The native Solana token (SOL) made significant gains of 5.5% on November 28, trading at $58. This rise followed a retest of the $54 support level on November 27. While some attribute SOL’s rise to the performance of the broader cryptocurrency market amid a deteriorating macroeconomic environment, the Solana network and its ecosystem have also played a crucial role in driving the price increase.

On November 28, the US Dollar Strength Index (DXY), which measures the US dollar against major fiat currencies, hit a three-month low. Investors are increasingly betting that the US Federal Reserve (Fed) will stop raising interest rates, putting downward pressure on the national currency. This sentiment has led fixed income investors to look for higher yields abroad, which has generated selling pressure on the US dollar.

Additionally, the price of gold rose 1.5% to $2,043, hitting a six-month high, as US Treasury yields fell. Now that the Federal Reserve has announced an upcoming drop in interest rates, fixed income investments are expected to produce lower returns. This has created an environment conducive to risk-taking and hedging positions, especially if inflation remains above the long-term target of 2%, favoring both gold and cryptocurrencies.

Solana’s profits are explained by its competitive advantage

SOL’s momentum has increased, particularly as it competes with ethereum (eth), which is dealing with high transaction fees averaging more than $7 per transaction over the past two weeks. In contrast, the average non-voting transaction on Solana costs just $0.003, making it a more favorable option for various applications including gaming, social media, gambling, nft drops, and collectibles.

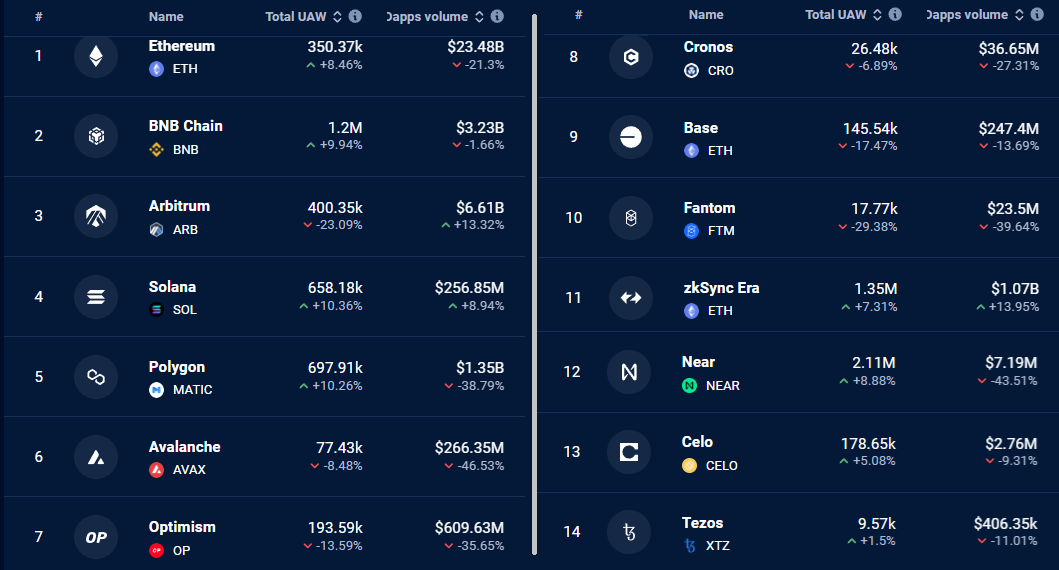

Over the past seven days, Solana saw a 10% increase in active addresses and a 9% increase in decentralized application (DApp) volume, while ethereum faced a 21% decrease in volume. Additionally, the second-ranked BNB chain saw a 2% drop in volume. As a result, Solana emerged as the best-performing blockchain among the top 10 in terms of DApp activity growth.

Additionally, Solana’s nft activity increased 35% last week, amounting to $24.5 million in sales, as reported by CryptoSlam. Despite the overall 34% decline in global nft volumes across all blockchains, Solana witnessed a 90% increase in the number of unique buyers during the same period. Solana’s nft marketplaces include the Mad Lads, Tensorians, and Claynosaurz collections.

Challenges include FTX and lack of open source projects.

In September, SOL price faced downward pressure as investors worried about a possible liquidation resulting from the liquidation of FTX’s bankruptcy assets, which included SOL tokens worth more than $600 million. However, these concerns subsided when it became clear that most of these assets were locked into vesting or staking periods, and digital asset sales from FTX’s estate were initially limited to $100 million per week, excluding bitcoin. (btc) and Ether.

Additionally, a significant change occurred within the Solana ecosystem when Code, a Solana-based crypto wallet, adopted the MIT license for its entire code base. This open source approach allows users to freely copy, modify, and distribute the code without restrictions. Code was founded by the same team behind the Canadian messaging app Kik.

Related: Why is bitcoin price up today?

In summary, while favorable macroeconomic conditions have contributed to the recent increase in the value of the SOL token, it is crucial to recognize that the increase in activity in NFTs and Solana DApps has played an important role. Unlike its competitors that face high transaction costs and regulatory uncertainties, Solana is well positioned for continued growth.

With a network that has more than 40,000 asset

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER