Image source: Getty Images

Looking for dividend growth stocks? These FTSE 100 The stock is expected to deliver strong payout growth for at least the next two years.

BAE Systems

Dividend yield: 2.5% by 2024, 2.7% by 2025

The stable nature of arms spending means defense tends to be a strong sector for generating dividends. This is especially the case today, when fractures in the global order drive rapid rearmament in the West.

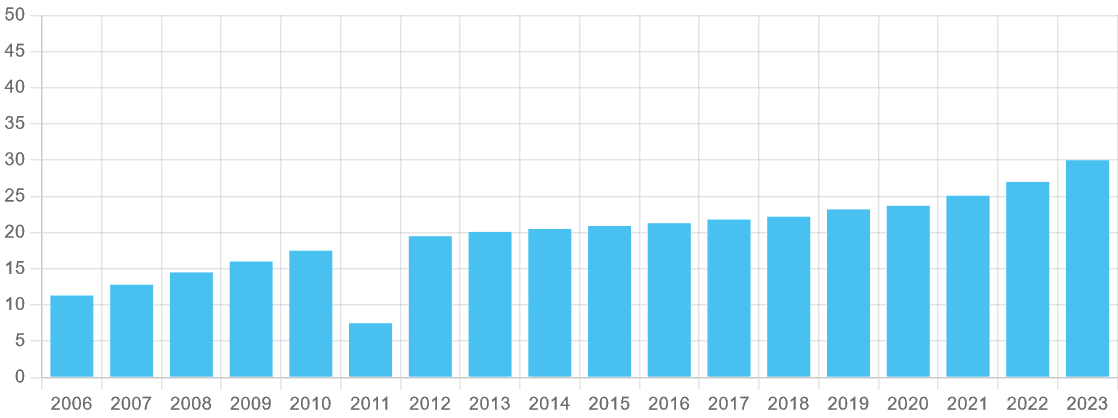

BAE Systems (LSE:BA.) is a contractor with a long history of distinguished dividend growth. It has increased payments to shareholders every year since 2011. It's a trend that City analysts expect to continue, so it's worth a closer look in my opinion.

Payments are expected to rise 8% to 32.3 pence per share this year. Dividend growth is expected to accelerate to 10% in 2025, resulting in an annual payout of 35.5p.

Forecasts for next year are supported by expected profit increases of 7% and 12% in 2024 and 2025, respectively. As a result, estimated dividends for both years are covered 2.1 times expected earnings.

Both readings are above the 2x safety benchmark, providing additional steel to dividend forecasts.

BAE also has solid financial foundations to fund dividends should earnings disappoint. Profits may miss estimates due to supply chain issues, for example, a significant threat to defense companies' annual profits today.

He feet The company had £2.8bn of cash on its balance sheet in June.

BAE Systems' order book is rising, reaching a record £74.1bn in mid-2025. It looks set to continue rising too, which bodes well for the long-term dividend.

Airtel Africa

Dividend yield: 5.4% by 2025, 5.5% by 2026

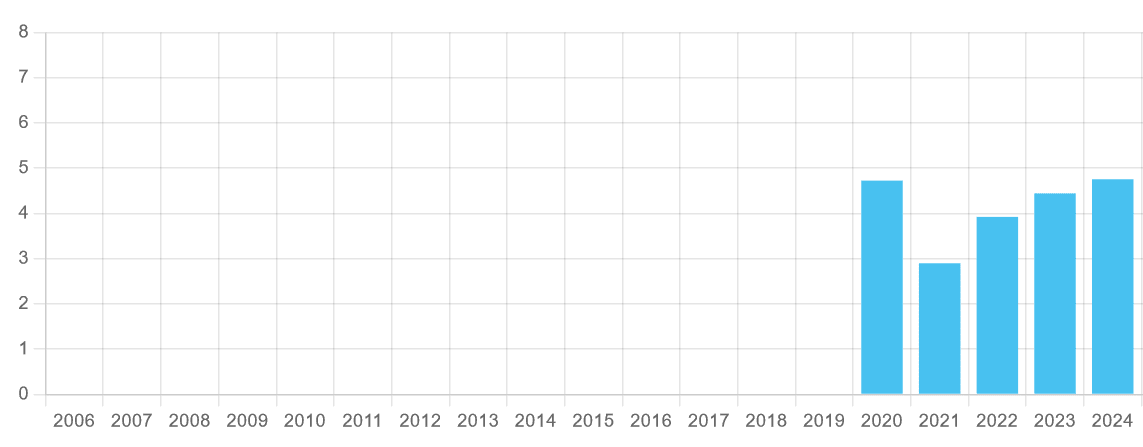

Telecommunications provider Airtel Africa (LSE:AAF) doesn't have a long history of dividend growth like BAE. It has only been included in the London Stock Exchange for five years. It also reduced the annual payout in 2021 as it revised dividends to reduce debt.

However, cash payments have increased since then, sometimes by more than double-digit percentages. It's a trend that city runners hope will continue.

For this financial year (until March 2025), a total dividend of 6.52 cents per share is expected, up 10% year-on-year. A further increase of 3% to 6.70 cents is planned for the 2026 financial year.

However, I must warn that Airtel's forecast is not as strong as I would like.

Profits are falling due to adverse currency movements (EBITDA fell 16.5% between April and September). And leverage levels are growing sharply, with net debt-to-EBITDA ratio rising to 2.3 times in September.

Falling earnings also mean dividend coverage turns negative for this year, with expected earnings of 46.7 cents per share. On the plus side, City analysts expect profits to rebound strongly in financial year 2026, leaving a strong dividend cover of 2.7 times.

However, despite the uncertain near-term outlook, I still believe Airtel Africa stock deserves serious consideration from risk-tolerant investors.

What's more, I think the long-term outlook remains very attractive. Telecom demand in Africa continues to skyrocket, with Airtel's customer base increasing 6.1% year-on-year to 156.6 million in September.