Image source: Getty Images

He Glencore (LSE:GLEN) share price has fallen 17.5% so far this year as commodity markets have normalized following the Russian invasion of Ukraine. Meanwhile, the deteriorating economic outlook in China has put pressure on mining stocks across the board.

In this context, should you invest more in these dividend stocks? We’ll see.

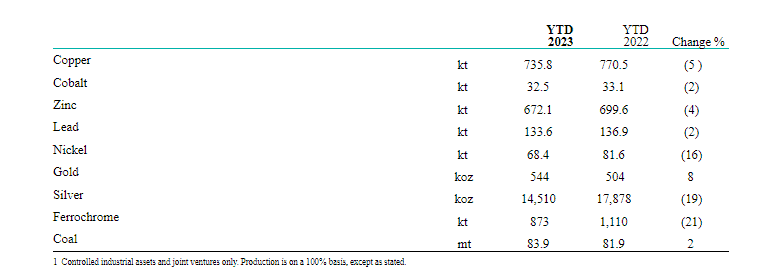

Third Quarter Production Update

Today (October 30), the share price rose 1% to 449 pence after the mining and commodities trading giant published its third quarter production update.

The key takeaway is that this was a solid production performance. And it means that the company’s general guidance for 2023 for the production of copper, zinc, coal and cobalt was maintained.

However, it cut its full-year nickel production forecast by 9% to around 102,000 tonnes.

In the statement, Glencore said: “Nickel has been lowered to reflect… maintenance outages at the Sudbury smelter and a longer-than-expected recovery from the 2022 strike, along with a lower full-year review for Koniambo..”

Strikes and maintenance issues are an inevitable risk for a company of Glencore’s scale and geographic presence. But this disruption seems minimal in the grand scheme of things.

Encouragingly, its trading division’s annual profits are above the high end of its long-term annual target of between $2.2 billion and $3.2 billion. They are likely to be in the previously reported $3.5-$4 billion range.

Glencore’s trading operations can help stabilize its financial performance when commodity prices are highly volatile. I find this diversification particularly attractive.

Concerns about the energy transition

Now, there are lingering problems surrounding Glencore’s hugely profitable coal business. Some large institutional investors, including Black Rock and Legal and generalhave expressed serious concerns about the company’s environmental credentials in this regard.

I believe the company will get there on time. It has already tried to buy the metallurgical coal assets of Teck Resources join with its own to spin them off into a separate entity. This has been rejected but may still go ahead, according to some analysts.

Additionally, Glencore is moving more toward extracting metals needed for the energy transition. For example, it is investing in lithium mining in the Democratic Republic of the Congo, where it already has copper operations.

Obvious income purchase?

Last year was a great one for commodity prices: Glencore’s net income was a whopping $18.9 billion. This figure is expected to more than half by 2023.

As a result, I don’t expect a repeat of last year’s $1.45 billion special dividend and $3 billion share buyback anytime soon. But I’m happy to wait to share the good times again, when the economic cycle allows.

That said, it’s not as if shareholder returns have fallen off a cliff. Still, the company raised its dividend by $1 billion in August and plans to buy back another $1.2 billion in shares by February.

Meanwhile, the valuation is cheap, as is often the case with Glencore shares. The expected profitability for 2024 is currently 6.3%.

Overall, I think buying at the current price could be a rewarding and obvious decision from an income perspective. And there could even be some share price gains if clarity emerges around its coal business.

So I’m looking to acquire more shares before 2024.