This article is also available in Spanish.

A recent report from crypto data and research firm Messari shed light on the performance of the Solana (SOL) ecosystem during the third quarter of 2024. The report highlights a combination of growth and challenges facing blockchain amid broader volatility in the cryptocurrency market. during that period.

Solana Stablecoin Market Cap Rises to $3.8 Billion

One of the highlighted metrics of the report is Solana's total value locked (TVL) growth in decentralized finance (DeFi), which increased 26% quarter over quarter (QoQ) to reach $5.7 billion.

This growth positioned Solana as the third largest network in terms of DeFi TVL, surpassing Tron at the end of September. Notably, SOL-denominated TVL also increased, growing 20% quarter-on-quarter to SOL 37 million.

Related reading

Kamino emerged as a leading player within the Solana ecosystem, experiencing 57% growth in TVL, ending the quarter with $1.5 billion and capturing 26% market share. This increase is attributed to the integration of new tokens, including PayPal USD (PYUSD) and jupSOL, which have improved the platform's appeal.

Despite the overall positive trends, decentralized exchange (DEX) volume saw a slight decline, reflecting a drop in memecoin trading. Average daily spot DEX volume fell 10% quarter-on-quarter to $1.7 billion.

According to the reportThe decline in interest in memecoins was evident as only two tokens, WIF and POPCAT, managed to crack the top ten by trading volume during the quarter.

In contrast, Solana's stablecoin ecosystem showed resilience: stablecoin market capitalization grew 23% quarter-on-quarter to $3.8 billion, cementing its ranking as the fifth-largest network in this category.

in it non-fungible token (nft), however, the performance was less favorable. Average daily nft volume fell 27% quarter-over-quarter to $2.5 million, with Magic Eden maintaining a dominant market share despite experiencing a 44% decline in volume.

Network activity thrives

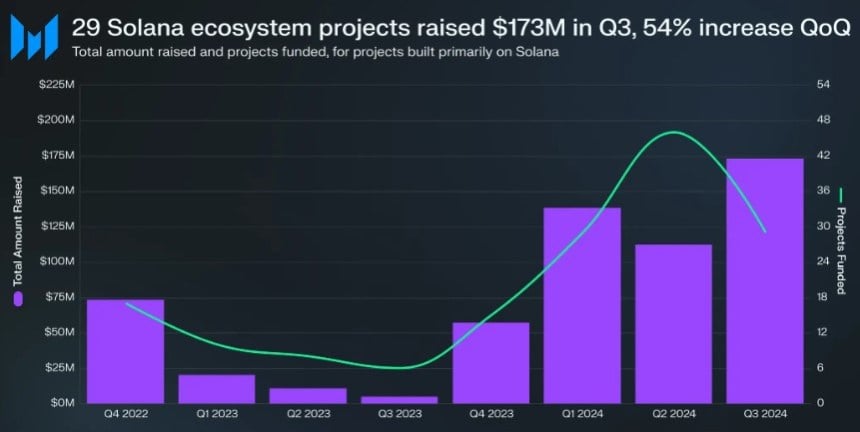

Despite the challenges, the number of funding rounds for projects within the Solana ecosystem saw a 37% reduction quarter-on-quarter, with only 29 projects announcing funding. However, the total amount raised soared to $173 million, a 54% quarter-over-quarter increase and the highest quarterly funding since Q2 2022.

Network activity remained strong, as evidenced by a 109% increase in average daily rate payers, which reached 1.9 million. Additionally, the average daily number of new ratepayers grew 430% quarter-on-quarter to 1.3 million, indicating a growing user base.

Related reading

the average transaction fee on Solana rose 6% quarter-on-quarter to 0.00015 SOL (around $0.023), while the median transaction fee fell 19% to 0.000008 SOL (around $0.0013).

As of October 15, Solana's market cap also grew 5% quarter-on-quarter, reaching $71 billion and maintaining its position as the fifth-largest cryptocurrency, behind only bitcoin, ethereum, Tether, and Binance Coin. .

However, the Real economic value (REV) from Solana, which tracks transaction fees and mining extractable value (MEV) for validators, decreased 25% quarter-on-quarter to 1.3 million SOL (approximately $196 million), with 56% of this total coming from of transaction fees.

At the time of writing, SOL was trading at $166, down 5% over the seven-day period.

Featured image of DALL-E, chart from TradingView.com