Image source: Getty Images

He Vodafone (LSE:VOD) The share price is a disaster that has been brewing for more than two decades. The shares of the FTSE 100 Index The telecoms giant hit a high of 550p in March 2000. Today, it is trading at just 73.84p.

That's a total drop of 86%, though to be fair it's a little misleading. Global stock values were inflated across the board in March 2000, thanks to the dotcom boom. The tech bubble burst that month and continued to deflate for two years, losing half its value.

Vodafone should probably be commended for surviving that debacle. Many similar companies followed the same path as the dodo.

<h2 class="wp-block-heading" id="h-tech-crash-victim”>Victim of a technological accident

What worries me is the past decade. Vodafone shares have fallen 60% in 10 years as the board struggled to get the global giant back on track. The worst seems to be over. The stock is up a modest 1.51% in 12 months. However, in six months it is up 14.86%. That is a dizzying figure by its standards. Is there more to come?

I love huge dividends as much as the next investor, but I've never been tempted by Vodafone. It's not very nice to get a 10% return if my capital is constantly taking a hit.

Worse still, that great performance was mostly a product of the falling share price. Shareholder payouts were halved in 2019 and then frozen at €0.09 for five years. In its 2025 year, dividends will be halved. The current yield of 10.37% is misleading. It will be roughly half that.

Vodafone delivered a slightly better-than-expected result in FY24 as organic services revenues rose 6.3%, with Europe, Africa and its Commercial division up.

It has also made numerous divestments, including the sale of Vodafone Spain, Italy, Hungary and Ghana, and the sale of its stakes in Vantage Towers and Indus Towers. But the battle to simplify its sprawling operations is far from won.

FTSE 100 Index Income Shares

Total revenue for the first quarter rose 2.8% year-on-year to €9.04 billion, but that was still one step forward and two steps back. Growth in Africa and Turkey was undermined by a slowdown in Europe and falling sales in Vodafone's key German market.

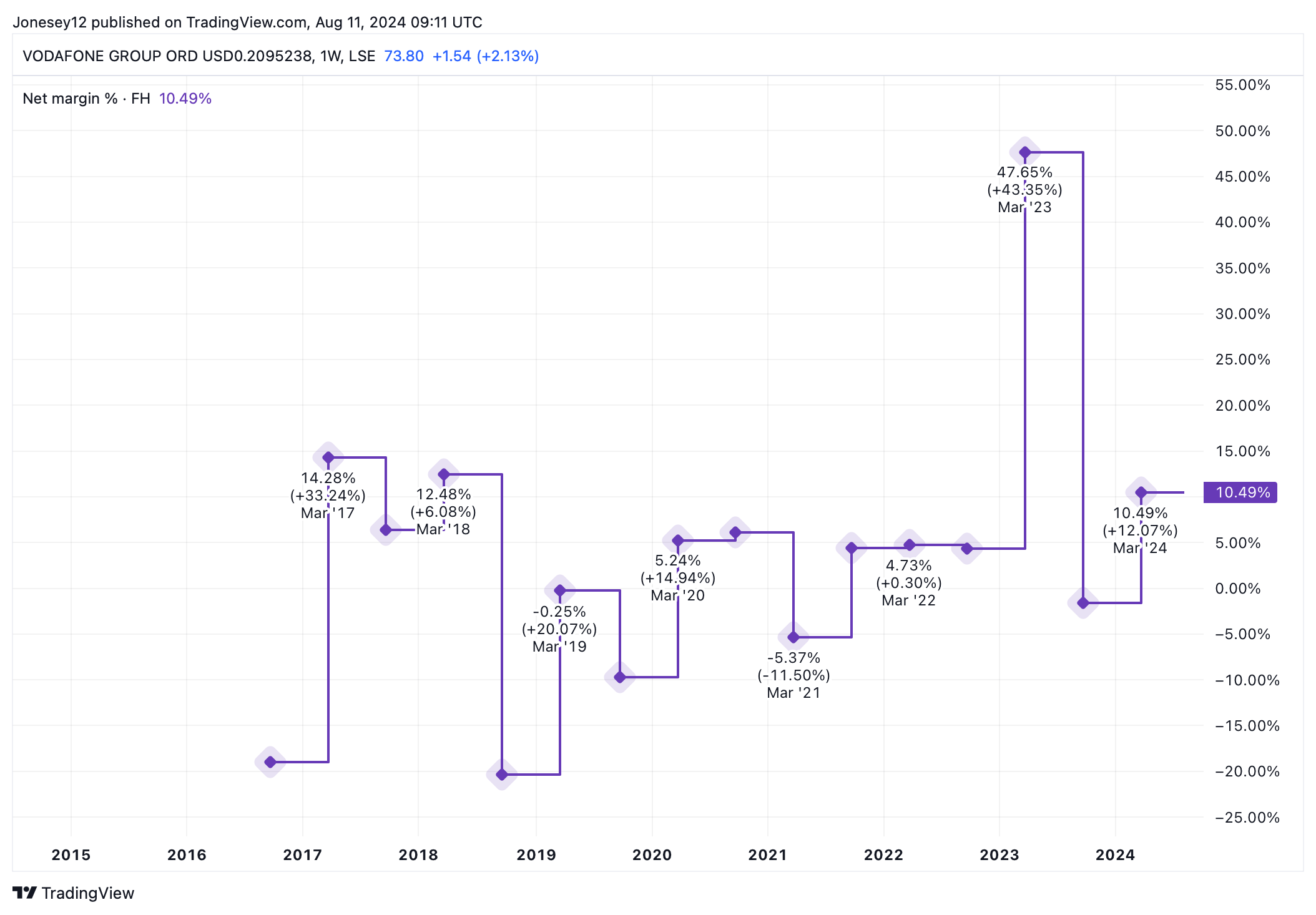

The story has been similar for years, as is often the case with large companies that get involved in too many issues. Net margins have also been uneven, as this chart shows.

TradingView Chart

The board expects to generate adjusted EBITDA of €11 billion in 2025, but that figure is in line with last year. The forecast adjusted free cash flow is €11 billion. “at least” In reality, €2.4 billion is less than the €2.6 billion in 2024 and €4.14 billion in 2023. However, divestments also play a role in this decline.

Despite its troubles, Vodafone remains a huge global brand and its relatively new chief executive, Margherita Della Valle, appears to be regaining control. The shares, which trade at 11.51 times earnings, don't look all that expensive either. And on Wednesday (7 August), it announced a share buyback programme worth up to €500m.

I wouldn't say it's in deep value territory, because I think it will take a long time for the board to unlock that value. But for me, Vodafone is back in play. I won't buy it today, as I can still find better prospects in the FTSE 100. But I'm not ruling it out any more.