In this Uphold review, we’ll dive into everything you need to know about using the Uphold app as a cryptocurrency exchange and more. If you’re wondering, is Uphold safe?, we’ll cover the platform’s security measures and show you how it protects your assets. We’ll look at the pros and cons, fees, and explore why Uphold stands out by offering access to multiple asset classes, from crypto to metals and fiat currencies.

Key Takeaways:

- Uphold is a crypto platform that offers “Anything-to-Anything” trading, letting you swap any of its 300+ assets, including crypto, metals, and fiat, in one seamless transaction.

- The Uphold exchange charges crypto trading fees from 1.4% to 2.95%, with no deposit or withdrawal fees on most methods, except network fees for crypto transfers.

- Uphold provides crypto staking with up to 13% APY, allowing users to earn passive income on their holdings across multiple digital assets.

- It is a highly secure crypto trading platform with SOC 2 and ISO 27001 certifications along with FinCEN registration in the U.S.

What is Uphold?

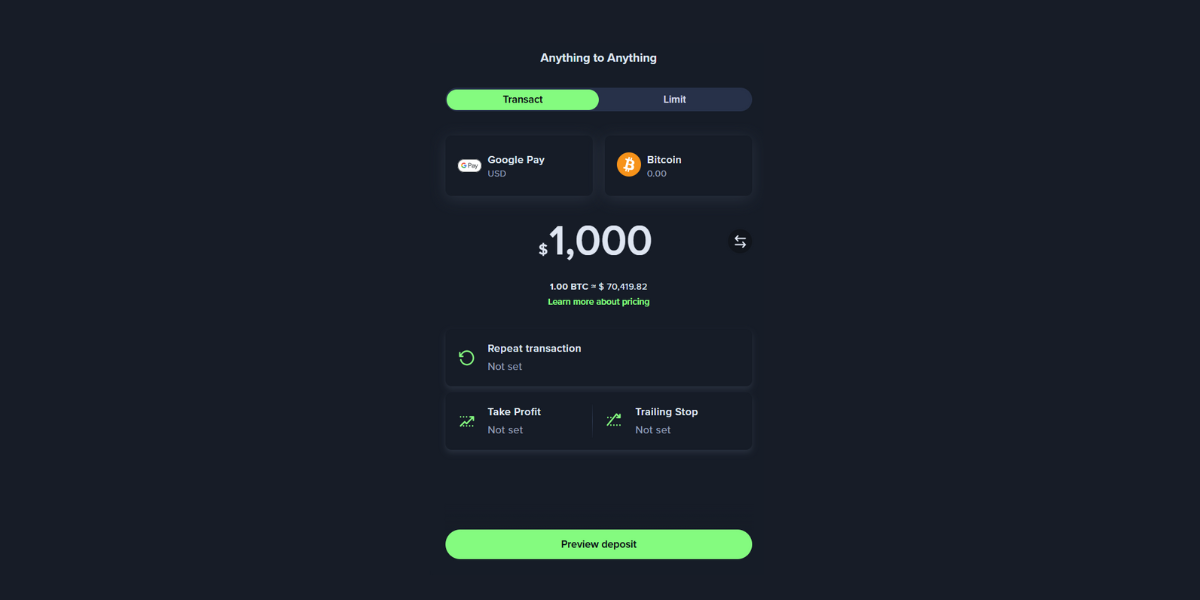

Uphold is a multi-asset trading digital platform, including cryptocurrencies, fiat currencies, and precious metals. With access to over 300 assets, it stands out with its “Anything-to-Anything” trading feature, allowing you to trade between any supported assets in one step. For example, you could trade btc to XRP or other cryptocurrencies without converting to fiat first.

You can start with as little as $1, and there are no fees for deposits or withdrawals, which is great if you’re just getting into trading. Uphold is available in over 180 countries, making it easy to transfer funds globally. They also offer up to 13% APY on crypto staking.

Uphold puts a lot of emphasis on security. They’ve got certifications like SOC 2 and ISO 27001, which are good indicators of strong data protection. Importantly, they never lend out customer assets, so you don’t have to worry about your holding’s insolvency. Plus, they’re transparent, publishing their holdings and liabilities publicly.

