With the United States economy at a standstill during the Covid-19 pandemic, efforts to stimulate the economy provided many opportunities to people who otherwise would not have had them.

However, the extension of these opportunities to those who took advantage of the times has had its consequences.

Related: American Express Reveals Record Profits and ‘Strong’ Spending in Third Quarter Earnings Report

Credit crisis

A Financial Times report claims that US borrowers who took advantage of credit opportunities during the Covid-19 pandemic are falling behind on their debt payments.

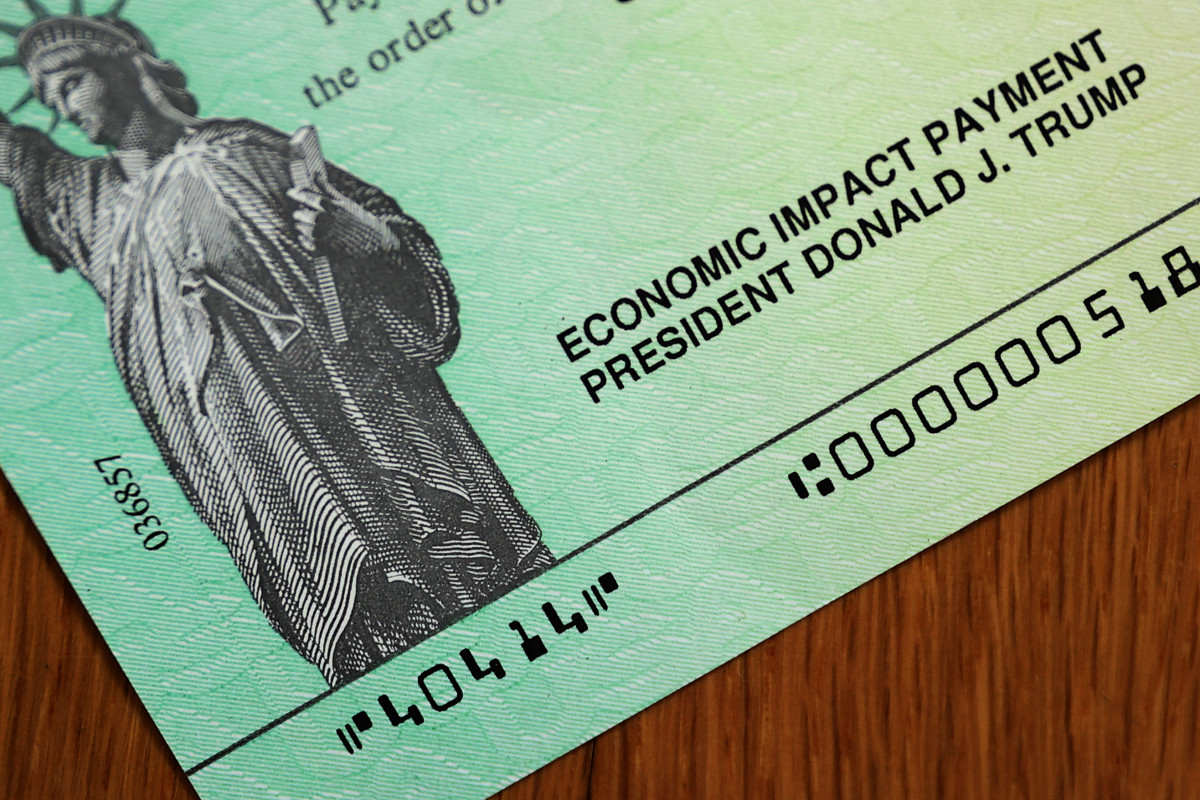

At a time when stimulus checks were delivered and loan payments were frozen to help those affected by the economic shock of Covid-19, many consumers in the United States found that lenders were more willing to extend consumer credit.

According to a report from credit reporting agency TransUnion, the average consumer credit score increased 20% to a high of 676 in the first quarter of 2021, allowing many to finally have “good” credit scores. However, their data also showed that those who applied for loans and credits from 2021 to early 2023 are having difficulty managing these debts.

“Consumer finance companies seized this opportunity to boost their growth at a time when financing was plentiful and consumers’ finances had been given an artificial boost,” Moody’s Analytics chief economist Mark Zandi told the Financial Times. . “Certainly, many low-income households that got caught up in all of this will feel financial hardship.”

Moody’s data shows that new credit card accounts opened in the first quarter of 2023 have a delinquency rate of 4%, while the same rate in September 2022 was 4.5%. According to analysts, these levels were the highest for the same period of the year since 2008.

Additionally, a study by credit rating company VantageScore found that credit cards issued in March 2022 had higher delinquency rates than cards issued at the same time over the previous four years.

More investments:

- Why did the recession never really come and what indicates it could still happen?

- Jim Cramer and Dan Ives say powerful technology will give markets a boost

- These are the companies that Nvidia joins the trillion-dollar market cap club

Credit cards weren’t the only debts American consumers took on. According to data from S&P Global Ratings, riskier auto loans taken out during the height of the pandemic have more payment problems than in previous years. In 2022, subprime borrowers were becoming delinquent on new auto loans at twice the rate of pre-pandemic levels.

Amy Martin, an auto loan tracker at S&P, told the Financial Times that lenders during the pandemic were “pretty aggressive” in terms of signing new loans.

Bill Moreland of the BankRegData research group has warned about this rise in defaults in the past and had recently estimated that by the end of 2022, there were hundreds of billions of dollars in what he calls “excessive loans based on artificially inflated credit scores.”

The role of government

Because many are not paying their bills, many fear that government aid has been a double-edged financial sword; as they were meant to alleviate financial stress during the lockdown, while for some of them it led to financial difficulties.

The $2.2 trillion Cares Act federal relief package passed in the early stages of the pandemic not only put cash in the pockets of American consumers, but also protected borrowers from foreclosures, defaults and, in some cases, lenders were prohibited from reporting late payments to credit agencies.

Pam Foohey, a law professor at Yeshiva University, specializes in consumer bankruptcies and believes the Cares Act was a good policy, yet it shifts the blame away from consumers and borrowers.

“I blame the lenders and the market structure for not taking a longer-term perspective. “That is not something that the Cares Act should have resolved and it still exists and still needs to be addressed.”

Get exclusive access to portfolio managers and their proven investment strategies with Professional with real money. Start now.

NEWSLETTER

NEWSLETTER