Image Source: Getty Images

Earning passive income is one of my top investing priorities this year. To accomplish this, I am interested in purchasing high-yield dividend stocks that can provide me with a second income. In the long run, I hope that the money I earn from my investments will be enough to ensure my financial independence.

Multiple UK stocks offer attractive returns. I’ve been looking for the FTSE 100 Y FTSE 250 looking for inspiration and decided on two companies that might be good choices for my passive income portfolio in 2023.

Let’s explore each one in turn.

fan

fan (LSE: AV.) Stocks currently have a whopping 6.6% dividend yield.

The share price of the FTSE 100 insurer is down 21% in the last 12 months. At this level, I think it could be a good investment for me.

Aviva offers wealth, retirement and insurance solutions to 18.5 million customers in the UK, Ireland and Canada.

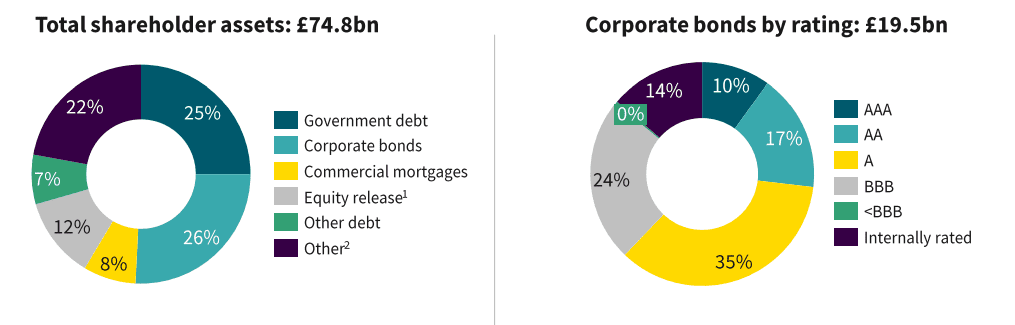

Its investment policy is relatively defensive, focused on sovereign and corporate bonds with limited exposure to stocks and emerging markets.

The firm’s solvency II ratio is 215%. This is above their target of 180%. The company’s liquidity position points to a healthy balance sheet and sustainable dividends.

In fact, the firm intends to launch a new share buyback program in March to support its full-year financial results.

In my view, this will prudently add shareholder value as the company awaits clarity on its year-on-year performance before deploying capital.

In line with the broader insurance market, the business faces ongoing risks due to high inflation. Rising prices have driven up claims costs that could weigh on Aviva’s share price.

However, I don’t see much evidence of weakness in the latest financial results. I would buy.

itv

itv (LSE: ITV) shares also have a market-leading return of 6.5%.

The share price of the FTSE 250 issuer is down 35% over the past year. I think this could be another opportunity to get a cheap dividend stock.

The media team is trading for a price-earnings ratio of just 6.5. This looks like an attractive level to enter a position with stocks apparently priced in on bad news.

The UK’s largest commercial broadcaster launched a new streaming service, ITVX, in November. It plans to invest more than £800 million in this project.

The financial impact remains to be seen, but I think this is an exciting development that could revive the company’s ailing fortunes.

Of course, the business faces risks from reduced advertising expenses. A bad set of financial results could derail the positive momentum that has lifted ITV’s share price since September.

I will wait until full year results on March 2 before investing. However, barring any unpleasant surprises, I find the stock undervalued at the moment and would add it to my portfolio.

My Passive Income Portfolio

If I were to invest £1000 between Aviva and ITV, my combined holding would produce an annual return of over £65.

Also, reinvesting dividends within a Stocks and Shares wrapper ISA means I could benefit from a compounding effect over the long term.

By allocating some additional cash into these two dividend stocks in 2023, I can take an important step on my journey to financial independence.