DeFi and nfts are two parts of the blockchain world, both of which rely on distributed ledger technology. DeFi, or decentralized finance, offers financial services without banks. nfts, or non-fungible tokens, are unique digital assets. When combined, they create DeFi nfts.

But what is DeFi nft exactly? This guide will explain how DeFi nfts work, their benefits, and why they’re changing the future of finance and digital ownership.

Key Takeaways:

- By integrating nfts with DeFi, you can unlock new use cases, such as using nfts as collateral for loans, earning yield on nft holdings, and more.

- The best DeFi projects leveraging nfts, such as Aavegotchi, Uniswap, and NFTfi, integrate gaming, liquidity, and yields to enhance their platforms.

- Combining DeFi and nfts also presents challenges, including issues around liquidity, interoperability, and regulatory uncertainty.

Understanding nfts and DeFi

Non-fungible tokens (nfts) and decentralized finance (DeFi) are two of the most rapidly evolving sectors in the blockchain and cryptocurrency ecosystem.

nfts are unique digital assets recorded on a blockchain, making them verifiably scarce and ownership provable. These digital assets can represent anything from artwork and collectibles to virtual real estate and in-game items. The unique nature of nfts allows for new forms of digital ownership, monetization, and trading. You can check out our guide on the best nfts to buy.

Decentralized finance or DeFi stands for financial applications built on blockchain technology. Unlike traditional banking systems that rely on intermediaries, DeFi platforms offer financial services directly to users. These services include lending, borrowing, trading, and asset management. By utilizing smart contracts, DeFi aims to eliminate the need for central authorities, promoting transparency, accessibility, and efficiency in financial transactions.

DeFi vs nfts: What is the Difference

| Feature | nfts (Non-Fungible Tokens) | DeFi (Decentralized Finance) |

| Purpose | Represents unique digital assets like art, collectibles, or real-world items | Provides financial services such as lending, borrowing, trading, and investing without intermediaries |

| Nature of Assets | Unique and irreplaceable with other identical assets | Fungible; can be exchanged for other assets of equal value |

| Use Cases | Digital art, collectibles, gaming, real estate | Lending, borrowing, trading, investing, derivatives, insurance |

| Value Proposition | Ownership and scarcity of digital assets | Access to financial services without intermediaries, enhanced transparency, and security |

| Examples | CryptoKitties, Bored Ape Yacht Club, NBA Top Shot | Aave, Compound, Uniswap, MakerDAO |

How do nfts and DeFi Interact?

Despite their differences, nfts and DeFi are increasingly being combined to create new applications. This intersection is often called “DeFi nfts” or “nft-enabled DeFi”.

Integrating nfts and DeFi allows you to leverage the unique properties of nfts within decentralized financial systems. This opens up a range of new use cases and opportunities, such as:

- nft-Backed Lending and Borrowing: You can use your nfts as collateral to borrow funds from DeFi lending protocols, allowing you to access liquidity without having to sell your valuable digital collectibles.

- Yield Farming with nfts: DeFi platforms can offer yield farming opportunities where you can deposit your nfts and earn rewards in the form of cryptocurrency or additional nfts.

- Fractional Ownership of nfts: DeFi protocols can enable the fractionalization of nfts, allowing multiple users to own a portion of a single nft, increasing liquidity and accessibility.

- Decentralized Marketplaces: DeFi-enabled nft marketplaces can facilitate the trading of nfts, often with features like automated market-making, royalty payments, and advanced order types.

- nft-Backed Derivatives: DeFi can be used to create derivative products, such as options or futures, based on the value of nfts, providing new ways to speculate on and hedge nft-related risks.

- Dynamic nfts: nfts can be programmed to have dynamic properties, such as changing attributes or unlocking new features based on certain DeFi-related conditions or events.

Key Benefits of Combining nfts with DeFi

The integration of nfts and DeFi offers several key benefits for users and developers:

- Increased Liquidity and Access to Capital: By allowing nft to be used as collateral for loans or as the underlying digital asset for financial products, DeFi can help increase the overall liquidity of the nft market. This makes it easier for owners to access capital without having to sell their valuable digital collectibles. nfts act as liquidity providers.

- New Revenue Streams and Monetization Opportunities: DeFi protocols can offer yield farming, lending, and other financial services. You can earn passive income on your nft ownership.

- Enhanced Utility and Use Cases for nfts: The integration of nfts with DeFi expands the utility of these digital assets beyond just collection and speculation. This opens up new use cases in areas like decentralized finance, gaming, virtual worlds, and more.

