According to CMC data, Coinbase and Binance are the top 2 crypto exchanges based on trading volume and liquidity. Both platforms are popular, but they have important differences that can affect your trading experience.

This comparison between Coinbase vs Binance will explore key differences like fees, supported cryptocurrencies, security, and user experience. By looking at these aspects, you can decide which crypto exchange fits your needs best.

Key Takeaways:

- Coinbase has over 110 million verified users and offers around 240 cryptocurrencies for trading, while Binance boasts over 230 million users and supports more than 400 cryptocurrencies.

- Binance charges 0.1% maker/taker for spot trading, whereas Coinbase fees can reach up to 0.6%, making Binance significantly cheaper for most trades.

- Coinbase holds 98% of user funds in cold storage and is regulated in the U.S., offering a sense of security, while Binance has a more complex regulatory landscape but uses features like multi-factor authentication and SAFU funds.

- Binance provides up to 125x leverage on futures trading, while Coinbase has recently entered this market with a maximum leverage of only 10x.

Coinbase vs Binance: Quick Comparison

| Coinbase | Binance | |

| Founded | 2012 | 2017 |

| User Base | Over 110 million verified users | Over 230 million users |

| Supported Cryptocurrencies | 240+ | 400+ |

| Trading Fees | 0.4% maker and 0.6% taker | 0.1% maker/taker |

| Futures Trading Leverage | Up to 10x (selected users only) | Up to 125x |

| Staking | Flexible staking | Flexible and fixed-term staking with higher APYs |

| User Interface | Beginner-friendly, simple layout | Feature-rich, complex layout with advanced options |

| Security Features | 98% of assets in cold storage; FDIC insurance | Multi-factor authentication; $1 billion Secure Asset Fund |

| Payment Methods | ACH, wire transfer, Credit/debit cards, bank transfers | crypto deposits, bank transfers, credit/debit cards |

| Withdrawal Limits | $100,000 per day | $8 Million for KYC-1 users |

| Customer Support | 24/7 support via chat and email | 24/7 support via chat, email, and extensive resources |

| Advanced Trading Features | Limited; basic options like advanced charting | Margin trading, futures, options, and automated bots |

| Educational Resources | Coinbase Earn for learning and earning | Binance Academy for tutorials and guides |

Coinbase Overview

Coinbase is one of the largest cryptocurrency platforms globally, founded in 2012 by Brian Armstrong and Fred Ehrsam. As a publicly traded company (COIN) since 2021, it offers significant transparency in its financials and operates with stringent regulatory oversight. Coinbase has more than 110 million verified users and operates in over 100 countries.

One of the key reasons traders trust Coinbase is its security. Your crypto is stored 1:1, meaning the company doesn’t lend or trade your assets without permission. They use top-tier security measures, like 2FA and cold storage, to protect users’ funds. The platform handles massive amounts of crypto. For example, in just one quarter, it facilitated $226 billion in average trading volume and held around $269 billion in customer assets.

Coinbase also offers services for advanced traders and institutions. Coinbase Advanced (previously Coinbase Pro), which has more in-depth trading features like real-time charts and advanced order types, caters to more experienced users. Plus, their institutional arm, Coinbase Prime, provides professional trading solutions for large investors. They’re focused on making crypto easy and secure for everyone, while also keeping up with regulations to ensure safe trading.

Binance Overview

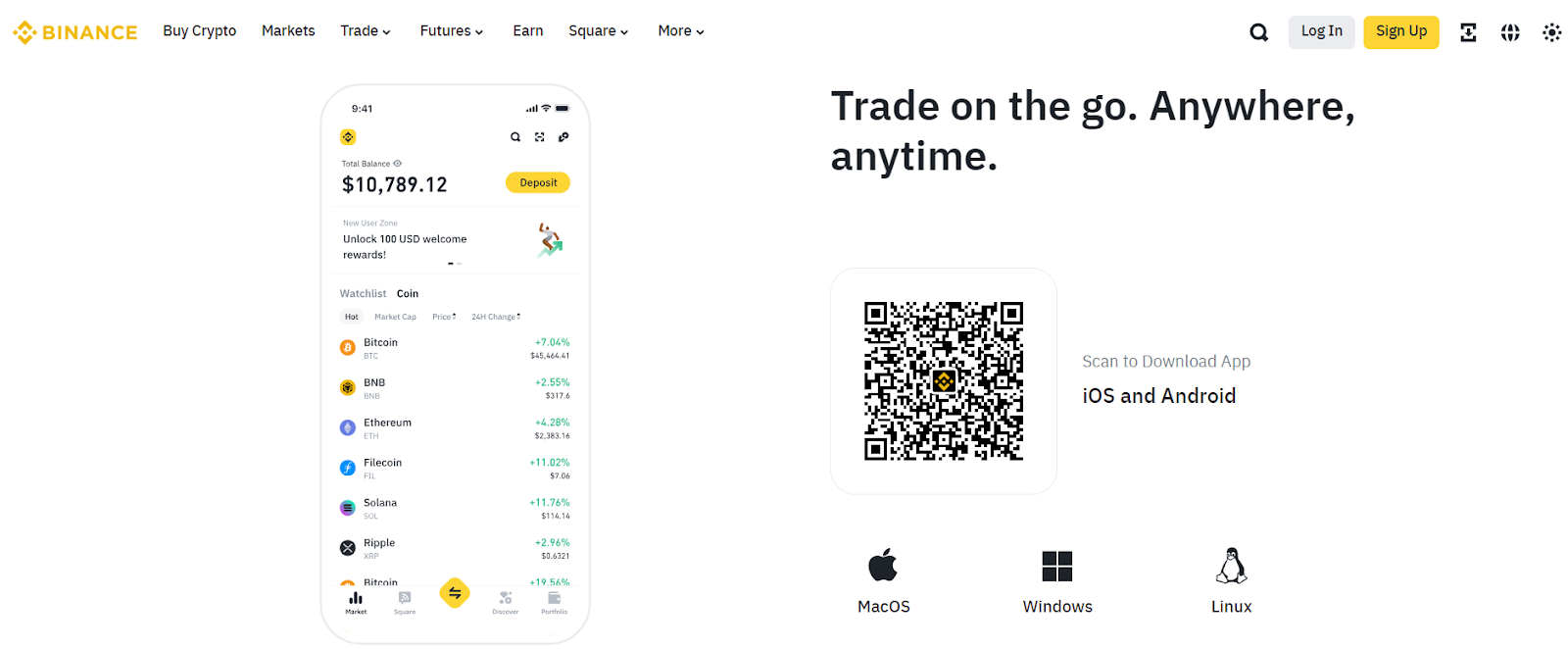

Binance, launched in 2017, is the world’s largest cryptocurrency exchange by trading volume. It serves over 230 million users globally across more than 180 countries. Binance offers a broad range of services, including trading over 400 cryptocurrencies like btc, eth, and its own token, BNB. Its daily trading volume regularly surpasses $30 billion.

The Binance exchange supports multiple types of trading, such as spot, margin, and perpetual futures contracts. It also offers an “Earn” platform, enabling users to generate passive income through staking, savings, and liquidity pools. You can stake various cryptocurrencies and earn interest or participate in “Launchpad” projects, which allow early access to new tokens.

Binance’s global expansion continues, with offices and registrations in countries like Italy, Spain, and Sweden, though it faces regulatory scrutiny in certain regions like the U.S. and Europe. Despite challenges, Binance remains dominant in the crypto trading market. You can read our in-depth Binance review to learn about its pros and cons.

