Image Source: The Motley Fool

Investing in banks can expose investors to a great deal of risk. The recent collapse of Silicon Valley Bank (SVB) serves as a stark reminder of just how fragile these institutions can be. So here are three of Warren Buffett’s top tips on choosing the best bank stocks.

1. Require a margin of safety

Banking is inherently a risky business. Commercial banks tend to lend large amounts of customer deposits and make a profit on the interest they earn on those loans. This means that they almost always have a deficit.

Therefore, if customers start withdrawing their funds en masse, banks may struggle to find liquidity, leading to what many refer to as a liquidity crisis. This was what led to the bankruptcies of SVB and several of its regional competitors.

However, these failures were partly the result of irresponsible capital allocation. As such, Warren Buffett’s advice on finding banks with a margin of safety is extremely important. The Oracle of Omaha believes that buying a stock is like buying a business, and due diligence is essential.

Therefore, it is crucial to ensure that a company has ample liquidity and a strong set of financials to withstand an economic downturn or liquidity crisis. These can be assessed through indices such as CET1 (which compares a bank’s capital to its assets), liquidity coverage, and countercyclical indices.

2. Look for economic moats

Most of Warren Buffett’s investments are in conglomerates with competitive advantages over their competitors. This is because companies that can successfully fend off competitors have a better chance of increasing their intrinsic value over time. This same precedent can be applied to banks.

The failure of several regional banks in the US has resulted in a flight to quality. Consequently, the tastes of JP Morgan and Bank of America they have received tens of billions in customer deposits since the SVB crisis. This is what Warren Buffett would call an economic moat.

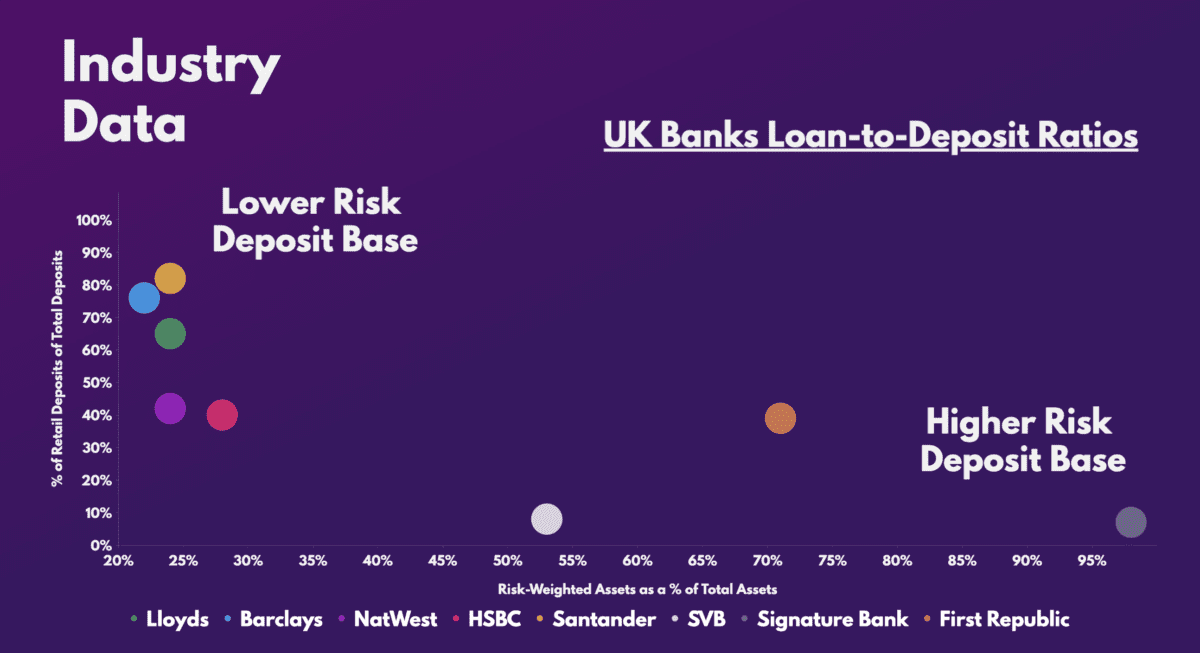

It is for those reasons that UK banks stand out as the most attractive to me: their strength and reliability. This is because their lower-risk deposit base gives them a much bigger cushion to protect themselves from a liquidity crisis.

This is due to the fact that the amount of risk-weighted assets they hold is much less than their US counterparts. Also, the number of retail customers they have is significantly higher. Therefore, the probability of a bank run is less since most of your funds are insured by a regulatory body.

3. Focus on the long term

Another piece of advice from Warren Buffett is to focus on the returns a bank can earn over the long term. In the context of bank stocks, they should generate high interest margins (the difference between income generated by interest-bearing assets and liabilities) and good returns on tangible equity (ROTE).

However, there is a fine line between striving for big profits and potentially sinking a business. Being too greedy can result in bankers taking unnecessary risks, while being too conservative can result in low profits.

Fortunately, however, UK banks fall between the two, which is why I am investing in lloyds. And given its cheap valuation multiples with a strong outlook for net interest income and ROTE for the next few years, you could even start a position in barclays.

| Metrics | lloyds | barclays | industrial average |

|---|---|---|---|

| Price-to-book (P/B) ratio | 0.7 | 0.3 | 0.7 |

| Price-Earnings Ratio (P/E) | 6.2 | 4.5 | 8.9 |

| Forward price-earnings (FP/E) ratio | 6.6 | 4.7 | 5.7 |

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);

NEWSLETTER

NEWSLETTER