Adam Gault

US 30-year Treasury (US30Y) yields have been abysmal in recent years, but a turnaround may be on the way this year, according to Bank of America (BofA) investment strategist Michael Hartnett.

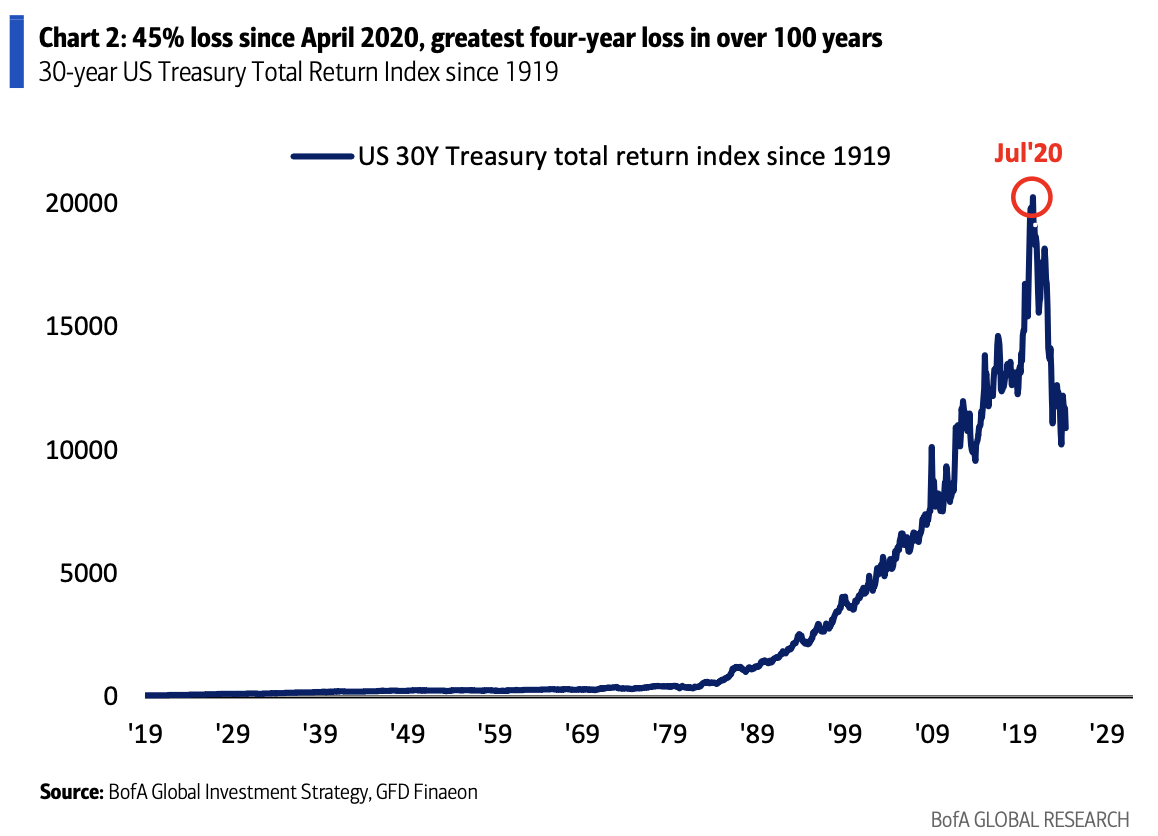

The total return on 30-year bonds (US30Y) has fallen 45% since April 2020, the largest four-year loss since 1919, Hartnett highlighted in BofA's “Flow Show” note this week. But there are signs that economic activity could be moving toward a contraction and that could lead investors to seek protection in long-term Treasury bonds. “The 30-year US Treasury bond is the best 'hedge' for weaker nominal growth,” Hartnett said.

The scenario of a hard landing is not very common on Wall Street: only 11% of global money managers in a BofA survey say the chances of a hard landing are too low. JPMorgan & Chase CEO Jamie Dimon warned this week that markets are too optimistic about a soft landing scenario.

“The 3Ps (Positioning, Policy and Profits) advocate a reversal” of the so-called “Everything but Bonds” trade in the second half of 2024, Hartnett said.

The “Everything But Bonds” view of bull markets in credit, stocks and commodities and strong 6% nominal growth in gross domestic product over the past four years have fueled the bond bear market, he said. But Hartnett pointed to worrying signs for the economy, including stagnating retail sales and the highest unemployment rate since January 2022. Those developments are a risk to a key “P”: earnings. “The 30-year Treasury bond is the best cyclical hedge for a hard landing,” he said.

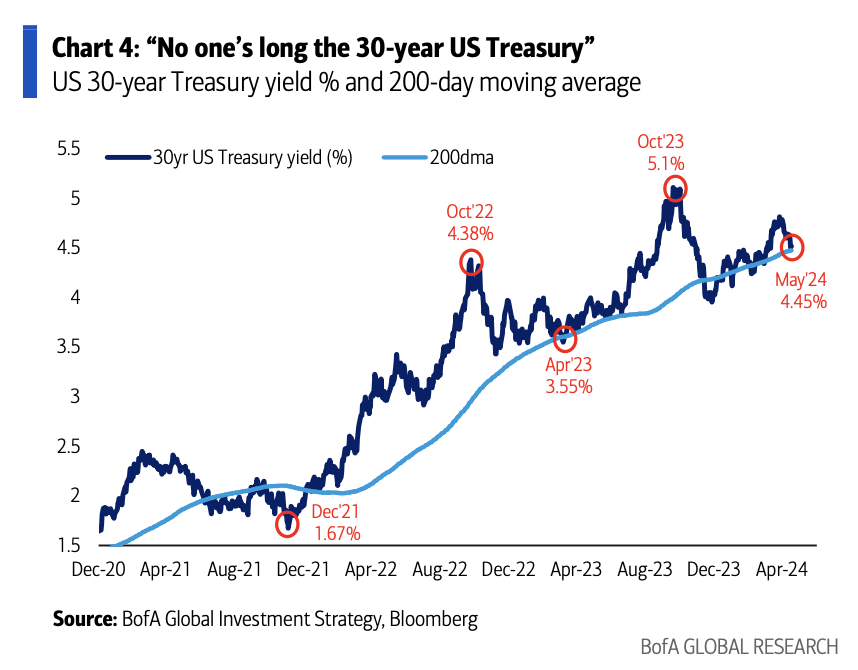

In terms of positioning, “no one” has long positions in the 30-year Treasury (US30Y), as investors are concerned about the dynamics of public debt, he said, noting that the government has spent $6.3 trillion on the last 12 months.

On the policy front, there is typically a “major slowdown” in government spending in the first year of a new presidential cycle, and American voters will head to the polls in November. Also, at the margin, monetary policy will become easier, fiscal policy will become tighter over the next 12 months and those factors are positive for bonds, he said.

Hartnett reiterated his view that bonds are in an early secular bear market driven in part by inflation and deficits. That bear market will end only once Main Street, through elections, and Wall Street, through failed debt auctions and lower debt ratings, “vote for less fiscal excess,” Hartnett said.

Bond ETFs that investors can check out include:

- iShares 20+ Year Treasury Bond ETF (TLT)

- ProShares UltraShort 20+ Year Treasury ETF (TBT)

- Direxion Daily 20+ Year Treasury Bull 3X Stock (TMF)

- Schwab Short-Term U.S. Treasury ETF (SCHO)