Pros

- Easily invest in stocks, fiat, and metals

- Simple user interface, particularly helpful for beginners

- Provides crypto staking with up to 13% annual returns

- Most deposits and withdrawals are free, except for crypto network fees

- High secure with regulatory licenses across the US and UK

Cons

- Relatively high fees compared to competitors

- Lacks advanced charting and analysis tools

- Up to 34% fee applies to crypto staking rewards

Uphold Key Features Reviewed

crypto Trading Platform

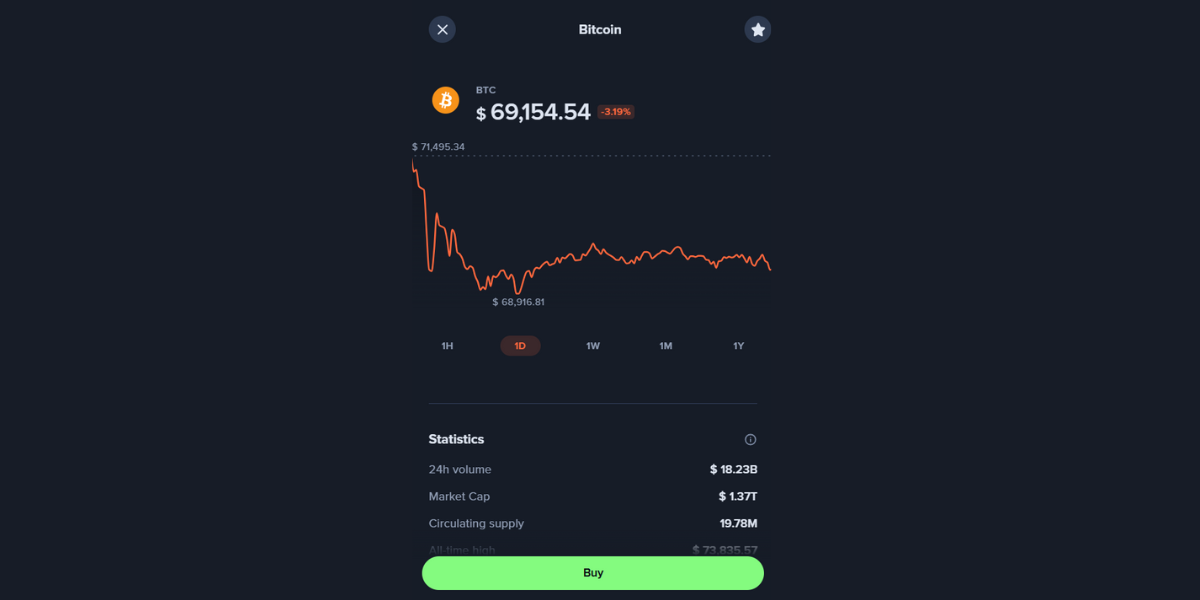

Uphold’s trading platform offers a wide variety, with over 300 crypto assets to choose from. It offers well-known cryptos like bitcoin (btc) and ethereum (eth) or many niche tokens, there’s a lot to explore.

They support assets across various up-and-coming sectors like nfts (Decentraland’s MANA), DeFi (Uniswap’s UNI), and even meme coins like Dogecoin (DOGE). There’s also exposure to the gamefi through tokens like Axie Infinity (AXS) and Real World Assets (RWAs).

Alongside crypto assets, the platform includes popular stablecoins – like USDC, USD Tether (USDT), and DAI – which are ideal for those who prefer to avoid market volatility but still want to trade digitally.

What’s unique is that Uphold also supports 20 different national currencies and 3 precious metals (gold, silver, and platinum), offering a diverse portfolio under one roof. Thanks to its unique one-step trading feature, you can easily trade between any of these assets without needing to go through USD first. This setup lets you switch from bitcoin to a precious metal like gold in one easy move, which is a rare convenience.

Uphold Vault

The Uphold Vault is designed for people who want full control and security over their digital assets. It operates with a “3-key” system that gives you, as the user, direct control and peace of mind. Here’s how it works:

- Your Private Key is the main key that you manage, giving you primary control.

- Vault Backup Key: If you lose your private key, the backup key is there to help, and Uphold can assist with recovery.

- Uphold Key: This key, managed by Uphold, is used to co-sign your transactions and can also help replace lost keys if needed.

This layered approach ensures that if you lose access to one key, you don’t lose access to your assets completely. The Vault currently supports bitcoin (btc) and XRP, with plans to add more networks soon. The cost is either $4.99 monthly or $49.99 per year, making it accessible to users looking for long-term, secure asset storage.