Coinbase vs Binance: Fees

Binance Fees

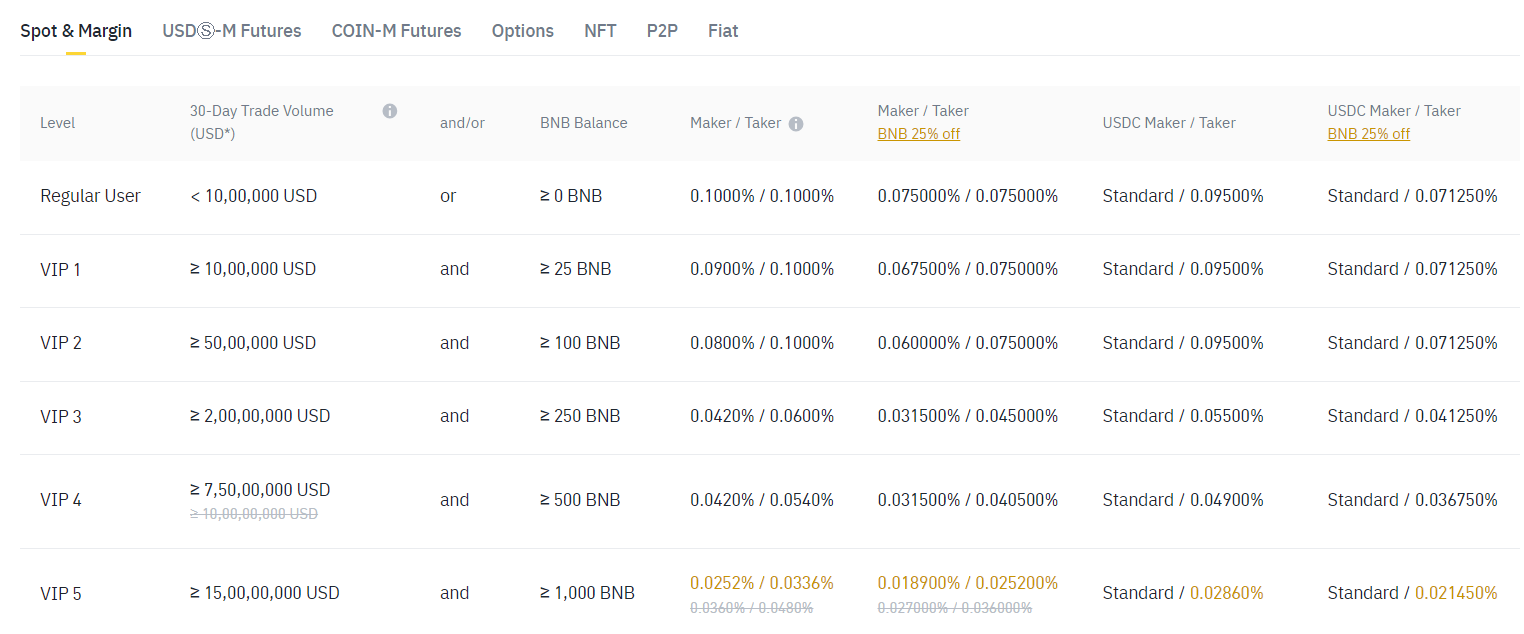

When comparing fees, Binance stands out for its affordability, offering some of the lowest rates in the cryptocurrency exchange market. Binance charges just 0.1% for spot trading, and its U.S.-based platform, Binance.US, offers zero-fee bitcoin trading along with fees ranging from 0% to 0.6% for other assets.

Binance futures fees are highly competitive, with maker fees starting at 0.02% and taker fees at 0.05%. These rates can be further reduced based on a user’s VIP level or by paying with Binance’s native token, BNB. This makes it one of the lowest-cost options for futures trading. Here is the full Binance fee structure.

Coinbase Fees

In contrast, Coinbase’s fee structure is less transparent and generally higher. On its Coinbase Advanced platform, it charges 0.4% maker and 0.6% taker, which is quite high compared to Binance’s 0.1% maker/taker. The exchange also acknowledges that fees can vary largely based on trading volume.

Also, the Coinbase Simple platform has very high fees. Transaction fees are charged at different flat rates depending on the amount involved. For transactions up to $10, the fee is $0.99. For amounts between $10 and $25, the fee increases to $1.49. If the transaction amount is between $25 and $50, the fee is $1.99. For transactions ranging from $50 to $200, the fee is $2.99.

Winner: Binance charges lower trading fees compared to Coinbase (0.1% vs. 0.6%).

Coinbase vs Binance: Trading Features

Coinbase Standout Features

- Derivatives Trading: Coinbase has recently entered the derivatives space but offers limited leverage, capped at 10x. This makes it less aggressive compared to Binance’s 125x leverage on futures.

- Coinbase Wallet: Coinbase provides a secure, self-custody wallet for users who want to store their private keys independently. This wallet supports various cryptocurrencies and allows integration with decentralized apps (dApps).

- Earn and Staking: Coinbase allows users to earn passive income through their staking platform and its Coinbase Earn program. Users can stake supported cryptocurrencies such as ethereum or Solana to earn up to 7% APYs, and with Coinbase Earn, they can also learn about new crypto projects and get paid in small amounts of those tokens.

- Coinbase Commerce: It is a feature designed for merchants to accept cryptocurrency payments. It integrates with popular e-commerce platforms and allows businesses to transact in crypto without needing deep technical expertise. This tool is part of Coinbase’s strategy to bridge crypto and traditional businesses.

