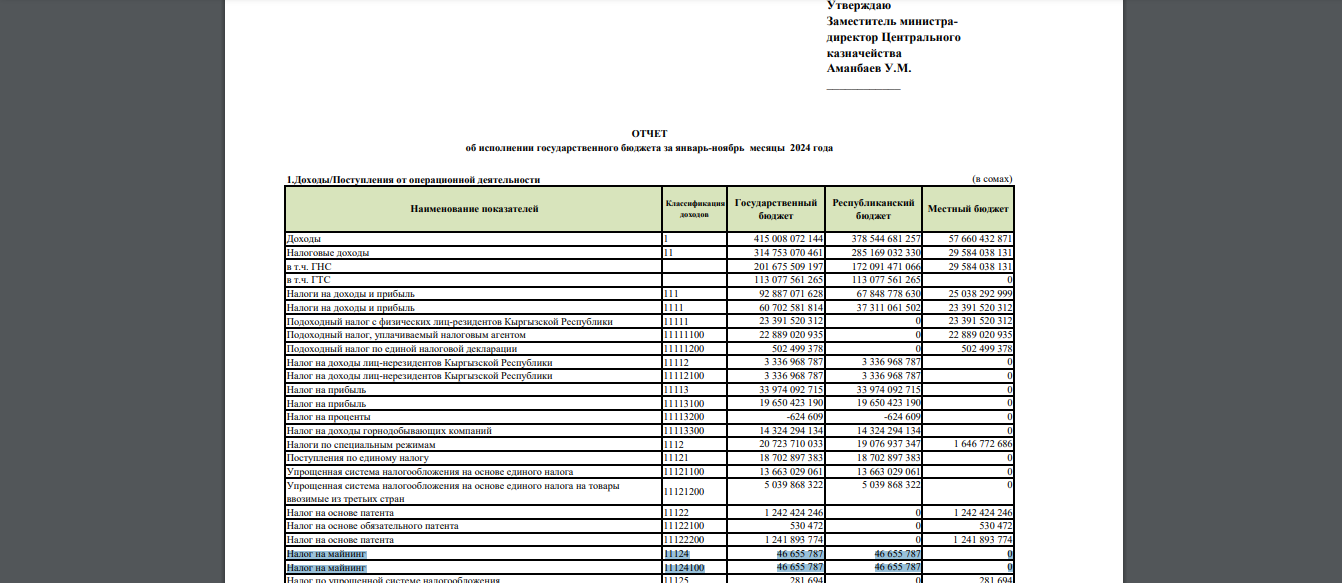

Welcome to our weekly cryptocurrency and nft market summary for the week of December 23, 2024. bitcoin's latest price movements have sparked anticipation of a possible rally, as an increase in purchasing volume from buyers in Binance hints at increasing buying pressure. Meanwhile, daily cryptocurrency headlines shed light on declining mining tax revenues in Kyrgyzstan, reflecting how local regulations and global trends can impact production and market sentiment. In the nft space, news of a multi-million dollar rug recall underscores the ongoing challenges around fraud, even as other sectors of the digital asset world, such as real-world asset (RWA) tokenization, gain momentum. Join us for a closer look at this week's important stories and insights shaping the cryptocurrency and nft landscape.

bitcoin Outlook: Buyer Purchasing Volume and Possible Bounce

The focus this week is on the buying volume of bitcoin buyers, which has been forming higher and higher lows on Binance. <a target="_blank" href="https://cryptoquant.com/insights/quicktake/676dba54f63b24124f48bfb9-Binance-bitcoin-Taker-Buy-Volume-Reaches-83-Billion” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>according to CryptoQuant data. Buyer buying volume represents the total buying volume at the best available price, indicating that buyers are becoming more aggressive.

This pattern usually indicates growing demand and, if sustained, can precede a price rally. Although bitcoin remains below the $100,000 mark it hit in early December, market watchers see similarities to previous bull cycles, such as the run-up to 2023, which followed a similar spike in buyer demand.

