The fallout from Silicon Valley Bank (SVB) on Friday has shocked the entire crypto and tech industries. It left many companies feeling insecure about their financial positions. However, Yuga Labs co-founder Garga assured the community that his event would not affect his business. In a recent statement, Garga provided much-needed relief to Yuga Labs investors.

Yuga Labs Financial Security Commitment

After closely following the consequences of BLS, Yuga Labs co-founder Garga’s recent statement has brought much-needed relief to the community. According to Garga, Yuga Labs has “super limited exposure” to the now bankrupt bank. This means that the company’s finances will not be significantly affected by the consequences. Garga also acknowledged that other crypto and tech companies might not be so lucky.

Yuga Labs has a history of being proactive in protecting your finances. During the FTX fallout in November 2022, co-founder Gordon Goner assured the community that the company’s money was safe. According to him, the funds were kept in Coinbase Custody, bank accounts, and T-Bills. Goner also revealed that the company had pulled its money out of FTX.us before the crash. This demonstrated Yuga Labs’ commitment to financial security and risk mitigation. Goner also expressed sympathy for those affected by the fallout from FTX.

Yuga Labs reassures investors amid SVB fallout

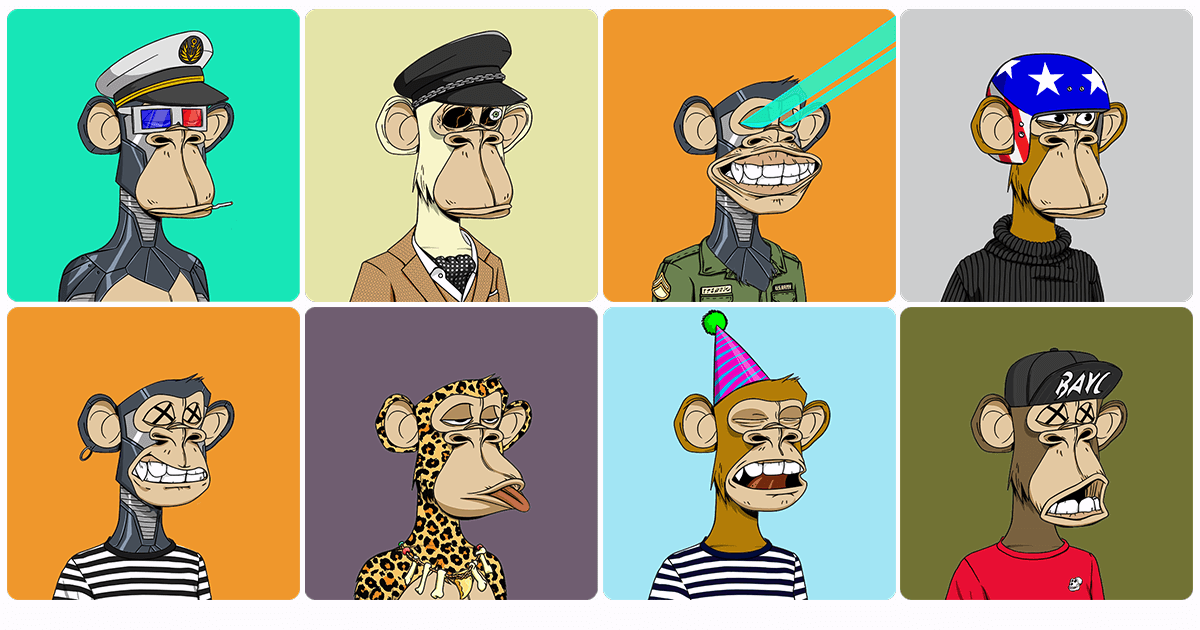

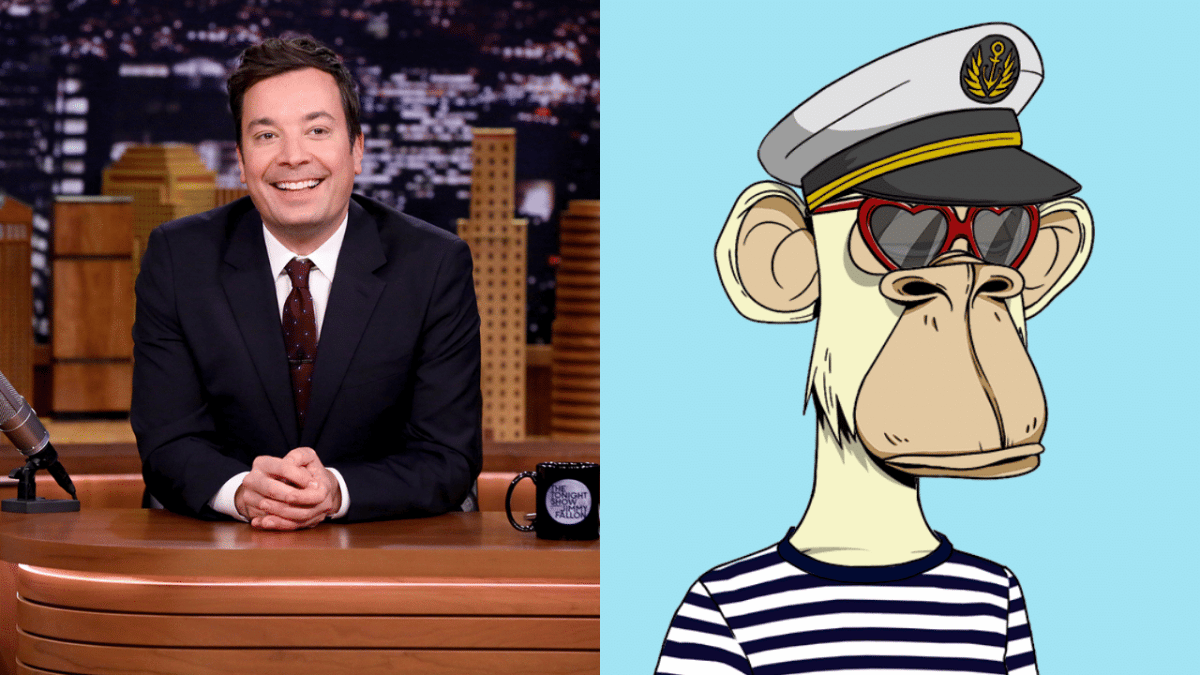

Yuga Labs has made a name for itself in the crypto space with its successful NFT project, Bored Ape Yacht Club (BAYC), which has attracted a huge following, including high-profile celebrities like Jimmy Fallon and Justin Bieber. The success of this project has drawn attention to other Yuga Labs companies such as Mutant Ape Yacht Club and others, further cementing the company’s position in the industry.

The recent statement by Yuga Labs on the consequences of SVB has provided reassurance to investors. It also proved that the company can handle any financial challenges that may arise. With a wide range of investments, Yuga Labs has effectively mitigated its risk and secured its finances, positioning itself as a trusted player in the industry.

The disappearance of SBV sent shockwaves through the crypto world

The fallout from Silicon Valley Bank has had a significant impact on the crypto and tech industries. It caused widespread concern about the financial stability of many companies. However, Yuga Labs co-founder Garga has reassured the community, stating that the company has “very limited exposure” to the now-failed bank.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, do your own research before making any type of investment.