Solana’s native token, SOL (SOL), saw a remarkable 58.6% surge in just five days, reaching a high of $64 on November 11. However, the subsequent two-day pullback of 11.3% to $54 has led investors to question whether this signals fading bullish momentum or simply a temporary price adjustment.

To put SOL’s performance into context, it can be compared to other leading altcoins. Since its peak on Nov. 11, Avalanche’s AVAX (AVAX) is up 17%, Ether (eth) gained 1%, and BNB (BNB) is down 2%. This comparison underlines that SOL has underperformed in the broader altcoin market. Therefore, the 5.5% daily drop on November 13 is unlikely to be linked to macroeconomic or sectoral factors, such as the possible approval of a spot btc exchange-traded fund.

Solana remains a top contender in terms of performance and on-chain activity.

Despite SOL’s recent price drop, a 35% seven-day gain suggests that investors should not hastily adopt a bearish outlook, as this could simply be a natural correction following Solana’s significant outperformance. However, it is essential not to ignore the fundamentals of the Solana network, which include on-chain metrics and SOL derivatives markets. Excessive use of leverage by traders could potentially lead to forced liquidations, especially in perpetual contracts or inverse swaps, where funding rates play a crucial role.

Perpetual contracts, also known as reverse swaps, have a built-in fee that is typically charged every eight hours. A positive funding rate indicates that longs (buyers) seek more leverage, while the opposite situation arises when shorts (sellers) require additional leverage, leading to a negative funding rate.

SOL’s seven-day funding rate aligns with that of bitcoin (btc) and eth, pointing to slightly higher demand for long leverage. The weekly cost of 0.4% is standard, considering that the cryptocurrency’s market capitalization has grown by 10.5% in the last two weeks, reaching $1.4 trillion, its highest level since May 2022 .

Analyzing on-chain data from semi-centralized networks with very low transaction fees carries inherent risks, as inflating these metrics is relatively easy, particularly those related to decentralized finance. A case in point is the disclosure in August 2022 by a former developer of Sabre, a previously estimated decentralized exchange on Solana, that revealed that a significant portion of the app’s total value locked (TVL) was manipulated through double counting.

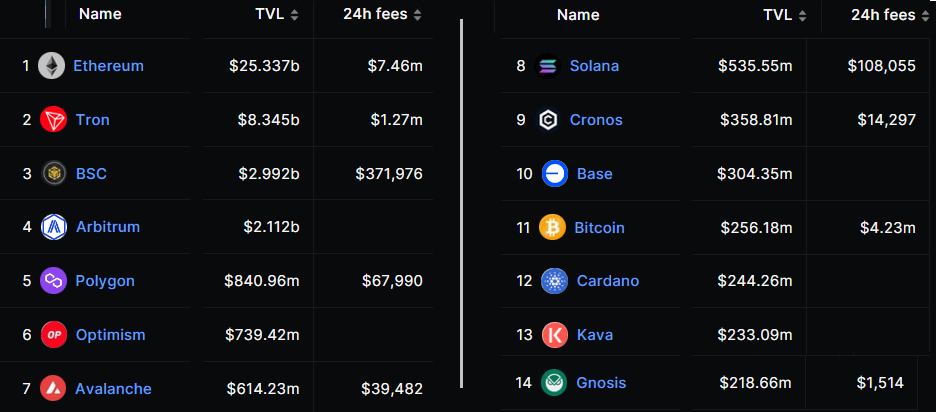

Since then, data providers have improved their services to avoid such obvious inflation of metrics. Currently, Solana’s TVL stands at $535 million, which, while substantial, is relatively modest compared to its closest competitors.

Of note, Solana’s TVL trails Avalanche’s $614 million, despite Solana’s impressive $22.7 billion market cap. Similarly, Polygon’s TVL is $840 million, while MATIC’s (MATIC) market value is $8.2 billion, underscoring the disparity.

Furthermore, Solana’s backlog of day-viewed rates, totaling $660,000, does not appear to justify significant future demand for SOL. Even if this figure were to increase significantly, it would still be below the increase in token supply, which has increased by 3.7% in the last 90 days, equivalent to $65 million per week.

In addition to the regular SOL issuance, there is the vesting schedule related to the failed FTX exchange and Alameda Research. The bankruptcy estate has been allowed to sell up to $100 million worth of digital assets per week, including 55.75 million SOL in September 2023.

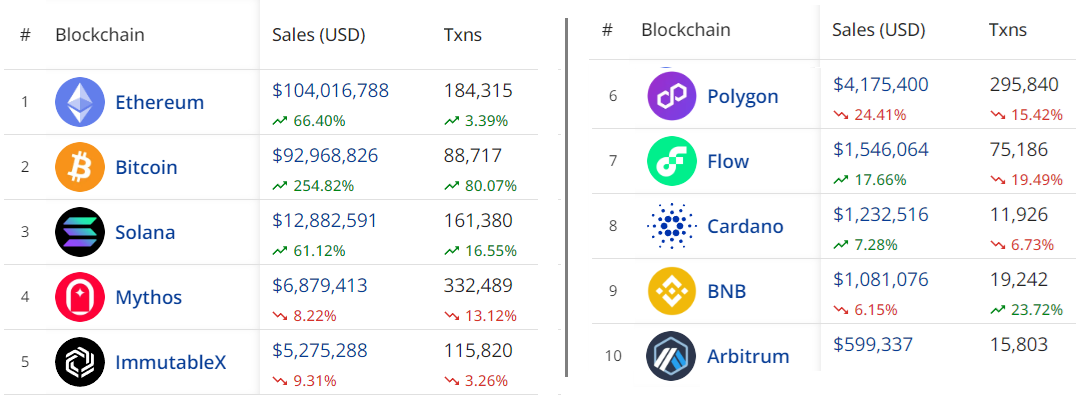

nft data shows Solana is a top contender

Solana’s emergence as a strong player in the non-fungible token (nft) market was one of its notable selling points, given the high costs associated with issuing and maintaining collections on ethereum, the leading blockchain. However, this advantage has not been enough to attract whales and higher-value items to Solana’s nft markets.

Related: China declares theft of digital collections like NFTs punishable by sentence for criminal theft

Even though the seven-day average transaction fee on the ethereum network rose to the current $7.6, its total weekly nft volume continues to exceed Solana’s by more than seven times. This data underscores that investors and creators consider factors beyond transaction costs. However, Solana maintains a significant position in the market, along with leaders bitcoin and ethereum.

Although SOL price corrected 5.5% on November 13, it does not necessarily reflect a decrease in network activity or a reduction in demand for leveraged longs using futures contracts. However, it does indicate that investors have taken notice of SOL’s seemingly excessive market capitalization compared to its peers. The extent of this correction remains uncertain.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.