Image source: Getty Images

After enjoying years of excellent profits, 2023 has been a challenging year for home builders. Another disappointing results update Barratt Developments (LSE: BDEV) highlights the extent of the challenges facing the sector and its actions. So should you buy some stocks now while they are trading at depressed levels?

First Quarter Business Update

It’s not hard to understand why the real estate market is so slow right now. Rising mortgage costs and the cost of living crisis have discouraged both buyers and sellers.

This continued slowdown is reflected in Barratt’s trading update published on Wednesday (October 18). During the period, average weekly net private bookings were 169, down 10%. Reservations per active point of sale fell 20%.

However, it maintained its orientation in relation to the total number of completed homes. It expects to deliver between 13,250 and 14,250 homes in FY24.

Mortgage affordability

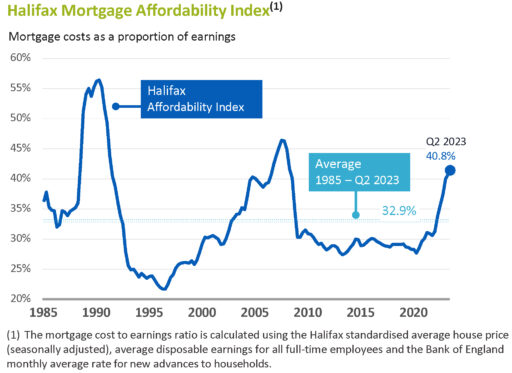

For more than a decade, aspiring homebuyers have benefited from an environment of ultra-low mortgage rates. The rapid rise in interest rates seen over the past year is clearly beginning to impact affordability.

The graph below shows how mortgage costs as a proportion of profits have fluctuated over the past 40 years. At the beginning of this year, they reached almost 41% of after-tax profits. This is above the historical average of just over 30%.

Source: Barratt Presentation

Most of the pain inflicted on the housing market can be traced back to the rise in bond yields in September 2022, following the disastrous mini-budget. However, what is even more worrying is that since this chart was published, UK bonds have surpassed even those levels.

Change incentives

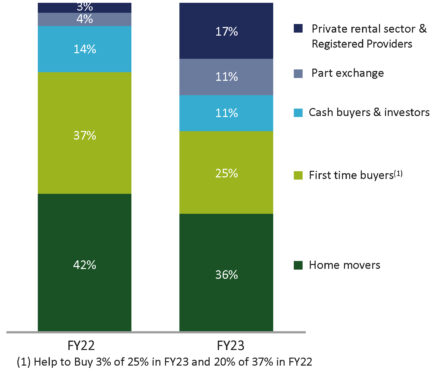

As mortgage rates rose and the Help to Buy scheme closed its doors in October 2022, Barratt’s private client booking mix changed dramatically. This is shown in the graph below, which shows the emergence of three trends.

Source: Barratt Presentation

First-time buyers, the cornerstone of a healthy housing market, have been hit hard. Particularly notable is the severe drop in help-to-buy purchases (see chart legend).

Secondly, to boost sales, it has expanded its parts exchange (PX) offering. PX can be a double-edged sword for homebuilders.

If used properly, it can be a very powerful tool to drive sales. After all, it eliminates the thorny issue of the real estate chain. But in a context of falling house prices and/or slow sales, it can be disastrous for profitability.

Thirdly, the business is starting to drive sales into the private rented sector and through registered social housing providers. Collectively, these increased from 3% in FY22 to 17% in FY23.

I should buy?

The underlying fundamentals of the property market across the UK remain strong. There remains a great need for more houses. Furthermore, the lack of supply is evident given the inflation of rents in the private rental sector.

Despite this fact, I believe that the end of the era of cheap debt fundamentally alters the dynamics of the entire market.

I don’t expect a drop like what was seen in 2008, so I don’t see the stock as a falling knife. But I also don’t expect house price inflation to skyrocket anytime soon. For now, the stock remains on my watchlist.