Image source: Getty Images

When I retire, I plan to top up my state pension by generating a second income from higher dividend stocks.

If I had a lump sum of £25,000 to invest today, I wouldn't hang around. I would spend the summer searching FTSE 100 stocks that can potentially generate a high and growing stream of passive income until retirement and beyond.

Today, I would reinvest all my dividends directly into the same stock, to help my money compound and grow. I would then look to earn them as income after I retire.

FTSE 100 high returns

I wouldn't throw my £25,000 on the market in one go. I'd be a little upset if the stock market crashed the next day. Although I wouldn't leave it for long. I want my money to be invested instead of sitting on the sidelines. Otherwise, I would risk missing out on the dividends and growth the market offers. I would like to invest in five shares of £5,000, in five different shares to spread my risk.

I would start by looking for a stock with a strong track record of generating growing dividends and share price growth. Distribution group Diploma (LSE: DPLM)), which supplies products and technical services to companies in North America and Europe, scores well on that front. Its shares have risen 39.3% in one year and a tremendous 158.04% in five.

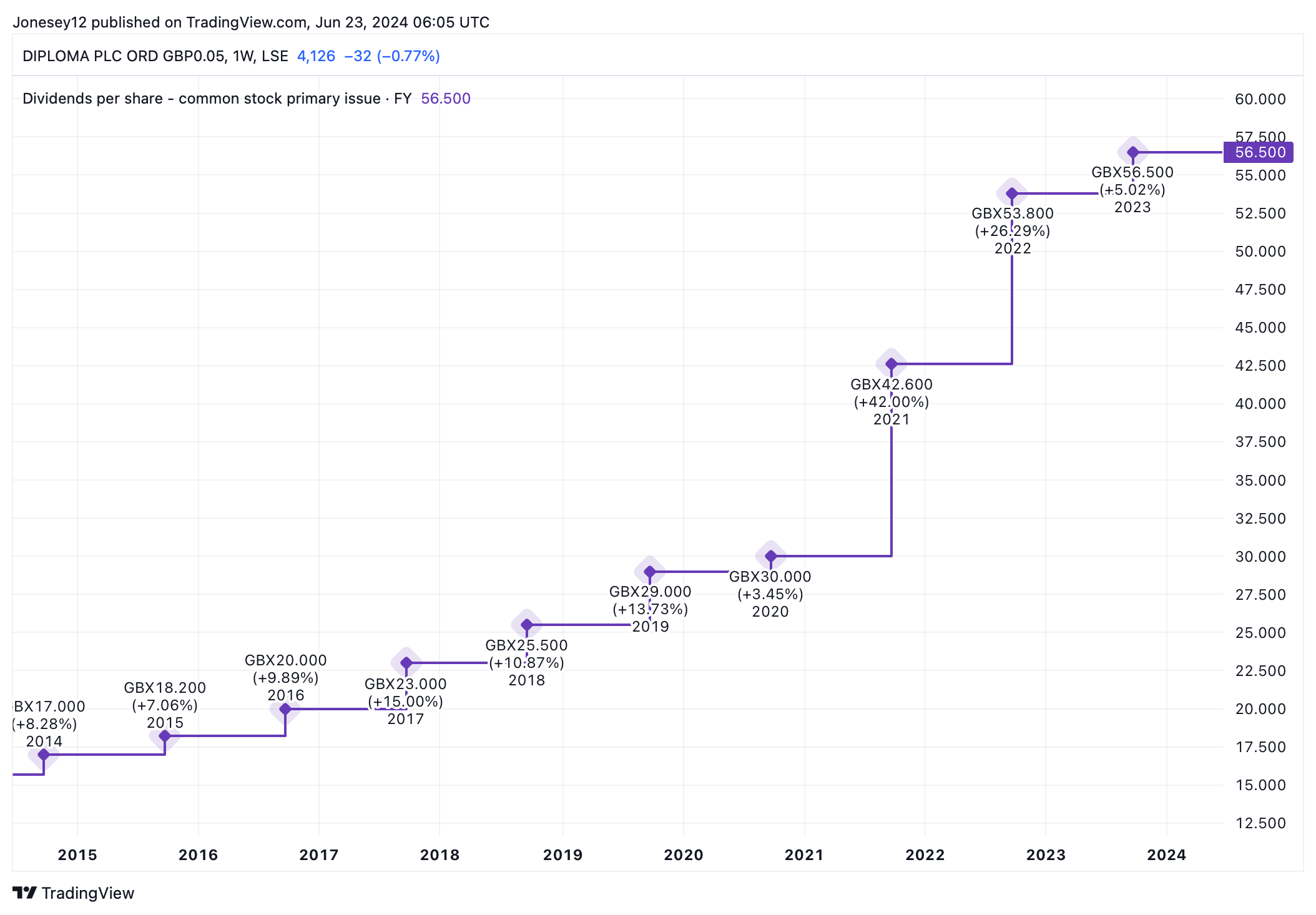

While the yield doesn't look spectacular (1.43%), that's largely a consequence of its skyrocketing share price. Diploma has a stellar track record of dividend growth lately. Let's see what the graph says.

Chart by TradingView

It has increased payments to shareholders at an average rate of 13.7% annually for a decade. AJ Bell The figures show it. It is now on track to increase its annual payout for the 24th consecutive year. This is a true dividend aristocrat. Over the last decade, Diploma has earned an annual total return of 620.2%, with all dividends reinvested.

<h2 class="wp-block-heading" id="h-top-dividend-growth-stocks“>stocks with the highest dividend growth

It is not cheap. Today, its shares trade at 33.09 times earnings. Another concern is that the U.S. economy is slowing, which could hurt sales.

But the £5.5bn group continues to grow, helped by a successful acquisition strategy, and recently posted a 17% rise in adjusted half-year profits. If the markets fall over the summer and that valuation decreases, I will consider buying it.

It could balance Diploma with some higher-performing companies, such as the insurance company Avivawhich currently pays an income of 6.96% annually, and the home builder Taylor Wimpeywhich yields 6.65%.

Let's say my stock picks returned an average of 5% annually and grew at a CAGR of 8%, with all dividends reinvested. After 30 years, my £25,000 would be worth £251,566. That's not a bad return. If my portfolio was still yielding 5%, that would give me an income of £12,578 a year.

Hopefully, that would continue to grow, as companies increased their dividends, while my capital would still be there.

Getting enough money to generate a decent second income takes years. That's why my goal is to start as soon as possible. There is no time to lose!