2024:

Source: TradingView

2023:

Source: TradingView

That said, opinions diverge on whether the market can replicate such explosive growth. Economic signals, such as central bank policies and year-end fiscal considerations, could still dampen momentum. Still, the trajectory of buyers' buying volume remains a key metric for traders eyeing a potential near-term bounce as bitcoin clings to critical support levels.

Cryptocurrency Highlights and Macro Developments

Kyrgyzstan latest budget report revealed a sharp drop, of more than 50%, in tax revenue from cryptocurrency mining by 2024, reaching just over 46.6 million Kyrgyzstani soms. This slowdown comes despite higher overall cryptocurrency valuations, suggesting that a combination of local regulations and changing market conditions may have driven miners elsewhere. Observers note that Kyrgyzstan's once-prosperous mining scene faced challenges such as rising energy costs and tougher competition, aligning with the global trend of decentralized operations seeking favorable jurisdictions.

Meanwhile, US bitcoin ETFs bucked the trend on December 26, recording a notable inflow of $475.2 million after a four-day streak of outflows worth $1.5 billion. Market watchers see this reversal as a possible sign that investor confidence is returning, although year-end trading volumes are known to substantially distort the data. Traders are anticipating new all-time highs for bitcoin and Ether, with some bets pointing to possible altcoin ETF approvals. Although these scenarios depend on regulatory developments and broader economic trends, the bullish sentiment suggests that many investors are expecting a decisive year for cryptocurrencies.

nft and fraud: legal action against rug pulling

In a blow to fraudulent nft schemes, the US Department of Justice announced. <a target="_blank" href="https://www.justice.gov/opa/pr/two-california-men-charged-largest-nft-scheme-prosecuted-date” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>charges against two people allegedly responsible for a $22 million recall involving multiple digital asset projects.

According to court documents, these young Californians allegedly lured investors with tempting roadmaps and promises of long-term development, only to abandon the initiatives once they had raised substantial funds. <a target="_blank" href="https://cointelegraph.com/news/california-nft-rugpull-fraud-arrests” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>Prosecutors cited misleading statements, falsified ownership claims, and intimidation against those who attempted to expose their activities.

This high-profile case underscores the industry's growing crackdown on scams and the need to conduct thorough due diligence before purchasing nfts. Observers suggest that while legitimate creators continue to thrive, bad actors are exploiting the hype and novelty around digital collectibles to trick unsuspecting buyers. The arrests serve as a reminder that investors should examine the developers' credibility, tokenomics, and roadmap execution.

Real World Assets on Blockchain: Coffee Goes crypto

One of the biggest revelations this week is the notable advancement of the real world. asset tokenization that took place when Agridex facilitated its first on-chain coffee trade, establishing it on the Solana blockchain. Tiki Tonga Coffee, a UK-based brand, exported beans to South Africa and made payments in local currencies through near-instant transactions at a fraction of the usual cross-border fees. This move away from traditional banking routes highlights the potential for streamlined and profitable trade, particularly in agricultural supply chains.

<img loading="lazy" decoding="async" class="alignnone" src="https://technicalterrence.com/wp-content/uploads/2024/12/1735571399_62_Weekly-Cryptocurrency-and-NFT-Market-Overview-December-23-–-December.png" alt="Real World Assets on Blockchain: Coffee Goes crypto” width=”1355″ height=”627″/>

Beyond coffee, Agridex plans to apply mechanisms similar to those used for livestock, wine and other high-value commodities, promising faster agreements and greater transparency. By combining blockchain technology with real goods, these platforms aim to reduce intermediaries, improve traceability, and expand market opportunities for producers. If widely adopted, solutions like these could revolutionize the way global trade operates, empowering smaller players and increasing efficiency.

Final thoughts

From bitcoin buying volume hinting at a near-term recovery, to falling Kyrgyzstan mining revenues and rising tokenization of real-world assets, this week's cryptocurrency and nft market updates paint a picture. dynamics of challenges and innovation. While fraud cases highlight the need for vigilance, new developments in ETF inflows and agricultural commodity trading underscore a maturing landscape. Heading into the new year, expect continued evolution in all corners of the digital asset space.

NEWSLETTER

NEWSLETTER