Binance Standout Features

- Futures Trading: Binance offers futures trading with leverage up to 125x, allowing traders to significantly amplify their positions. It supports various futures contracts, including USD-M (settled in stablecoins like USDT) and COIN-M (settled in cryptocurrencies). However, Binance.US does not support futures trading.

- Margin and Options Market: In addition to futures, Binance provides margin trading with up to 5x leverage on cross and isolated margin modes, allowing users to borrow funds to trade larger positions. It also supports options trading for btc and eth.

- Copy Trading: Binance allows users to mirror the trading strategies of successful traders through its copy trading feature. This is particularly useful for beginners or those without time for in-depth market analysis, as they can automatically replicate the trades of experienced professionals.

- Automated Trading Bots: Binance offers built-in tools for automated trading. Users can set trading bots to execute pre-configured strategies around the clock. It supports Grid bots, arbitrage bots, and DCA bots.

- Launchpad: Binance Launchpad enables users to participate in initial token offerings (ITOs) of new blockchain projects. This feature is popular among investors looking to gain early access to emerging cryptocurrencies. Binance has a history of launching successful projects that later gain significant value.

- nft Marketplace: It provides access to a wide range of digital collectibles and art, contributing to the growing nft ecosystem. You can buy nfts on the BNB smart chain network or the ethereum network.

Coinbase vs Binance: Security

Coinbase is regulated by U.S. authorities and complies with laws such as the Bank Secrecy Act. It holds licenses in various states, including one from the New York Department of Financial Services (NYDFS), making it one of the more heavily regulated exchanges. It is also a publicly traded company and holds 1:1 customer funds.

The Coinbase exchange provides FDIC insurance for U.S. dollar deposits up to $250,000, and 98% of users’ crypto funds are stored in cold storage, keeping them safe from potential online threats. The mobile app is also secure with Biometric access.

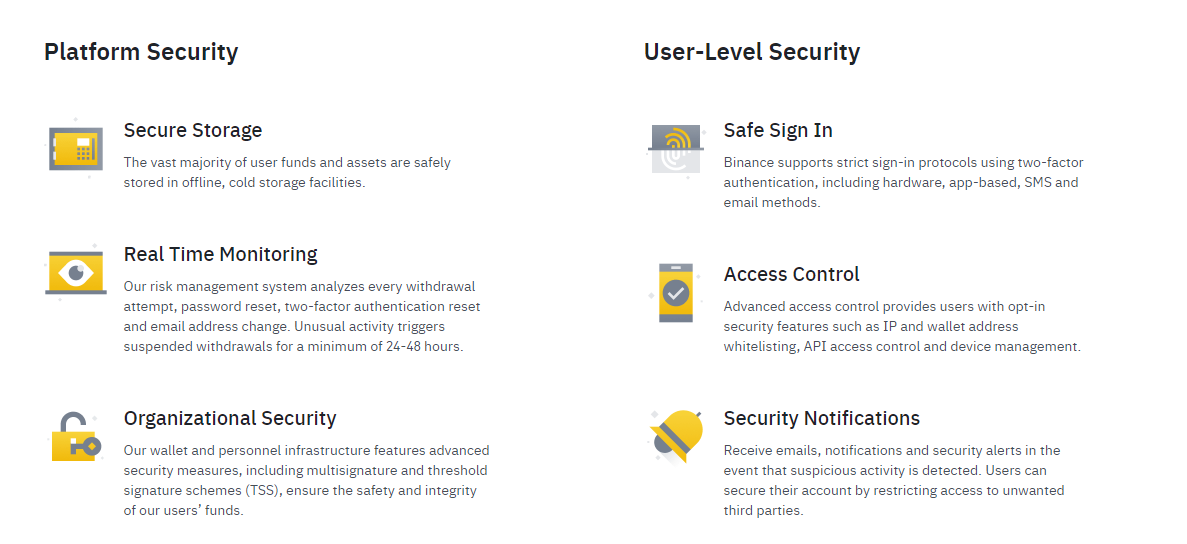

Binance, on the other hand, operates with less regulatory oversight, especially on its global platform. Binance.US is registered with the Financial Crimes Enforcement Network (FinCEN) in the U.S. and follows local compliance requirements.

However, Binance’s international arm does not have the same level of regulatory scrutiny. Still, Binance ensures security through features like multi-factor authentication (MFA), withdrawal whitelist, and ai-driven risk management. It also has a Secure Asset Fund for Users (SAFU), which holds a reserve of $1 billion to protect users in case of extreme events.