USD Interest Account

Uphold’s USD Interest Account lets users earn up to 4.9% interest on USD holdings of $1,000 or more. Balances under $1,000 still earn 2%, which is competitive for a flexible account. There are no fees, no lock-ins, and deposits are insured up to $2.5 million through a network of FDIC-insured banks, so users can withdraw whenever they need without penalties.

This account is a good fit for those who want to earn a solid yield on their USD savings but don’t want the volatility that can come with crypto.

OTC Platform

Uphold’s Over-the-Counter (OTC) platform, known as Uphold Ascent, is aimed at high-volume traders and institutional clients who need to execute large trades smoothly and privately.

When you make a big trade, it’s crucial to avoid affecting market prices and Uphold Ascent smartly routes orders to more than 30 different trading venues. These include centralized exchanges, decentralized platforms, Layer-2 networks, and rollups, providing deep liquidity access.

This setup not only minimizes the risk of slippage on large orders but also ensures efficient order fulfillment. Institutional and high-net-worth clients also receive personalized support.

Uphold Debit Card

The Uphold Debit Card makes it easy for you to spend your crypto anywhere Visa is accepted. With the card, you can choose which asset to spend on each transaction, so you have the flexibility to pick from your btc, eth, or USD balances as needed.

Rewards sweeten the deal: you get 2% crypto-back on purchases made with digital assets and 1% cash-back on fiat transactions.

The card has no foreign transaction fees, which makes it a convenient option for international travelers looking to use crypto as part of their everyday spending without extra costs. The card bridges the gap between digital and traditional finance, letting users seamlessly bring their crypto into real-world purchases.

Uphold Fees & Commissions

Uphold’s fee structure is straightforward but varies across the platform’s trading, deposit, and withdrawal options. Here’s a detailed breakdown of what to expect in terms of costs when using Uphold’s services:

Trading Fees

Uphold does not charge direct commission fees for trades, but it does include a spread in each transaction based on the asset’s type and liquidity. For highly popular cryptocurrencies like bitcoin (btc) and ethereum (eth), the trading fee typically falls between 1.4% to 1.6%. These two assets are widely traded, so they benefit from a relatively lower spread.

For stablecoins – such as USD Coin (USDC) and USD Tether (USDT) – and major fiat currencies, the spread is notably lower, at approximately 0.25%. This is a cost-effective option for users looking to make quick transactions between stable assets without high fees.

Less liquid or niche altcoins have a higher trading spread. These assets can range from 1.9% to 2.95%, reflecting the additional effort and risk Uphold takes to maintain liquidity in these markets. Precious metals, like gold, silver, and platinum, fall into this same range, with spreads typically set between 1.9% and 2.95%.

Note: If you are looking for a zero-fee or minimal-fee exchange, check out our guide on the best no-fee crypto exchanges.

Deposit Fees

Uphold’s deposit fees vary based on the payment method and region, especially between the U.S., U.K., Europe, and Canada.

For ACH deposits in the U.S., there are no fees, making it a convenient and cost-effective choice. However, ACH deposits are limited to $25,000 per day. For deposits via credit or debit card or through Apple Pay and Google Pay, the fee is set at 3.99% of the deposit amount. This applies globally, including for Canadian users, and is a standard rate in digital platforms to cover the cost of instant processing for card-based payments.

For users opting for wire transfers, Uphold applies a split fee structure: any wire transfer above $5,000 is processed for free, while transfers below this amount incur a $20 fee.

In the U.K. and Europe, Faster Payments (FPS) and SEPA deposits are generally free. This makes bank transfer deposits a more affordable method in these regions compared to the 3.99% charged for card-based deposits.

You can check the complete Uphold deposit details along with the limits here.

Withdrawal Fees

Withdrawal fees on Uphold depend on the method and speed of withdrawal. In the U.S., standard ACH withdrawals to a bank account are free, but if you prefer an instant withdrawal, a 1.75% fee is applied, with a minimum charge of $1. This option is available for those who need funds faster than the typical 3-5 business days for ACH processing.

For debit card or Apple Pay withdrawals, users also pay a 1.75% fee, making it an affordable option for those looking to move money quickly. International withdrawals vary, but for card transactions, the fees usually fall between 1.75% and 2.75% depending on the region, helping cover the costs of cross-border transactions.

crypto Withdrawal Fees

For those withdrawing crypto from Uphold to an external wallet, fees are based on blockchain network costs, which can vary depending on congestion. For bitcoin withdrawals, there’s a fixed network fee of 0.0001 btc, while ethereum and other tokens have variable network fees.

