There was a panic in the financial markets when Silicon Valley Bank collapsed under the pressure of large-scale withdrawals by depositors.

The saga spread to crypto through Circle’s USDC, which had reserves at the bank. He lost his link with the news that he was a client of SVB. This raised concerns that the stablecoin was no longer fully supported.

However, Circle’s reserves were later confirmed to be safe, bringing some relief to the markets. Both the centralized and decentralized markets experienced turmoil due to the failure of SVB.

US regulators confirmed that they took over Silicon Valley Bank (SVB) to quell panic among depositors and prevent the spread of the crisis in the banking system. This brought back memories of the response to the financial crisis of 2008 and the COVID-19 pandemic in 2020.

Within 48 hours, regulators formulated emergency measures to guarantee all deposits held at SVB and crypto lender Signature Bank. Additionally, the Fed launched a line of credit to support other banks, ensuring compliance with depositors’ demands.

Major cryptocurrency exchanges see significant decline in market depth

Market depth refers to the number of buy and sell orders at different price levels, which indicates the level of market liquidity. Decreasing market depth is a major concern for cryptocurrency traders as it can lead to increased price volatility.

A decrease in market depth can make it difficult for traders to fill large orders without moving the market price.

According Kaiko market dataMajor cryptocurrency exchanges have seen a substantial decline in market depth due to disruptions in USD payment channels and failures by crypto banks.

Coinbase and Binance were hit the hardest, dropping 50% and 29%, respectively. Meanwhile, Binance Global saw a 13% decline in market depth.

Disruptions in USD payment channels and crypto bank failures have been recurring issues in the cryptocurrency market, raising concerns about the stability and reliability of the sector.

Circle suffers setback in USDC reserves

In a surprising turn of events, Circle, a fintech firm, suffered a significant setback to its USDC reserves.

The company recently announced that $3.3 billion, representing 8.2% of its total USDC reserve of $40 billion, is currently stuck in seized SVB accounts. This news has shocked the entire financial industry, leading to widespread panic and redemption calls.

The impact of the Circle situation has been felt across a number of exchanges, with some being forced to suspend their USDC conversion services. For example, Binance has suspended automatic USDC to BUSD conversions, while Coinbase has temporarily halted USDC to USD conversions.

Robinhood has also suspended USDC deposits and trading. Consequently, the value of USDC broke away from the US dollar and hit a record low of $0.87 on March 13.

The severity of Circle’s situation and its ripple effect on the broader financial ecosystem has raised concerns about the stability of the digital currency market. This incident reminded everyone that the cryptocurrency market is highly unpredictable and volatile, despite gaining mainstream acceptance.

Stablecoin Sector Struggles

The stablecoin sector has been at the center of the carnage. The problems began with the terraUSD collapse in May 2022 and have intensified ever since, with regulators turning their attention to stablecoins in recent weeks.

USDD

The USDC peg loss also affected Tron’s USDD stablecoin. Investors sold their USDD, causing it to lose its peg and trade as low as $0.93 at one point on March 11, 2023.

ICD

DAI, partially backed by USDC, traded as low as $0.90. Traders responded by flocking to tether, the world’s largest stablecoin, which has a market value of over $72 billion and is not exposed to SVBs. However, concerns remain about Tether’s business practices and reserves.

The market began to recover on March 12 after Circle announced that it would cover any shortfalls with corporate resources. USDC and DAI have recovered ground and are trading closer to their dollar parity.

Although DAI experienced a decoupling due to a portion of its reserves being held in USDC, there is a silver lining to the situation. Circle, the company behind USDC, still has other reserves, which means that USDC is unlikely to lose value completely.

Furthermore, only around 8% of USDC reserves were affected, indicating that the stablecoin is expected to recover and regain its stability.

Financial companies affected by the US banking crisis.

Fears about the possibility of more bank failures after the bank collapse in the US led to a drop in bank shares. However, other areas of the market saw prices rise as investors hoped that recent events would lead the Fed to reconsider its strategy of raising interest rates, which has caused disruptions in the economy.