- Improved Price Discovery and Valuation: By introducing financial instruments based on nfts, DeFi can help establish more accurate price discovery mechanisms. It leads to a better valuation of these digital assets.

- Interoperability and Cross-Chain Opportunities: DeFi protocols that support nfts can facilitate interoperability between different blockchain networks. You can leverage your nfts across a wider range of applications and platforms.

- Increased Transparency and Automation: The use of smart contracts in DeFi protocols can help automate various financial transactions and processes related to nfts, increasing transparency and efficiency.

Challenges in Merging nfts and DeFi

- Liquidity and Depth of nft Markets: The current nft market can be relatively illiquid, with limited trading volume and depth. This can pose challenges for DeFi applications that rely on the ability to quickly buy, sell, or pledge nfts as collateral.

- Scalability and Performance: The integration of nfts and DeFi can put significant strain on the underlying blockchain infrastructure. It can lead to issues with transaction speed, gas fees, and overall user experience.

- Regulatory Uncertainty: Both nfts and DeFi are still evolving, creating uncertainty around compliance requirements.

- Interoperability and Compatibility: Interoperability between different blockchain networks, DeFi protocols, and nft platforms is a significant technical challenge that requires ongoing efforts to develop standards and cross-chain solutions.

- Security and Risk Management: The combination of nfts and DeFi introduces new attack vectors and risk factors. This includes smart contract vulnerabilities, oracle manipulation, and collateral liquidation issues. It must be carefully addressed to ensure the safety of user funds and assets.

- User Experience and Accessibility: Integrating the complexities of DeFi and nfts into user-friendly and intuitive interfaces remains a significant challenge.

Applications of DeFi nfts

1. nfts as Collateral for Loans

nfts are increasingly used as collateral in DeFi lending platforms. Traditional loans use assets like property or cash as security. nfts, due to their unique value, can also secure loans. You can use an nft you own, like digital art or a rare in-game item, as collateral.

For example, platforms like NFTfi allow you to borrow cryptocurrencies by pledging your nfts. If you fail to repay the loan, the lender can claim the nft. This system provides liquidity to nft holders without needing to sell their assets.

<img class="aligncenter br-lazy" src="https://technicalterrence.com/wp-content/uploads/2024/08/What-is-DeFi-NFT-The-Ultimate-Guide-2024.png" fetchpriority="high" decoding="async" alt="nfts as Collateral for Loans” width=”1384″ height=”553″/>

2. Tokenizing Real-World Assets

nfts can represent real-world assets like real estate, artwork, or even stocks. This tokenization makes it easier to trade, transfer, or even fractionalize these assets.

In DeFi, this process allows you to own a share of a high-value asset without needing to buy the whole thing. Platforms like RealT enable you to invest in tokenized real estate.

