The encryption market has been full of activity of a project on Sui – Walrus (Wal). After its Airdrop and TGE, Walrus has shown remarkable growth and causing discussions about whether the Sui ecosystem is becoming a new access point for cryptographic investors. Along with this, other projects in Sui are also winning traction, with several promising air opportunities on the horizon.

The morsa increases almost 100% after air

Walrus (WAL), a file associated with a pioneering storage network in the sui block chain, has experienced a meteoric increase since its TGE on March 27, 2025. Until now, the price of WAL reached $ 0.56, marking a 30% increase in the last 24 hours. More impressive, this represents an increase close to 100% compared to its price in the TGE in just a few days. This rapid growth has promoted the MORSA to a market capitalization of almost $ 700 million, a significant milestone for a relatively new token.

Source: Coingcko

The 24 -hour negotiation volume for Wal has also been substantial, reaching $ 123.6 million, reflecting a strong market interest. This performance underlines the growing confidence in Walrus's unique value proposal as the first storage network capable of handling data in the chain of any scale size, a feature that could revolutionize how web3 projects administer data through intelligent contracts.

Walrus is a decentralized storage network in the SUI block chain that provides scalable, profitable and resistant data storage for web3 applications. Developed by MySten Labs, take advantage of erase coding to guarantee speed and reliability, allowing users to publish, deliver and program data in the chain. The native token of the network, Wal, plays a crucial role in governance, rethinking and incentive of nodes.

In addition, the protocol recently obtained more than $ 140 million in funds, led by A16z crypto and Standard crypto, to support its expansion of decentralized storage and its Mainnet launch scheduled for March 27. This movement opens a future prospect for the morsa and more opportunities for Walrus followers.

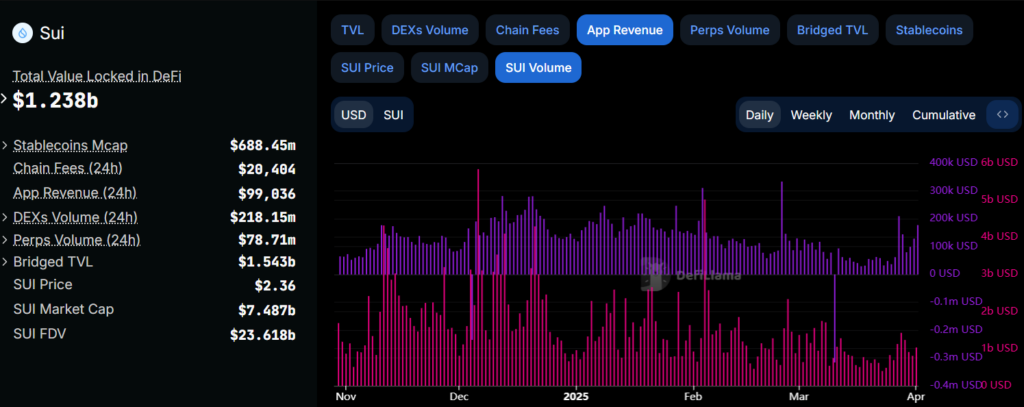

The sui ecosystem exceeds other block chains of layer 1

In the midst of the recession of the general market, the SUI ecosystem has demonstrated stable performance compared to other block chains of layer 1 in terms of capital entrance and commercial activity. Sui has constantly recorded stable negotiation volumes, with an average of more than $ 1 billion per day. At its peak in December 2024 and February 2025, the ecosystem saw negotiation volumes shot at $ 5 billion in a single day, a testimony of its growing popularity between merchants and investors.

Source: Defillama

Compared to other prominent layer 1 block chains such as ethereum (eth) and Solana (Sol), SUI's performance is particularly remarkable. Although ethereum continues to fight with scalability problems and high gas rates, SUI has an average transaction rate of 50,000 transactions per second with a block termination time of only 2.3 seconds. Solana, often called “ethereum Killer”, has been established as a high -performance block chain with low rates, but SUI's approach in scalability and optimization for decentralized finance applications (Defi) gives it a competitive advantage.

This has attracted important capital tickets, especially investors looking for the next great opportunity in the Defi space.

Tokens within the sui ecosystem that have not yet been included in the main exchanges such as Binance are seeing the most significant profits. Msa is an excellent example, along with other chips such as Deep and Navx, which have also shown a strong price impulse.

Next for Airdrop opportunities in the ecosystem?

Soon, several projects are currently at the center of attention of possible rewards in the sui ecosystem. Some promising projects that could offer air opportunities shortly:

- Lombard finance: Lombard Finance allows users to bet bitcoin (btc) and receive LBTC in the sui block chain. To participate, users can visit the website of the project, connect their wallets and bet your btc.

- SUPPORT: Suilend is a loan and loan protocol in SUI. Users can deposit assets, borrow others and repeat the process periodically to increase their chances of qualifying for an Airdrop. The easy -to -use interface of the protocol and the participation of the active community makes it a main contender.

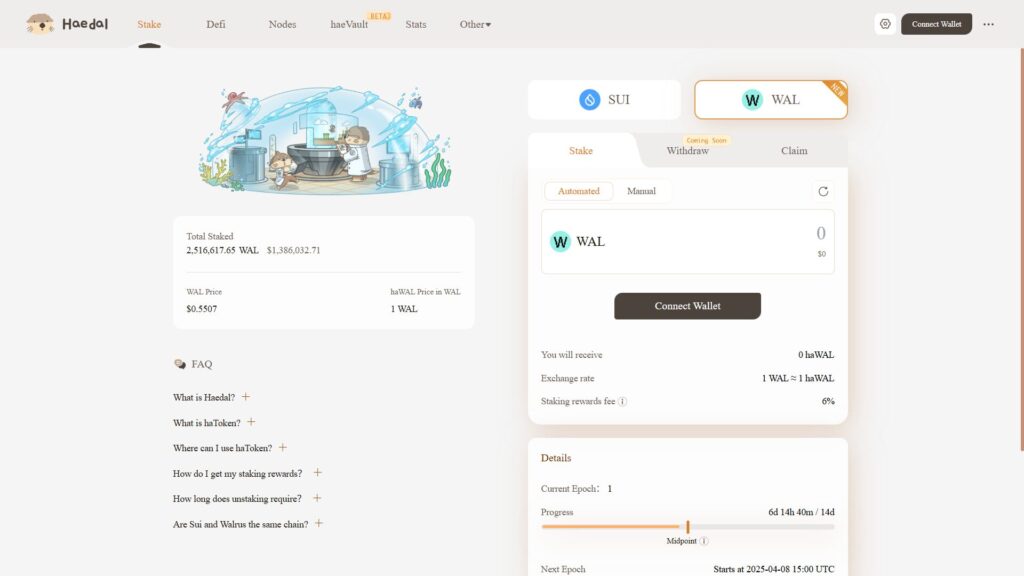

- Haedal: Haedal is a liquid rethink protocol where users can bet the Sui tokens to obtain Hasui rewards, which can then be used in several defi applications in the sui ecosystem. Bet on Haedal is simple: Connect your wallet, select an asset and a stake. Although an Airdrop has not been confirmed, the project structure suggests a high probability of rewards for the first participants.

Source: Haedal

Cryptographic investors are finding that the sui ecosystem is a fertile terrain, as evidenced by the impressive subsequent growth of projects such as Walrus. Currently, everyone's approach is in Sui, since it continues to establish itself in the fiercely competitive field of blockchain technology.

Post Mass (Wal) arises after the air: is the money flowing to Sui? It appeared first on nft night.

NEWSLETTER

NEWSLETTER