Image source: Getty Images

Is the investment a matter of time? It is not only About time, of course, but time can be very important. The same stock can be a brilliant performer or a total dog for an investor, depending on when they buy or sell it. So when I look for stocks to buy, I take into account how attractive the business is, but also when I would be willing to invest.

Here are two stocks on my watch list that I think are great businesses. I would be happy to buy the stock next year if its price drops to what I consider an attractive level.

Dunelmo

At face level, Dunelmo (LSE: DNLM) may not even seem expensive. After all, its P/E ratio of 14 is lower than some stocks I bought this year, such as Diageo.

However, I have been burned before by owning retail stocks (such as my stake in boohoo).

Retail tends to be a fairly low profit margin business, so profits can drop significantly for seemingly small reasons. Last year, for example, Diageo's after-tax profit margin was 19%. Dunelm's was less than half, at 9%.

Dunelm's business is efficiently managed, has a large retail footprint and a growing digital footprint, and, thanks to many unique product lines, is able to differentiate itself from the competition. Sales have grown considerably in recent years.

Created with TradingVew

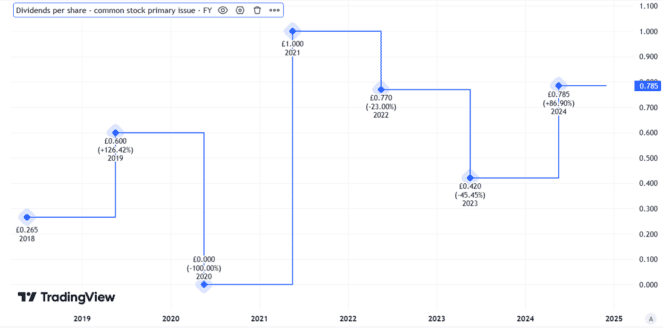

Dunelm is also a solid dividend payer. The return on ordinary dividends is around 4.1%.

But the company has often paid special dividends, meaning the total return has often been higher than the ordinary dividend yield alone.

Created with TradingVew

Still, Dunelm's share price is up 57% since September 2022.

That seems high to me given that sales growth in the last reported quarter was 3.5%, perfectly respectable in my opinion, but not spectacular.

I believe a weak economy and increasingly tight household budgets could hit sales and profits in 2025. If that happens and the share price falls enough, my current plan would be to buy some Dunelm shares for my portfolio.

NVIDIA

I think it's easy to look at the NVIDIA (NASDAQ:NVDA) price chart and you immediately think “bubble!“

In fact, the P/E ratio of 53 offers little to no margin of safety for risks such as a pullback in ai spending once the initial round of large installations currently underway have run their course. That helps explain why I didn't buy stocks this year.

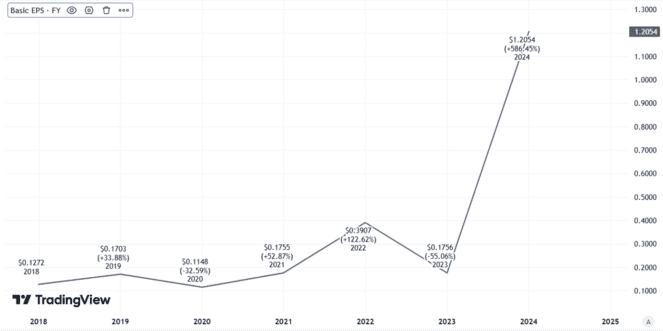

Still, that P/E ratio is despite Nvidia's stock. increasing 2.175% only in the last five years. The price has skyrocketed, but so have profits.

Created with TradingVew

Nvidia is not a meme stock without a long-term future. It is a successful and hugely profitable company with a proven business model.

In my opinion, its competitive moat is also huge: Rivals simply can't make many of the chips that Nvidia makes, even if they wanted to.

Valuation alone is the reason I haven't bought Nvidia stock this year. It's a stock I would love to buy (by far) in 2025 if the price seems more reasonable to me.

NEWSLETTER

NEWSLETTER