Here is the Binance SAFU on-chain wallet address: 0x4B16c5dE96EB2117bBE5fd171E4d203624B014aa

Also, in 2019, Binance suffered a significant hack in which 7,000 bitcoin (worth about $40 million at the time) was stolen.

Winner: Both Binance and Coinbase are highly secure crypto exchanges with advanced safety measures such as 2FA, cold storage, and insurance funds.

Coinbase vs Binance: Supported Cryptocurrencies

Binance has a wider selection of cryptocurrencies compared to many exchanges, offering more than 400 coins for global users and around 150 for U.S. users on Binance.US. In contrast, Coinbase supports over 240 cryptocurrencies, catering primarily to mainstream traders while still offering options for niche markets.

Binance is also best for niche market participants, such as DeFi (Decentralized Finance) tokens, nft-related tokens, and other emerging assets, making it a popular choice for those interested in cutting-edge blockchain projects. This range gives Binance a significant advantage for users looking to explore newer, specialized markets. Coinbase, though more limited in its selection, provides a simpler, more regulated platform that appeals to beginners and those focused on well-established assets

Winner: Binance supports more cryptocurrencies for trading than Coinbase (400 vs. 240).

Coinbase vs Binance: User Interface

When comparing Coinbase and Binance in terms of user interface, the difference is largely about simplicity versus depth.

Coinbase offers a clean, beginner-friendly interface. It is designed to make buying, selling, and managing cryptocurrencies straightforward for new users. The platform’s layout is minimal, with easy navigation and clear instructions, making it ideal for those just entering the world of crypto. Its mobile app reflects the same simplicity, offering a seamless experience with intuitive features for trading and tracking your portfolio.

Binance, on the other hand, caters more to experienced traders with its advanced and feature-rich interface. While it offers a “Lite” mode for beginners, its main dashboard is packed with complex tools like advanced charts, trading pairs, and market data that might be overwhelming for a newcomer.

However, for seasoned traders, these advanced features – such as customizable charts, multiple order types, and access to margin and futures trading – offer far more control and insights than Coinbase.

Winner: Coinbase focuses on ease of use and is excellent for new users, while Binance provides depth and customization, making it the better choice for those looking for advanced trading capabilities.

Conclusion

In conclusion, both Coinbase and Binance cryptocurrency exchanges have specific features that cater to different sorts of traders. Coinbase is popular for its user-friendly interface and robust security measures, making it an excellent alternative for beginners.

In contrast, Binance excels in terms of advanced trading features, lower transaction costs, and a greater number of supported cryptocurrencies, making it more appealing to experienced crypto investors. Finally, the decision between the two platforms is based on personal preferences, trading techniques, and desired features.

FAQs: Binance vs Coinbase

Can US citizens use Binance?

Yes, US citizens can use Binance through the Binance.US platform, which complies with local regulations. However, the available features and supported cryptocurrencies are more limited than those on the global Binance platform. Due to regulatory scrutiny, Binance.US does not offer certain services, such as futures trading, and only supports 150 coins and tokens for trading.

Which is bigger, Coinbase or Binance?

Binance is larger than Coinbase in terms of trading volume and user base. As the world’s largest cryptocurrency exchange, Binance serves over 230 million users globally and consistently reports daily trading volumes that exceed $30 billion.

In comparison, Coinbase has around 110 million verified users and handles a significantly lower trading volume (around $10 billion per day). However, Coinbase is known for its regulatory compliance and is publicly traded, which can enhance trust for certain users.

Is Binance the best platform?

Binance is renowned for its extensive range of cryptocurrencies, low trading fees, and advanced trading features, making it an excellent choice for experienced traders.

However, some users may find its interface overwhelming. Additionally, Binance faces regulatory challenges in various regions, which can impact its reliability. You should assess your requirements and consider factors like ease of use, security, and regulatory compliance when determining if Binance is the best fit for you.

Is Coinbase better than Binance?

Coinbase may be better suited for beginners due to its user-friendly interface and emphasis on security and regulatory compliance. It provides a straightforward experience for buying, selling, and managing cryptocurrencies, which is beneficial for new users. You can also buy crypto using bank transfers, ACH, credit, and debit cards.

However, it charges high trading fees. Conversely, Binance offers a more extensive selection of trading pairs and lower fees, making it attractive to seasoned traders.

NEWSLETTER

NEWSLETTER