Western Alliance Bank

Despite attempts to reassure investors that other banks would not be affected by the same problems as SVB. These concerns proved valid as Signature Bank became the third lender to shut down in a week, following the closure of cryptocurrency-friendly Silvergate bank.

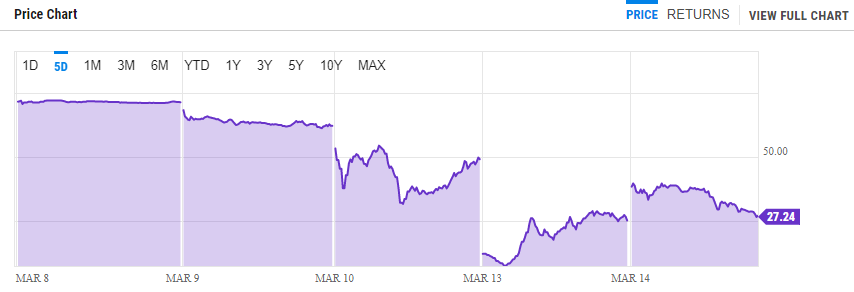

The SVB bankruptcy has put pressure on smaller lenders, sending shares of Western Alliance Bancorp plummeting. On March 13, the Arizona-based bank saw its shares drop 83%, before a 21% drop on March 10.

Bank of the First Republic

First Republic Bank shares experienced a significant drop of more than 76%, indicating increased investor concern for the bank’s stability following the collapse of SVB on March 10.

Despite the regional bank’s efforts to address investor concerns regarding its financial health, the shares fell 15% on March 10, plummeting to $19. Trading in the shares had to be paused several times due to high volatility.

In a presentation made on March 12, The company was announced to receive $70 billion in financing from JPMorgan Chase and the Fed’s emergency loan program, which provides one-year loans to banks in exchange for some form of collateral.

Commerzbank and Santander

Share prices of banks such as Commerzbank and Santander fell significantly by 12% and 7% respectively, raising concerns about the health of the sector.

Despite HSBC agreeing to buy SVB’s UK arm, London’s FTSE 100 index plunged 2.6% and other stock markets in Frankfurt, Paris and Milan suffered heavy losses.

Analysts including George Godber, a fund manager at Polar Capital, attributed the market slide to investor fears of other unknown challenges that could arise. Although banks initially dragged down US markets, they rallied and closed unchanged.

FDIC takes over SVB

The FDIC has taken over the SVB to ensure depositors’ money is safe. The FDIC stated that it will make some payments for uninsured deposits next week, with the possibility of additional payments as the regulator sells off SVB’s assets.

The recent wave of bank failures in the US sparked Fear, Uncertainty, and Doubt (FUD) among cryptocurrency investors, resulting in a significant drop in the prices of several digital currencies, including bitcoin (BTC).

President Biden has come out to defuse the situation, saying that all depositors will be paid in full in due time.

Markets responded positively to the news, with major coins like BTC and ETH rallying over 15% in hours. However, Biden also added that the bank’s investors would not be compensated because they ignored their task of closely watching how SVB operates.

At the time of writing, Bitcoin has seen a surge in the past 24 hours, with its current price sitting above $24,500. BTC’s market capitalization crossed the $500 billion mark, with a 43.7% market dominance.

According to recent data, ETH, the second largest cryptocurrency, saw a net inflow of approximately $1 billion, with a positive flow of $50.6 million to exchanges.

On the other hand, tether (USDT), the largest stablecoin, had a negative flow of $226.9 million from exchanges as roughly $1.5 billion worth of USDT was deposited while around $1.5 billion was withdrawn. 1.7 billion.

Binance Coin (BNB) also saw a significant increase in value, with its current trading price at $316.83 and a 24-hour trading volume of $1,316,716,794. This marks an impressive 13.00% increase in the last 24 hours and a 7.85% increase in the last seven days.

Keep watching crypto.news for updates on macrofinance, bitcoin, and other crypto-related news.