Smaller trades (typically under $500) may incur an extra $0.99 fixed fee on certain blockchains to cover network expenses. Some assets, such as XRP, are offered without network fees for smaller transactions, making it a cost-effective choice for smaller crypto transfers.

Here is a quick overview:

| Withdrawal Network | Asset/Token | Fee |

| bitcoin Cash Network | BCH | 0.0003 BCH |

| bitcoin Network | btc | 0.0001 btc |

| Cardano Network | ADA | 1 ADA |

| DASH Network | DASH | 0.0003 DASH |

| ethereum Network | eth, ERC-20 Tokens | Network Fee |

Is Uphold Safe? Security Measures Reviewed

Uphold takes security very seriously, emphasizing that it is central to its operations and essential for building user trust. They believe that transparency is key, allowing users to monitor their assets in real-time. To support this, Uphold publishes its assets and liabilities every 30 seconds, so customers can always see how their funds are being managed.

They utilize advanced encryption techniques to protect user data and transactions. Regular audits and penetration testing conducted by security professionals help identify and address any vulnerabilities. Uphold also ensures that all third-party providers are subject to strict due diligence checks, particularly those that handle sensitive information.

And, all employees undergo background checks and are required to participate in ongoing security and privacy training. Plus, Uphold has established a bug bounty program, which invites users to report any security vulnerabilities they find, with rewards offered for valid submissions.

For users, Uphold stresses the importance of practicing good security habits. They encourage using strong passwords and enabling two-factor authentication (2FA). There is also a mandatory KYC verification.

Certificates and Compliance

Uphold is also committed to regulatory compliance, adhering to multiple frameworks, including the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Plus, Uphold holds important certifications, such as SOC 2 Type 2 and ISO 27001, which affirm their high standards in data security and operational excellence.

It is also fully committed to compliance as a FinCEN Registered Money Services Business (MSB) in the United States. Additionally, it acts as an Electronic Money Issuer (EMD) agent regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

Customer Support and User Experience

On the positive side, many users appreciate Uphold’s intuitive interface, which simplifies trading across various asset classes, including cryptocurrencies and precious metals.

The platform’s ability to facilitate trades seamlessly, combined with features like the AutoPilot for recurring purchases, makes it particularly attractive to beginners in the crypto space.

However, customer support experiences can vary. Some users have reported difficulty in getting timely assistance, especially during high-demand periods. While Uphold offers support through various channels – including live chat, email, and social media – there are accounts of long response times and insufficient help for complex issues. It also offers a Help Center with detailed FAQs.

Again, some Reddit users express frustration over getting automated replies instead of personalized help.

Some users have also raised concerns regarding account verifications and withdrawal processes. Instances of delays in withdrawal requests have been noted, leading to frustrations. Many Trustpilot ratings and reviews show that Uphold charges high spread and fees compared to other competitors like Coinbase and eToro.

Uphold vs Other crypto Exchanges

eToro, Coinbase, and Kraken are the best alternative cryptocurrency exchanges to Uphold. Here is a quick comparison between Uphold vs eToro vs Coinbase vs Kraken:

| Feature | Uphold | eToro | Coinbase | Kraken |

| crypto Availability | 300+ coins | ~100 coins | 240+ coins | 200+ coins |

| Trading Fees | 1.4% – 1.6% | ~1% | 0.4% maker and 0.6% taker | 0.25% maker and 0.4% taker |

| Supported Assets | crypto, stocks, metals, fiat | crypto, stocks, ETFs, indices, forex, commodities | crypto | crypto |

| Mobile App | iOS, Android | iOS, Android | iOS, Android | iOS, Android |

| Payment Methods | Bank, card, Apple/Google Pay | Bank, card, e-wallets | Bank, card, PayPal | Bank, card, crypto, Apple Pay |

| Staking | Yes | Yes (very high commission) | Yes | Yes |

| Best for | Multi-asset investors | Social trading | Instant Buy/sell crypto | Advanced crypto traders |

How to Create an Account on Uphold?

