Image source: Getty Images

I bought some high-risk, high-maintenance British stocks this year, and would now like to balance them with a couple of solid stocks. FTSE 100 dividend stocks. The kind that won't cost me too much time or trouble. Nice and easy and obvious shopping.

I'm not looking for ultra-high returns, but rather a solid, sustainable rate of income that should increase over time. A little share price growth wouldn't hurt. I hope to get £2,000 to invest in January. If I do, I'll consider splitting it between these two.

Accounting software specialist wise group (LSE: SGE) fits very well. I had always seen it as a growth stock, but the data from AJ Bell shows that he is also an unsung hero of dividends.

Sage Group has a very smart dividend policy

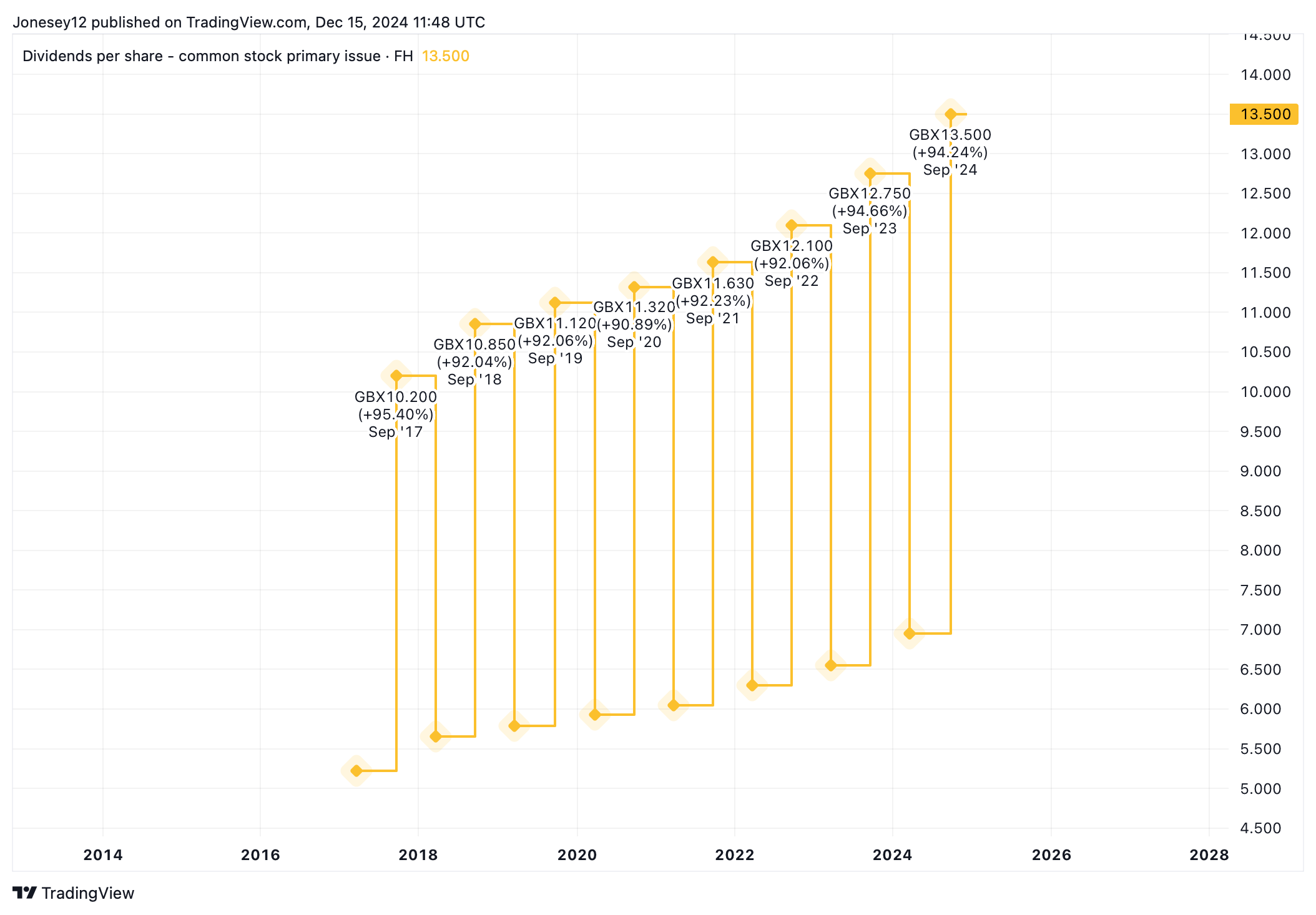

Over the past decade, the board has increased the dividend at an impressive rate of 5.7% annually, according to AJ Bell. Let's see what the graph says.

Chart by TradingView

It's easy to overlook its dividend potential, given a residual yield of just 1.56%. That has been eroded by its impressive share price performance. Sage shares are up 9.97% in 12 months and 78.57% in five years.

Some feared the group's business model would be hit by the ai revolution, but as we learn more about what ai can and (fundamentally) can't do, it seems more likely that it will be driven by it.

On 20 November, Sage reported an 11% rise in annualized recurring revenue to £2.34bn, while underlying operating profit rose 21% to £529m. Subscription renewal rates are an enviable 101%.

My big concern is that Sage's share price is expensive, with a P/E ratio of 34.47. That's more than double the FTSE 100 average of 15.8%. Growth only has to disappoint slightly for stocks to sell off.

This is a concern given the turbulent global economy, with small and medium-sized businesses (in other words, Sage customers) on the front line. So it's not a 100% no-brainer, but it's very close.

DCC is a dividend superhero

Sales and marketing company. DCC (LSE: DCC) offers energy, healthcare and technology solutions. The final dividend yield is 3.6%, but its history is much more impressive. It has increased payments to shareholders at an average of 10.8% annually over the past decade.

This is a true dividend aristocrat, having increased payouts to shareholders every year for three decades. However, the stock has fallen 2.34% over the past year. It's cheaper than Sage, with a modest P/E of just 11.98 times earnings.

DCC has been divesting lately as it seeks to streamline its operations and focus on the energy sector.

It expects to conclude the sale of DCC Healthcare next year and will review its options for DCC technology thereafter.

The group raised £150m after selling its majority stake in the Hong Kong and Macau liquefied gas business in July. All of this should help unlock embedded value and focus attention on its successful energy sector.

The risk is that, having announced it, it will be difficult for you to fulfill it. Even if it did, there is a danger that its narrow focus could leave it more exposed to volatile energy prices.

No action is a total no-brainer. But Sage and DCC are as close as it gets and I'll invest £1,000 in each when I get that £2,000.

NEWSLETTER

NEWSLETTER