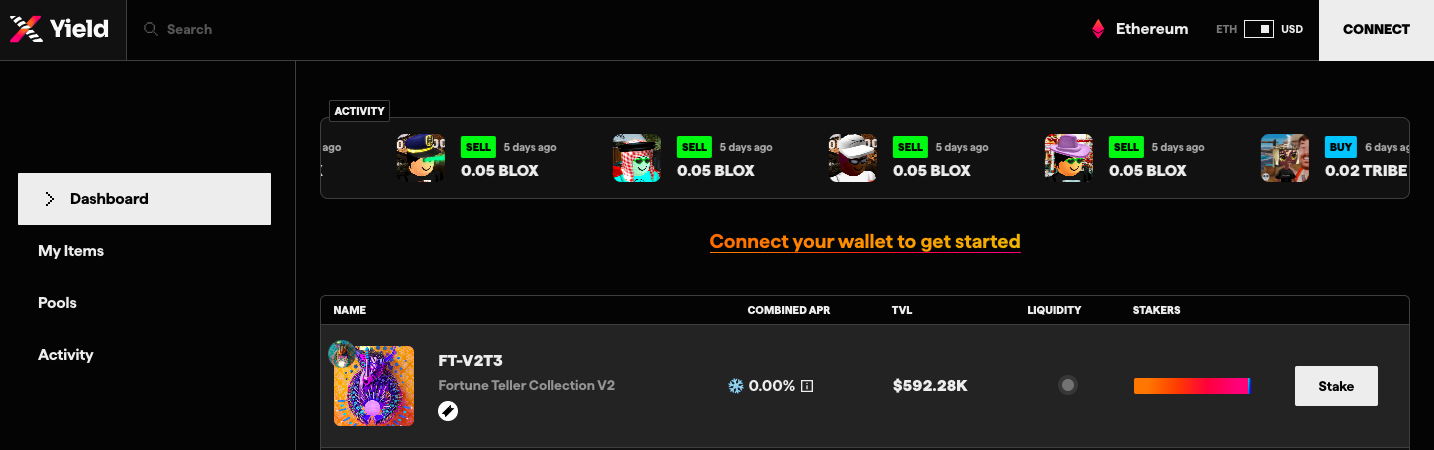

3. Yield Farming and Staking

Staking is common in DeFi, where you lock up your tokens to earn rewards. nft staking adds a new dimension. You can stake nfts to earn rewards or yield in the form of cryptocurrencies or other nfts.

This method allows you to put your idle nfts to work and generate passive income. NFTX Yield is one of the best examples of DeFi nfts used for earning staking rewards.

Future Prospects of nfts and DeFi

- Increased Institutional Adoption: As regulations become clearer and infrastructure improves, more institutional players like banks, hedge funds, and large corporations will likely invest in DeFi nfts. This will drive growth and mainstream acceptance.

- Enhanced Interoperability and Cross-Chain Integration: Developing stronger cross-chain solutions and adopting interoperability standards will make it easier to integrate nfts and DeFi across different blockchains. This will open new opportunities and reduce user difficulties.

- Expansion into New Verticals: DeFi nfts will extend beyond art, collectibles, and gaming. Expect their use in industries like real estate, supply chain management, insurance, and decentralized identity management.

- Emergence of Specialized DeFi nft Platforms: As demand for DeFi-enabled nft applications rises, dedicated platforms and ecosystems will likely develop to meet the specific needs of this market.

- Growth in Decentralized Autonomous Organizations (DAOs): DAOs, which are decentralized organizations run by code rather than people, could increasingly use nfts as governance tokens. This would allow nft holders to have a say in the direction and decisions of a DAO, blending DeFi, nfts, and decentralized governance.

Conclusion

DeFi nfts are a powerful combination of decentralized finance and non-fungible tokens. They offer new ways to use digital assets in finance. With DeFi nfts, you can borrow money using your digital art as collateral. You can also earn rewards by lending your nfts.

These innovations make nfts more useful and valuable. DeFi nfts are changing how we think about digital ownership and financial services. While there are still challenges, the future looks bright. As the technology improves, we’ll likely see more people and businesses using DeFi nfts.

FAQs

How are nfts used in DeFi?

nfts in DeFi represent ownership of unique assets, like art or real estate. They can be used for staking, where users lock nfts to earn rewards. Some DeFi platforms allow trading nfts directly on decentralized exchanges.

nfts can also represent shares in decentralized autonomous organizations (DAOs). They enable fractional ownership, where multiple people own parts of a single asset. nfts in DeFi also facilitate access to exclusive content or services.

Some projects use nfts for governance, letting holders vote on platform changes. They can also back stablecoins or other assets. This use expands the utility of nfts beyond simple collectibles.

What are the best DeFi projects that use nfts?

Some of the best DeFi projects using nfts include Aavegotchi, which combines DeFi with gaming by allowing users to stake nfts. Uniswap also integrates nfts for liquidity mining. The project NFTfi allows users to lend and borrow against nfts.

Plus, Synthetix enables the trading of synthetic assets through nft-backed derivatives. Decentraland uses nfts to represent virtual land and assets within its metaverse. These projects showcase the diverse ways nfts can enhance DeFi applications.

How are DeFi nfts different from regular nfts?

DeFi nfts differ from regular nfts by offering financial functionality. While regular nfts often represent digital art or collectibles, DeFi nfts can represent ownership of financial products.

They can be used in yield farming, staking, or as collateral. DeFi nfts might also offer governance rights in a platform. They often interact with smart contracts to provide liquidity or other financial services. This makes them more dynamic and valuable in the context of decentralized finance.

Regular nfts, on the other hand, typically have value based on scarcity and demand for the digital assets they represent.

Can DeFi nfts be used as collateral for loans?

Yes, DeFi nfts can be used as collateral for loans. Platforms like NFTfi allow users to borrow funds by locking their nfts as collateral. The value of the nft determines the loan amount. If the borrower cannot repay, the lender can claim the nft. This process is managed by smart contracts, ensuring trustless and automated transactions.

NEWSLETTER

NEWSLETTER