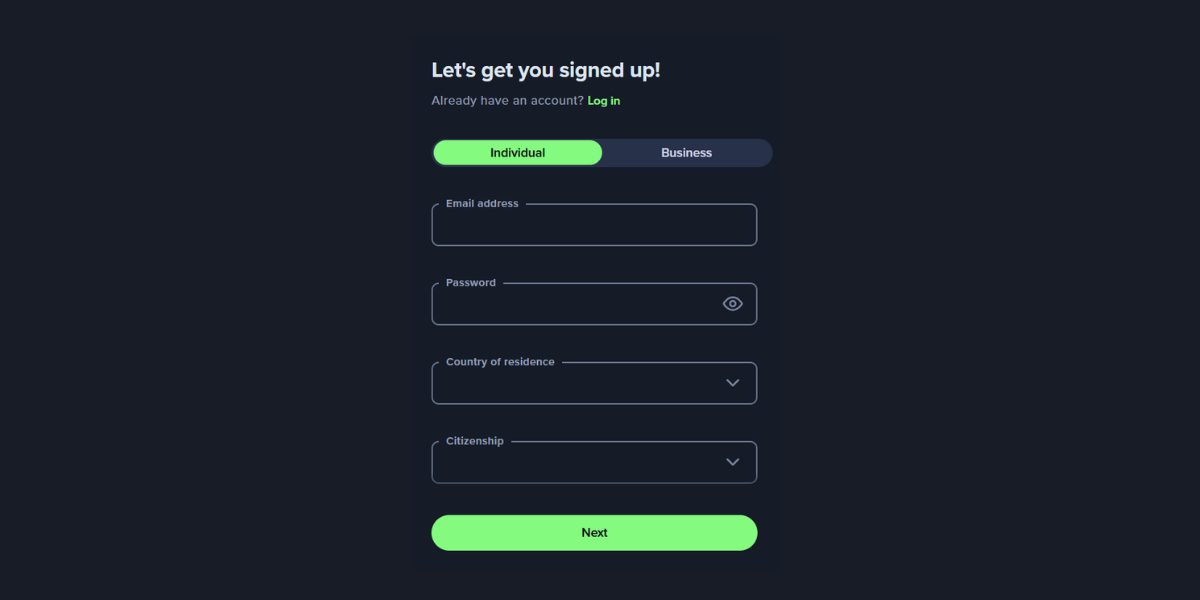

Step 1: Create an Uphold Account

First, download the Uphold app from the btc–eth-and-300/id1101145849″ target=”_blank”>App Store for iOS or the Google Play Store for Android. You can also visit the Uphold crypto exchange website directly on your computer.

Next, click on “Get Started”. You’ll need to enter your email address and create a password. Make sure to use a strong password to keep your account safe. Also, provide your country and citizenship details. You can also create a business account.

After that, check your email for a verification link. Click on it to confirm your account and get started.

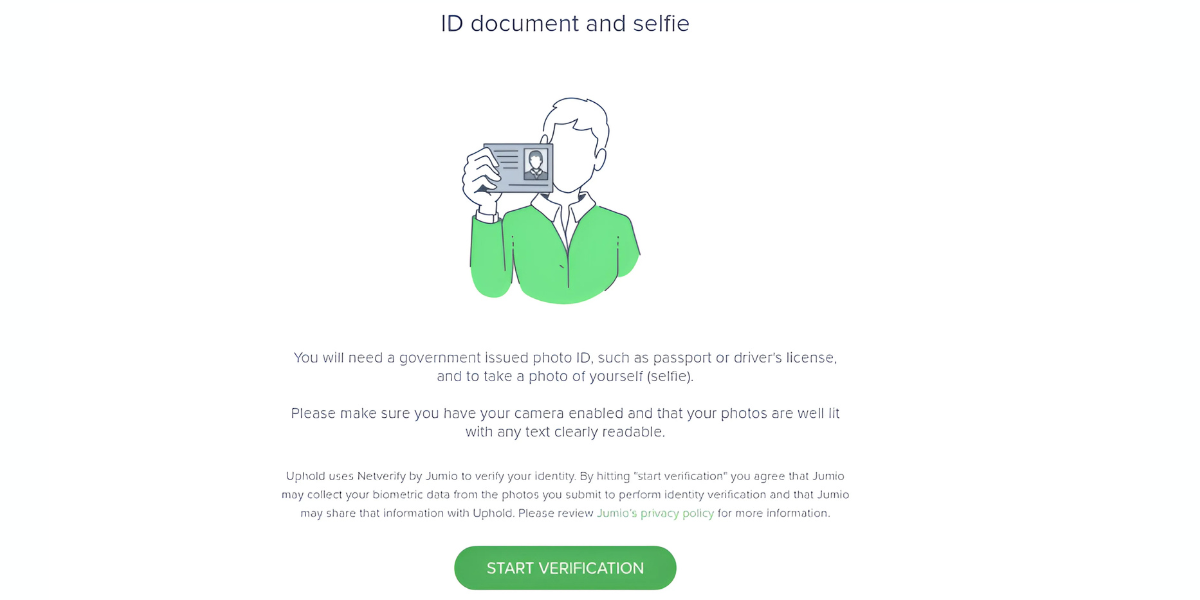

Step 2: Complete KYC

Now it’s time to complete the KYC (Know Your Customer) process. Once logged in, go to your “profile” and look for the option to verify your identity. You’ll need to fill in some personal details like your name, date of birth, and home address.

