Updated at 8:48 am EST

Applied materials (ENORMOUS) stocks rose in early trading Friday as analysts weighed in on the chip equipment maker's stronger-than-expected fiscal first-quarter earnings report, which underscored the long-term potential for ai-related demand. .

Advances in artificial intelligence are reaching virtually every corner of the technology sector, with investments planned to boost performance and increase profits, from giant cloud computing providers to interactive “touch and talk” menus in fast food restaurants .

However, realizing that potential will require massive investments in both the chips and semiconductors that power ai technologies and the machines that help design and produce them.

Applied Materials, like its European rival ASML, (ASML) It falls into the latter camp by providing the equipment to produce chips for everything from flat-screen televisions to personal computers and smartphones.

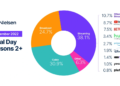

Growing investments from so-called hyperscalers, or large cloud computing service providers, continue to drive the majority of investment in ai. In fact, Morgan Stanley analysts predict that cloud capital spending growth will increase 26% this year from 2023 levels, marking the largest increase for the so-called Big Four (Amazon, Google, Microsoft and Meta Platforms) since 2018.

Shutterstock

And those investments will eventually reach the sectors where Applied Materials has the most control, such as memory and ICaps, which refer to chips for Internet of Things, communications, automotive, energy and sensor applications.

AMAT CEO: ai needs more chip power to unlock potential

“The full potential of technologies like ai cannot be unlocked without next-generation chips with better performance, power and cost,” Applied Materials CEO Gary Dickerson told investors on a conference call Thursday evening. .

“Our perspective has not changed at all in relation to how we see the market,” he added. “There are some powerful drivers in the digital transformation of every industry… we still see semiconductors costing $1 trillion by 2030.”

Applied Materials is starting to see the first fruits of that investment effort, forecasting revenue for the current quarter in the region of $6.5 billion, well above Wall Street forecasts, and adjusted earnings between 1.79 and 2 .15 dollars per share.

Adjusted earnings for the three months ended December, the group's fiscal first quarter, were $2.13 per share, firmly above the Wall Street consensus forecast of $1.79, with revenue largely stable with compared to the previous year at 6.71 billion dollars.

Related: Nvidia Reaches Major Milestone as ai Excitement Focuses on Profits

“Surprisingly, Applied Materials stands alone among its peers in revenue and EPS growth during seemingly the worst cycle in living memory,” said Steve Barger, an analyst at KeyBanc Capital Markets, who gives a sector-weight rating to the action.

“Applied Materials also held an upbeat conference call, saying conditions are improving with cloud investment accelerating, factory utilization rates rising across all device types, and manufacturing inventory levels normalizing. memory,” he added.

That tone, as well as the underlying ai investment thesis, is driving a series of changes to Applied Materials' price target by Wall Street analysts.

Applied Materials 'well positioned,' says JPMorgan

Mizuho Securities analyst Vijay Rakesh added $40 to his price target, taking it to $225 per share, while Citigroup raised its target by $41 to $211 per share.

Needham analyst Charles Shi added $60 to his price target, taking it to $240, while affirming his buy rating on the stock.

Meanwhile, JPMorgan added $60 to bring its target to $230 per share. The investment firm noted that the equipment maker is “well positioned to benefit from multiple future technology inflections that should drive outperformance of (wafer manufacturing equipment) for years to come.”

More ai actions:

- Analyst Reveals New Broadcom Stock Price Target Linked to ai

- ai stocks Soar on New Guidelines (It's Not Nvidia!)

- Big tech stocks are doubling down on ai

KeyBanc's Barger, however, remains cautious about the stock in the near term, saying he was “not willing to chase it as it may take time for results to grow toward entrenched expectations.”

“We believe (the) stock is already reflecting a strong cyclical inflection, which is not yet fully evident; a multi-year expectation of strong earnings per share growth; and potentially a valuation appreciation,” he wrote.

Applied Materials shares rose 9.7% in premarket trading to indicate an opening price of $205.82 each, a move that would extend the stock's six-month gain to around 50%.

Related: A veteran fund manager picks his favorite stocks for 2024

NEWSLETTER

NEWSLETTER