Image source: Getty Images

Phoenix Group (LSE:PHNX) stock has proven to be an exceptional investment for dividend investors for over a decade.

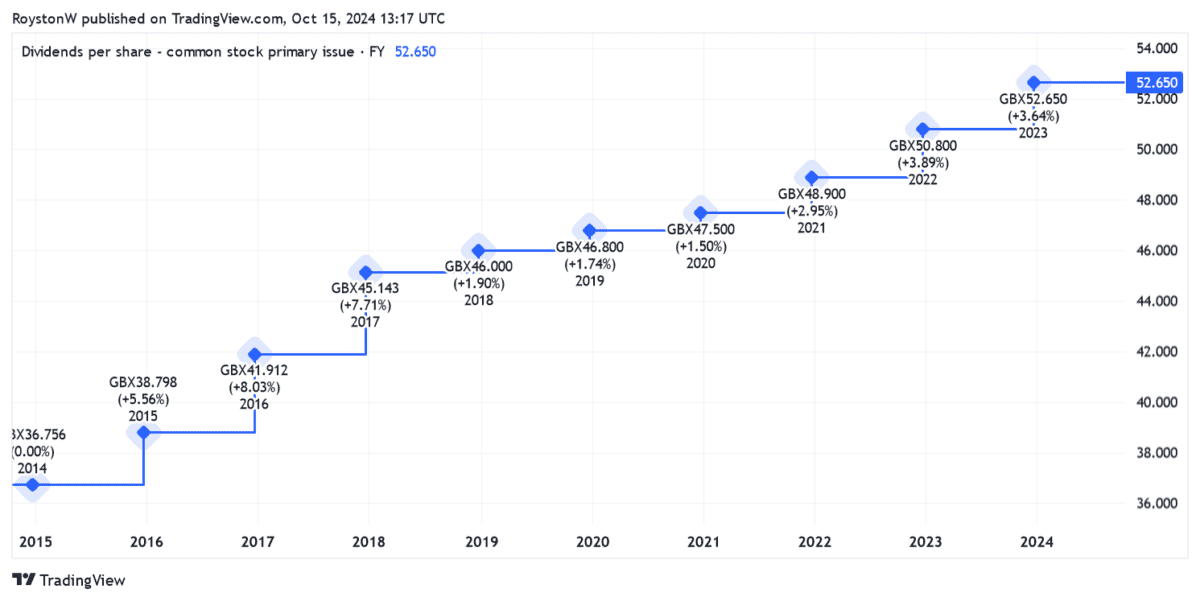

Payments to shareholders have increased steadily over that time. And the performance of FTSE 100 The company has long outperformed the ratio's average of 3% to 4% during the period.

Past performance is no guarantee of future returns. But encouraging for income seekers is the fact that the city's analyst community expects Phoenix stock dividends to continue climbing skyward.

So how much passive income could you make today from a £10,000 investment?

11.1% dividend yield

Phoenix's long history of generous and growing dividends reflects its commitment to a healthy balance sheet. Even when profits have fallen (which has happened three times in the last five years), cash rewards have steadily increased.

Last year, Footsie increased its shareholder payout by 4% to 52.65 pence per share. And as the table below shows, City brokers expect dividends to continue rising until at least 2026:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 54p | 3% | 10.4% |

| 2025 | 55.6p | 3% | 10.8% |

| 2026 | 57.3p | 3% | 11.1% |

As you can see, dividend yields on Phoenix shares are subsequently two to three times higher than the FTSE 100 average.

And even if dividends don't grow beyond 2026, you could still earn four-figure monthly dividend income with a lump sum investment.

Compound Earnings

Let's say I have £10,000 that is ready to invest. If the runners' forecasts are accurate, this would give me:

- £1,040 in dividends in 2024

- £1,080 in dividends during 2025

- £1,110 in dividends in 2026

If dividends remained fixed at 2026 levels, over the next decade you would enjoy £11,100 in dividends. Over 30 years, you would earn £33,300 in passive income.

That's not bad, I'm sure you'll agree. But it's not as much as I would earn by reinvesting my dividends or compounding my returns.

Huge passive income

If you had used this common investment strategy, after 10 years and based on that same 11.1% dividend yield, you would have earned £22,208 in dividends. That is more than double the £11,100 he would otherwise have earned.

Considering a 30-year base, the difference is even more marked. With the dividends reinvested, you would have earned a passive income of £291,653. That dwarfs the £33,300 it would have generated without the reinvestment.

With my initial investment of £10,000 added, my portfolio would be worth a staggering £302,653 (assuming zero share price growth). With a 4% annual withdrawal, you would have £12,106 of passive income, which equates to £1,009 a year.

bright perspective

That being said, I look forward to Phoenix's stock price. and Dividends per share will also increase strongly during this period, a scenario that would give me an even larger second income.

I expect profits here to soar in the coming decades, as the UK's growing elderly population drives demand for pensions and other retirement products.

If it can maintain a strong balance sheet, Phoenix could continue to pay large dividends while also investing for growth. It is encouraging that its Solvency II ratio reaches a formidable 168%, according to its latest financial statements.

The company faces significant competitive pressures that could derail earnings and dividends. But all things considered, I think it's worth watching Phoenix's stock very closely right now.

NEWSLETTER

NEWSLETTER