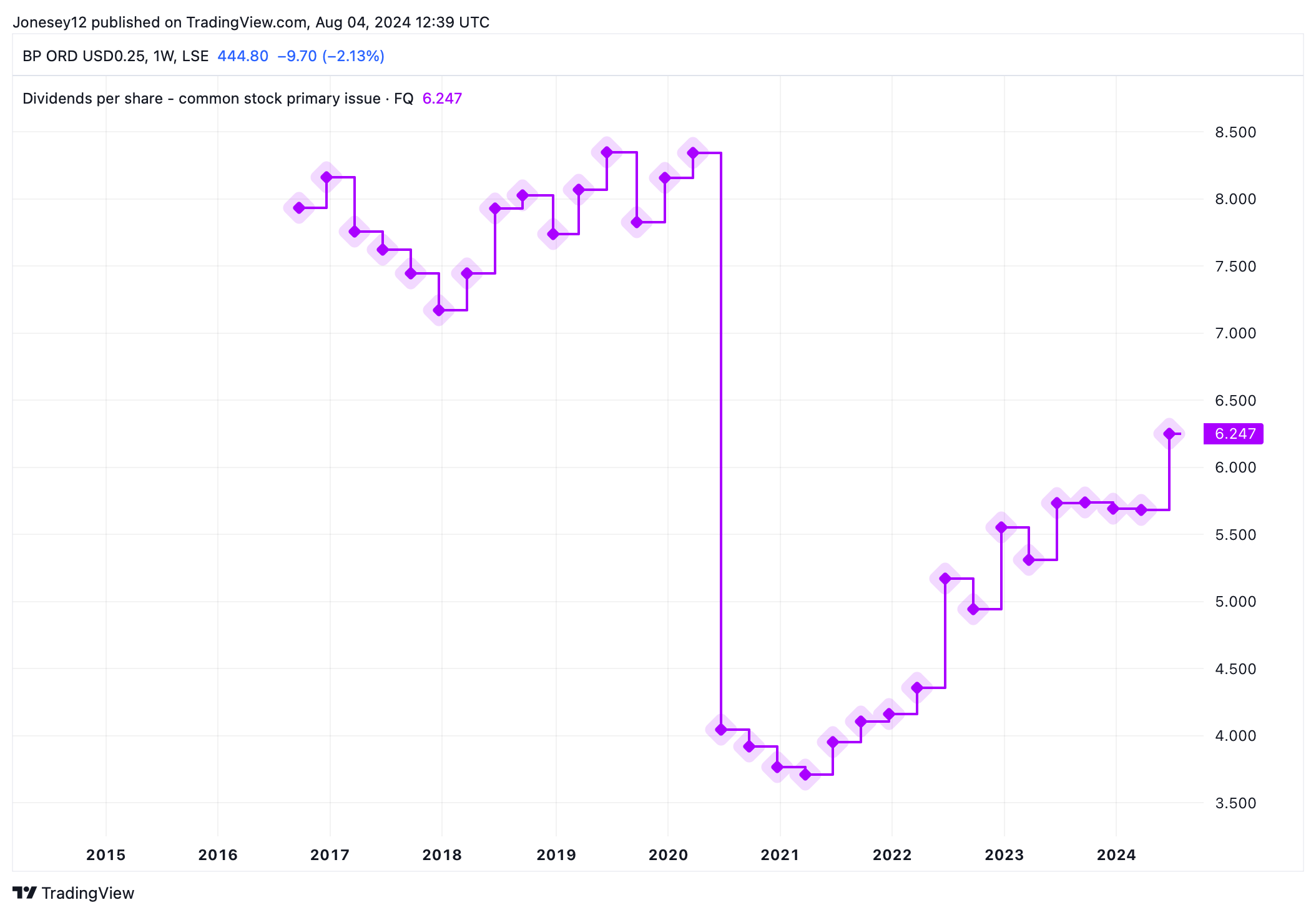

BP changed its dividend after the pandemic, but it is returning to more respectable levels. Let's see what the chart says.

TradingView Chart

The current yield of 5.01% is expected to reach 5.43% in 2024 and 5.83% in 2025. And let's not forget about share buybacks.

BP can break even with an oil price of just $40 a barrel, but the higher it goes, the better, obviously. Energy prices tend to be cyclical, and I prefer to buy energy stocks when they are falling rather than rising, as today.

Much now depends on the broader economy. Last week's volatility in the US stock market was largely due to the Federal Reserve's decision to hold interest rates in August. Some analysts fear that even if the Fed cuts rates by 50 basis points in September, it will be too little, too late to prevent a US recession.

I have a longer-term concern. BP appears to have taken advantage of the pushback against net-zero emissions to cut its use of renewables, but this problem is not going away. I buy stocks with a minimum five- to 10-year outlook, and over that time the pressures of climate change look set to increase. However, as we have seen with electric cars, weaning the world off oil will not be easy.

Despite these concerns, I think BP shares look like a brilliant bargain. At the cheap valuation they have today, I don't see much point in waiting until they get cheaper. I'll add them to my portfolio when I have the cash.