Image source: Getty Images

The latest data from both the UK and the US indicates that inflation will be one of the key themes of 2025. And that means investors looking at growth stocks need to think carefully.

Some companies are more resistant than others to the effect of higher prices. And in general, those are the companies that manage to differentiate themselves from their competitors.

Differentiated distribution

FTSE 100 industrial conglomerate Diploma (LSE:DPLM) offers a service its customers can't get anywhere else. It combines the benefits of large scale with close attention to individual customer needs.

One of the company's big points of differentiation is the size of its inventory. When your customers need a part for a machine, it is usually urgent and Diploma gives them the best chance of finding it quickly.

Providing a service that customers can't get elsewhere is a good thing when it comes to fending off the effects of inflation. But there are risks that investors should consider.

One is the possibility that inflation will give way to an economic recession if interest rates rise. This could cause a slowdown in the pace of sales growth, something that is already happening to some extent.

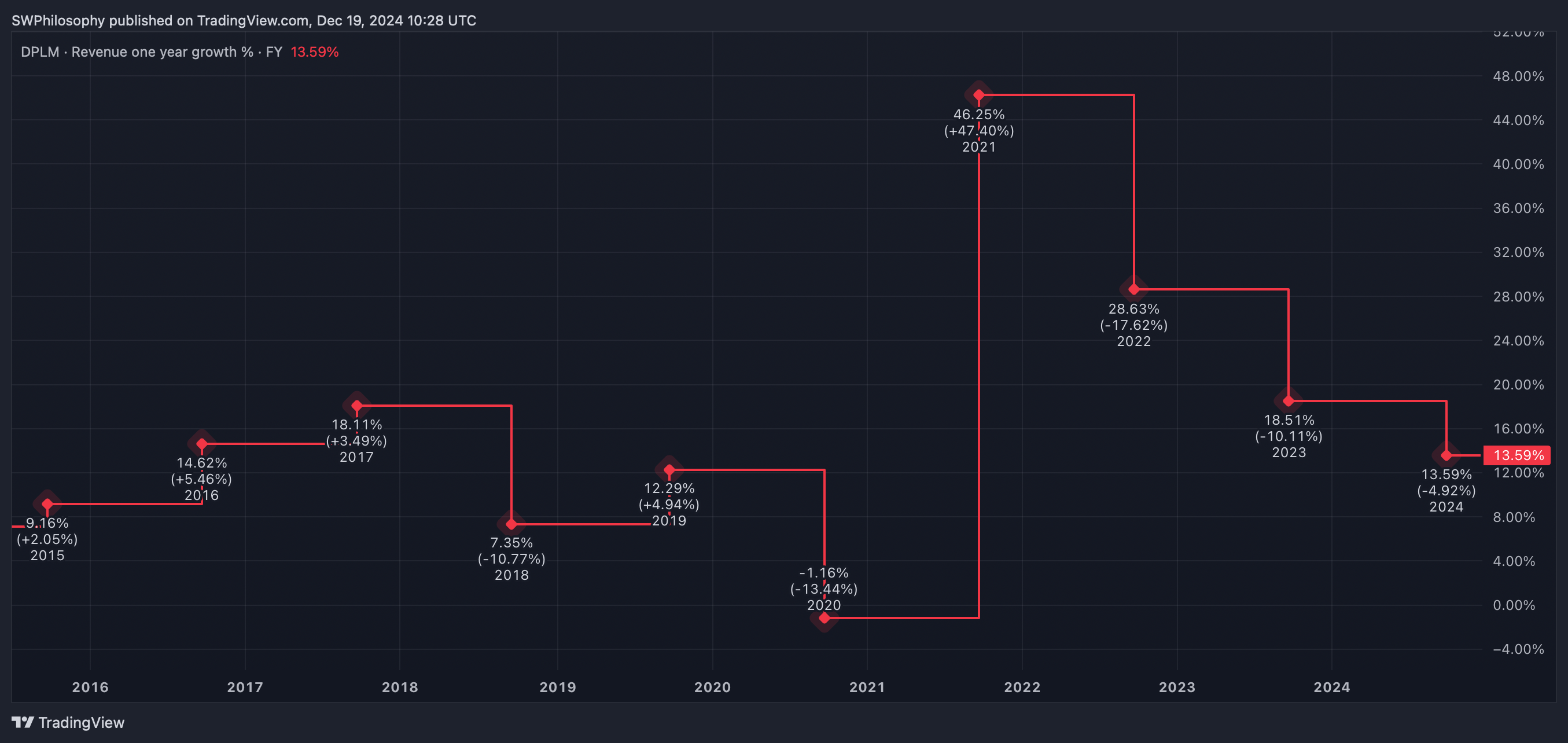

Growth of annual diploma income 2020-2024

Created in TradingView

The risk for investors is exaggerated by the fact that Diploma shares reflect an optimistic outlook in terms of growth. But the company's ability to offer a unique service to its customers remains intact.

This is what gives it the ability to weather an inflationary environment. And even if this remains intact, I think you could still consider buying the stock.

Brand power

From FTSE 250, AG up (LSE:BAG) has a small but powerful portfolio of brands that could well give it room to pass on the effect of higher prices. Irn Bru is a good example of this.

With a few exceptions – mainly in the United States – soft drink companies are not known for their growth prospects. But the company has been acquisitive in recent years, and revenue has risen sharply as a result.

AG Barr Total Revenue 2015-2024

Created in TradingView

However, until now the company has not fully taken advantage of the possible synergies derived from the acquisition of INCREASE a couple of years ago. Therefore, operating margins have been lower in recent years.

AG Barr Operating Margin 2015-2024

Created in TradingView

That's where the next wave of growth for AG Barr comes from. And I am optimistic that the resilience of Irn Bru in its main market will allow the company to offset the effects of inflation.

One potential risk to the business is the rise of anti-obesity drugs. These have the potential to decrease people's enjoyment of these types of drinks, which could potentially decrease demand.

I suspect, however, that the market is underestimating AG Barr's ability to raise prices to offset a gradual decline in demand. With the stock falling to £6, I think investors should consider buying.

Inflation again

Warren Buffett says that the best investment someone can make against inflation is in their own abilities. And the next best thing is to own shares of a prominent business.

Whether inflation is 2% or 10%, companies that can increase their profits to compensate for this will generally do better than those that cannot. And that makes growth stocks important going into 2025.