Next, upload an ID. Choose a government-issued ID, such as a driver’s license or passport. It’s important to make sure that the photo is clear and easy to read. You may also have to take a selfie for verification. This helps Uphold confirm that the person opening the account is the same as the ID holder.

Note: If you want to trade crypto without KYC, check out our guide on the best no-KYC crypto exchanges.

Step 3: Deposit Funds on Uphold

After getting verified, go to the “Portfolios” section. Here, click on “Transact” to see your deposit options. Uphold offers several methods, including bank transfers, credit/debit cards, or even cryptocurrency deposits.

Then, choose your deposit method and follow the instructions. If you opt for a bank transfer, you’ll need to provide your banking details. Finally, wait for confirmation. After your deposit is processed, you’ll receive a message saying your funds are ready to use.

Step 4: Buy crypto on Uphold

When you’re ready to buy crypto, head to the “Markets” tab. You’ll find a list of cryptocurrencies available on Uphold, like bitcoin and ethereum.

Then, pick the asset you want to buy. Click on it to see more information about prices and market trends. Next, enter how much you want to purchase. Uphold will show you the equivalent amount in your local currency.

Lastly, confirm your purchase. Review all the details, including any fees, and click “Buy” to finish. You’ll get a confirmation message, and your new cryptocurrency will be in your wallet.

Final Verdict

To conclude, this Uphold review shows that Uphold is a secure and versatile platform for trading crypto, metals, and fiat currencies. It’s beginner-friendly, with a straightforward interface that makes trading easy. The standout feature is “Anything-to-Anything” trading, which allows smooth swaps between asset types. Uphold supports a broad range of cryptocurrencies, offers competitive interest rates, and has strong security.

However, trading fees for some assets are on the higher side, and advanced tools are limited. Hence, we can say that Uphold is a good choice for casual and multi-asset investors looking for a secure and flexible platform.

FAQs

Is Uphold available worldwide?

Yes, Uphold is available in over 180 countries. However, some regions may have restrictions due to local rules. It is currently not available in the Virgin Islands (U.S.), North Korea, China, and more. Check the full list of Uphold-restricted jurisdictions here.

Are there any hidden fees on Uphold?

Uphold tries to be clear about its fees. There are no direct trading fees, but there is a spread, or small markup, on each transaction.

For popular cryptos, the spread is usually between 1.4% and 1.6%. For less common assets, it can be up to 2.95%. ACH bank deposits and standard withdrawals are generally free, though instant withdrawals have a fee. Withdrawing crypto may also come with blockchain network fees.

What cryptocurrencies can you trade on Uphold?

Uphold offers a variety of over 300 cryptocurrencies. You can trade popular coins like bitcoin (btc) and ethereum (eth) or niche altcoins. The platform includes assets from sectors like DeFi, GameFi, and even meme coins.

Is Uphold user-friendly?

Uphold is easy to use, especially for beginners. Its layout is simple and helps you find what you need. The “Anything-to-Anything” feature lets you quickly switch between assets. This saves time and makes trading smoother. For new traders, Uphold’s design makes it easy to learn and explore. Resources on the platform offer helpful tips. There’s also the AutoPilot feature for setting up recurring purchases. This makes managing investments easier.

Does Uphold have a mobile app?

Uphold has a mobile app for iOS and Android. It allows you to manage your trades and assets on the go. The app is simple to use and includes most desktop features. You can buy, sell, and swap assets, check prices, and even set up recurring buys. For those who like mobile trading, the app offers flexibility. It also keeps you connected to your portfolio wherever you are.

Is Uphold available for US customers?

Yes, Uphold is available to users in the United States. It’s a popular option for U.S.-based crypto traders and investors. Uphold follows U.S. regulations as a FinCEN registered Money Services Business. U.S. customers can trade many assets, from crypto to metals and currencies. The platform also offers ACH bank transfers, which is convenient for U.S. users.

The post Uphold Review 2024: Fees, Pros, Cons, & Safety appeared first on nft Evening.