Image source: Getty Images

These FTSE 100 and FTSE 250 The stock looks very cheap right now. Are they brilliant bargains or classic traps for investors?

Travis Perkins

Builders Trader and Home Improvement Retailer Travis Perkins (LSE:TPK) is in the news again on Wednesday. Unfortunately, it’s for all the wrong reasons.

The company’s sales are plummeting as the housing market cools and repair, maintenance and improvement (RMI) spending sinks. Today, it said comparable sales fell 1.8% between July and September, a result that forced it to lower its full-year profit forecast.

Adjusted operating profit is now forecast to be between £175m and £195m, significantly less than the estimated £240m it was talking about just two months ago.

Travis Perkins shares have fallen about 7% on the news and are trading around 52-week lows. Therefore, the business now trades on a forward price-to-earnings (P/E) ratio of 10.8 times. This is just above the widely considered benchmark value of 10 times.

But I think the company deserves such a low rating. The UK economy is set for a prolonged slowdown, while higher-than-usual interest rates also look set to persist. Therefore, any changes to its end markets could be a long way off.

Travis Perkins has a huge retail presence, which should put him in a good position when conditions finally improve. But the prospect of sustained earnings pressure and ever-increasing debt still makes it a cheap stock that I’m willing to avoid. I think his stock price could continue to collapse.

JD Sports Fashion

Sportswear/Lifestyle Retailer JD Sports Fashion(LSE:JD.) shares have been on my watch list for some time. And after strong share price weakness in 2023, I’m thinking about making it my next stock purchase. Today the FTSE 100 The company trades on a forward price-to-earnings ratio of 10.6 times.

On the one hand, the low valuation of JD stock could be considered fair given the uncertain outlook for the global economy and therefore consumer spending. Sellers of premium products such as brand-name sportswear and sneakers could be considered especially vulnerable to customer cutbacks.

However, the retailer’s resilience despite recent difficulties suggests this low rating is undeserved. Organic sales soared 12% in the six months to July, with revenue helped by increasing market share in key markets.

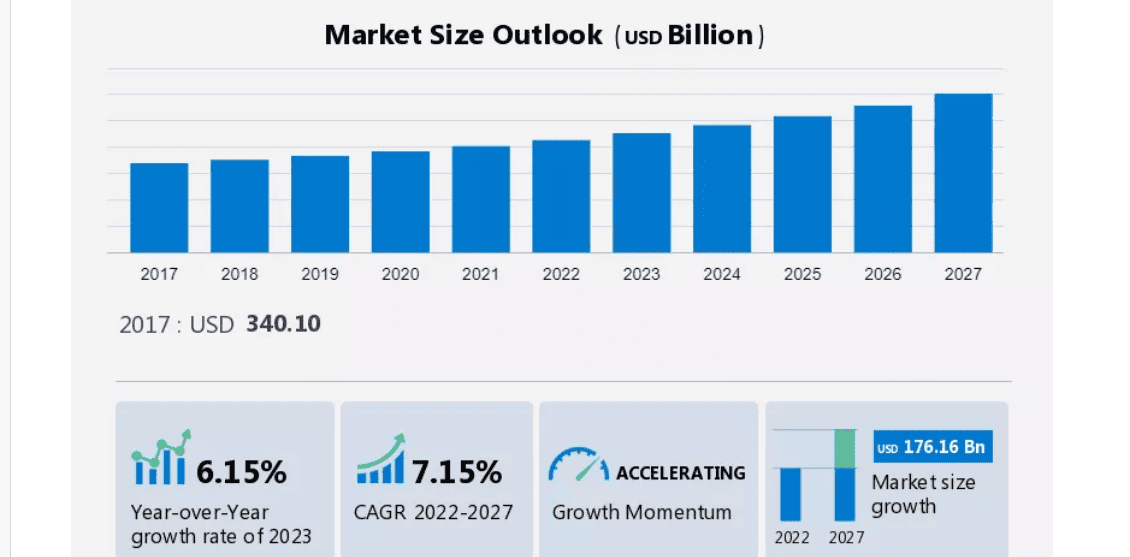

As a long-term investor, there are two things I’m especially excited about when it comes to JD stock. First, the global athleisure (casual sportswear) market is expected to continue growing strongly, as the chart below shows.

Second, the company remains committed to rapid expansion to take full advantage of this opportunity. JD, which operates more than 3,300 stores in Europe, North America and Asia, is on track to open 200 new outlets in the current financial year alone. It is also investing heavily in its e-commerce channels.

Analysts at Shore Capital recently described the company as “materially undervalued”. I’ll look to add JD stock to my portfolio the next time I have cash to invest.

NEWSLETTER

NEWSLETTER