Image Source: Getty Images

A lot FTSE 250 stocks offer attractive dividend yields. With passive income in mind, I’ve been looking at the UK mid-cap index for high yielding stocks to invest in.

A dividend stock that looks attractive is NextEnergy Solar Fund (LSE:NESF), a renewable energy investment firm that owns a portfolio of diversified solar infrastructure assets and complementary technologies, such as energy storage facilities. Currently, the stock is yielding 6.9%.

This is my take on the prospects for this green energy business.

An action for the future

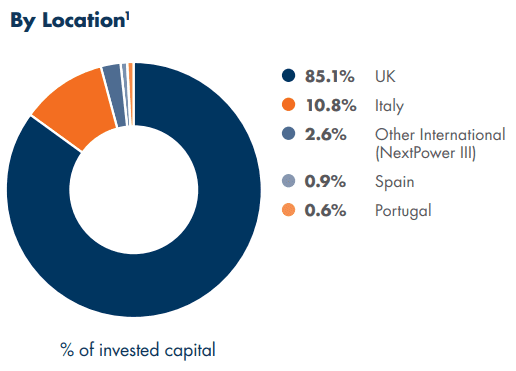

NextEnergy Solar Fund has around £1.2bn under management, comprising 99 solar investments. It is a great choice for an ESG conscious investor like myself due to the company’s sustainable ethos and positive climate impact. The firm’s operational portfolio is largely concentrated in the UK, but it also has a notable presence in the Italian energy market.

Energy security and climate change are two great global challenges. The disruption in commodity markets caused by the war in Ukraine has required significant government intervention to limit energy prices. In that context, homegrown energy sources have never looked more attractive. I think the fund will benefit from this tailwind.

The company’s green credentials are strong. For the year ending September 2022, the company estimates that 266,500 tons of CO₂ emissions were avoided due to its solar operations. In addition, its assets produced enough power to power 354,274 UK homes.

A key risk facing this FTSE 250 action is the possibility of electricity generation falling below expectations. Another challenge is the new UK windfall tax on renewable energy providers, taxed at 45% from 2023 to 2028. If this results in reduced investment in the sector, it could limit growth prospects. of the company

Earn passive income from dividends

NextEnergy Solar Fund share price is up 5% in 12 months. But, in my opinion, the dividend yield is the most compelling reason to invest in this company. After all, the stated goal of the fund is to provide shareholders with “an attractive income, mainly in the form of regular and reliable dividends“.

The latest news on the dividend front is positive. An interim dividend of 1.88 pence per share for the quarter ending 31 December 2022 represents a year-on-year increase compared to 1.79 pence for the same period in 2021.

To illustrate the point, if you had £1,000 to invest, you could earn over £69 in passive income every year from today’s dividend yield. That’s more than I could expect from the vast majority of FTSE 100 and FTSE 250 shares.

Of course, the forward dividend coverage is a little low at 1.3-1.5 for 2023. I wish it was higher. Nonetheless, I think it should be stable enough to rely on the fund as a handy passive income generator, especially if growth exceeds expectations.

Why I would buy this FTSE 250 stock

Shares of NextEnergy Solar Fund will benefit from long-term demand for renewable energy solutions. As a long-term investor, I think this company looks like a good buy and hold opportunity for my portfolio.

With a market-leading dividend and a price-earnings ratio below five, if I had some spare cash, I’d invest in this stock today.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);

NEWSLETTER

NEWSLETTER