Image Source: Getty Images

It can be quite discouraging when the stock market is considered for the first time as a way of generating a second income. There is a lot of jargon to have your head. But it is not as complex as it seems.

With this in mind, here there are some simple steps that a new investor could follow to attack the considerable income of dividends.

Choose the right account

To start, there must obviously be an account to buy shares. This will open through a brokerage, which is a company that acts as an intermediary to facilitate the purchase and sale of shares.

There are a few. Some inherited platforms such as Hargreaves Lansdown It still charges customers for trade. However, there are many new applications that allow free trade. To be fair, Hargreaves Lansdown has a large amount of resources for new investors, while free trade applications are luxurious are very DIY. It depends on the preference.

The investment account with which someone would generally begin in the United Kingdom is Isa action and actions. This wonderful vehicle allows a portfolio to grow more quickly because there are no tax liabilities in income and returns (the annual contribution limit is £ 20,000).

Keep in mind that tax treatment depends on the individual circumstances of each client and may be subject to changes in the future. The content in this article is provided only for information purposes. It is not intended to be, it does not constitute any form of fiscal advice. Readers are responsible for carrying out their own due diligence and obtaining professional advice before making investment decisions.

<h2 class="wp-block-heading" id="h-consider-quality-high-yield-dividend-stocks“>Consider high quality high performance dividends

As the objective is to start obtaining a second income, the next approach will be to look for actions that pay dividends. These are semi-regular payments made by companies to shareholders, usually of profits. They are mostly paid two or four times a year.

The dividend yield of the action will determine how much passive income is offered. For example, insurance and asset management firm Legal and general (LSE: LGEN) currently has a powerful 8.9%yield.

In other words, an investor could put £ 2,000 in this Ftse 100 Actions and hope to receive £ 178 every year in dividends. However, it could be less than this (if the company reduces payment, which is always possible) or ideally more.

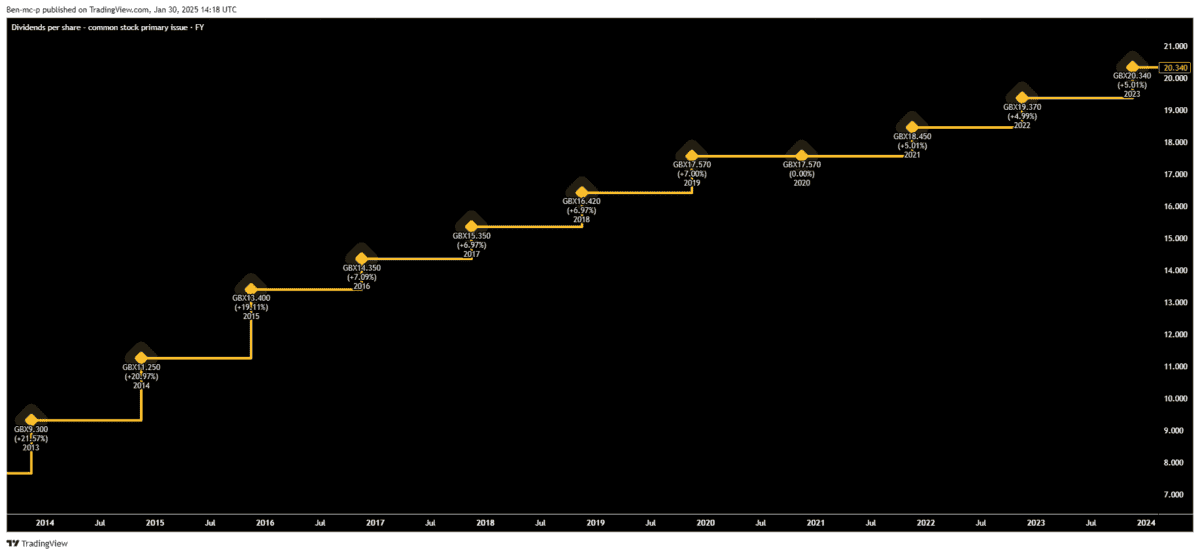

Personally, I think Legal & General is one of the best income shares, so I have it in my own portfolio. The company has a solid brand, a large customer base and an excellent history of increasing its payment.

However, an opportunity, however, may arise risks of the massive assets of $ 1trn+ of the group under administration. It is exposed to stock market recessions, which can quickly reduce the value of its investment portfolios, as well as change interest rates that drive fluctuations in bond prices. Economic recessions can also negatively affect profits.

However, for investors looking for high performance income, I think Legal & General is worth considering in a diversified portfolio of quality actions.

Invest regularly

The keys to building a considerable passive income portfolio are time and consistency.

If someone invested £ 750 per month, achieving an average yield of 8%, it would end with approximately £ 275,000 after 15 years. This assumes that dividends are reinvested during this time instead of spending.

At this point on the trip, the ISA portfolio would generate annual income of approximately 20,000. Then I could enjoy or reinvest for a longer time to aim at an even greater figure.

(Tagstotranslate) category. Investing

NEWSLETTER

NEWSLETTER