Image source: Getty Images

I bought Ocado Group (LSE:OCDO) in a burst of inspiration in July, but with the FTSE 250 Index The 25% drop in the stock this month looks more like a fit of madness.

Or rather, double madness, because I bought the shares twice, on July 22 and four days later. So far, I have lost 17.29%.

I can't complain. I knew the food logistics and online grocery retailer was a high-risk stock when I bought it.

Ocado is a recovery project

Ocado's share price has plunged 88% since peaking at 2,808p in February 2021. I still think the markets have given it a hard time, but I seem to be in a shrinking minority.

I thought sentiment might improve as it approaches profitability, but we're not there yet. Ocado continues to lose money hand over fist as it pours funds into building the business, posting a pre-tax loss of £403.2m in 2023. Revenue is rising steadily, but not fast enough, as my table shows.

| End of the year | 2019 | 2020 | 2021 | 2022 | 2023 |

| Revenue | 1.756 billion pounds | £2.331 billion | 2.498 million pounds | 2.517 million pounds | 2.825 million pounds |

| Profits before taxes | -£214.5 million | -£52.3m | -176.9 million pounds sterling | -£500.8 million | -£403.2 million |

On July 16, Ocado shares rose 18% following news that it had narrowed its interim six-month pre-tax loss from £289.5 million to £154 million.

They rose again on July 22, when the board announced that US food giant Kroger had ordered more Ocado kits for its retail distribution centres. This followed a similar decision by Japan's AEON.

Ocado shares remain the plaything of general economic sentiment. When investors are optimistic, they flock in. When they are nervous, they flee in a disorderly rush. I was way ahead until the global stock market crash on August 5.

Given its volatility, I could easily recoup my losses after a single set of positive results, so I'm not too discouraged. We got some good news on August 27, when the board announced that two customer fulfilment centres (CFCs) in Australia were finally operating after a two-year delay. They are part of its partnership with local supermarket Coles. That brings the global total to 25.

It could crash or fly away.

Their high-tech CFCs are mind-blowing. They are powered by the Ocado automated smart platform, which CEO Tim Steiner says increases freshness and speed. I wish they could add some freshness and speed to the share price too.

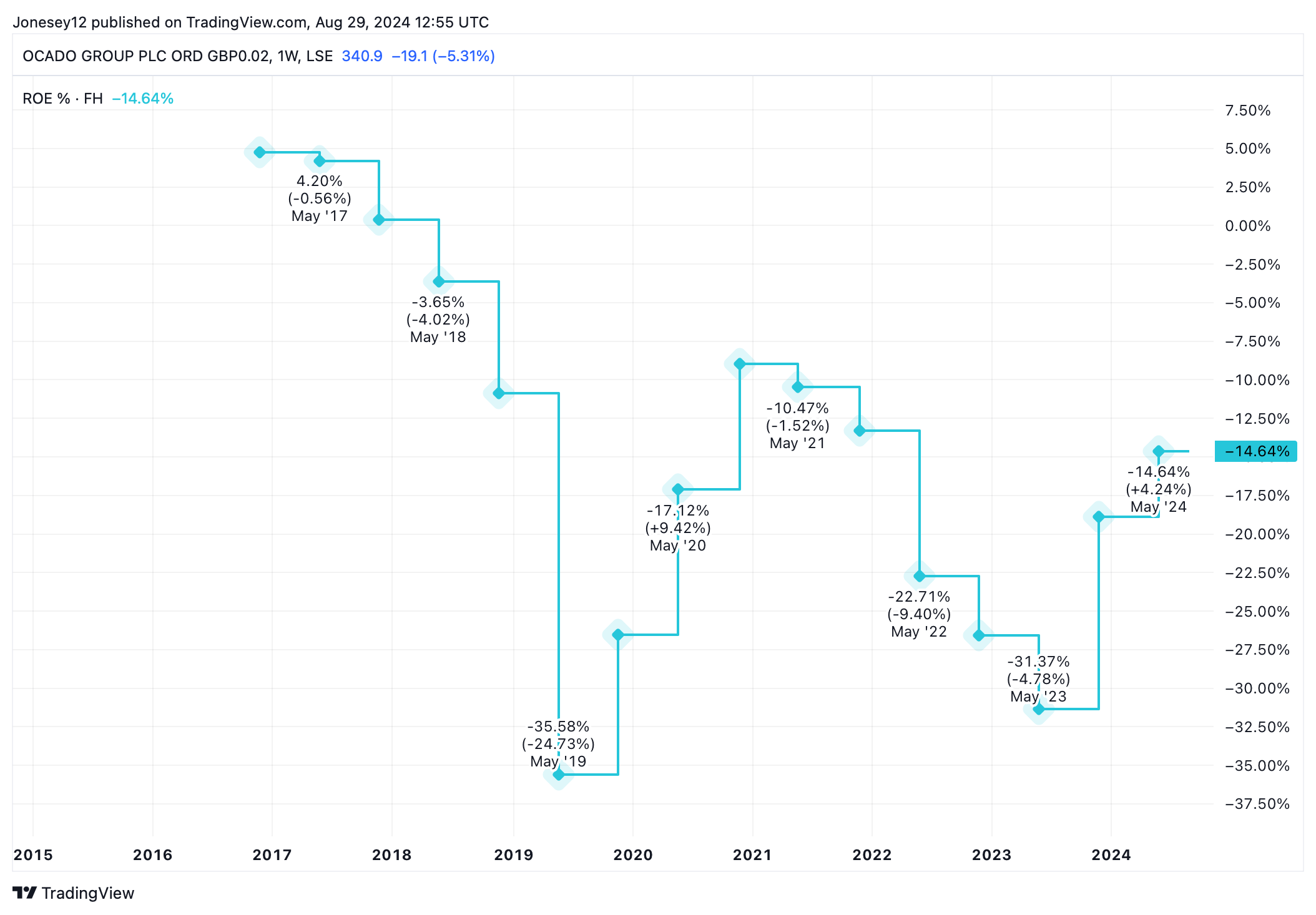

With 13 of the world's biggest supermarkets on board, I still think there is a tremendous opportunity here. However, judging by the group's return on capital, it will still be a case of one step forward, two steps back. Let's see what the charts say.

TradingView Chart

I bought Ocado as a long-term investment and I'm sticking with it. The 12 analysts who follow this stock have set an average target price of 425p. That suggests a 25% upside from today's 340p, but here's the thing: the range is huge, from a high of 2,900p to a low of just 230p. I think that tells us all we need to know about its prospects.

I still think there is a lot of value here, but Ocado remains a binary bet. It could go either way. I could take advantage of the dip by investing another £1,000, but investing more would be madness.

NEWSLETTER

NEWSLETTER